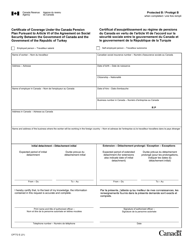

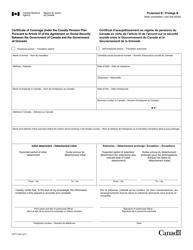

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST322

for the current year.

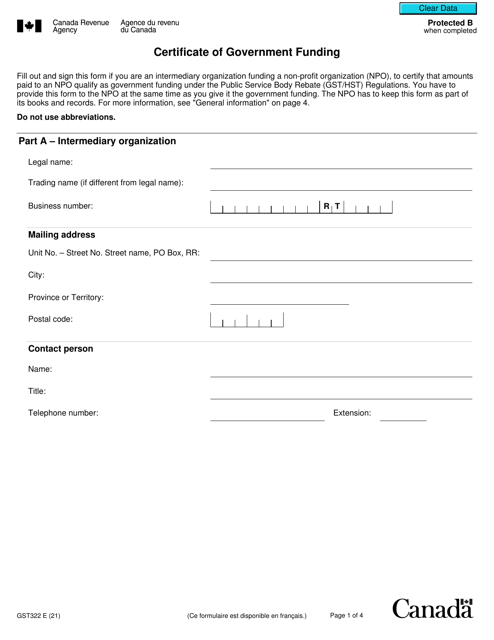

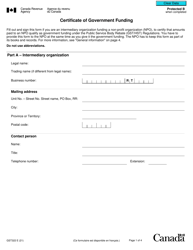

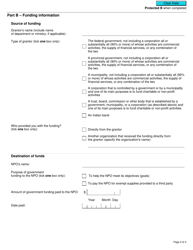

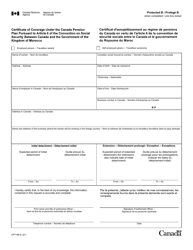

Form GST322 Certificate of Government Funding - Canada

The Form GST322 Certificate of Government Funding in Canada is used to claim a refund for the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) that was paid on purchases made with government funding.

The Form GST322 Certificate of Government Funding in Canada is typically filed by organizations or businesses that receive government funding.

FAQ

Q: What is Form GST322?

A: Form GST322 is a certificate of government funding in Canada.

Q: Who needs to use Form GST322?

A: Organizations that receive government funding in Canada may need to use Form GST322.

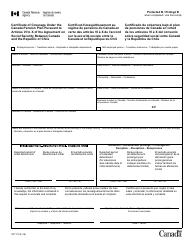

Q: What is the purpose of Form GST322?

A: The purpose of Form GST322 is to certify that the recipient of government funding is eligible for a Goods and Services Tax/Harmonized Sales Tax (GST/HST) exemption.

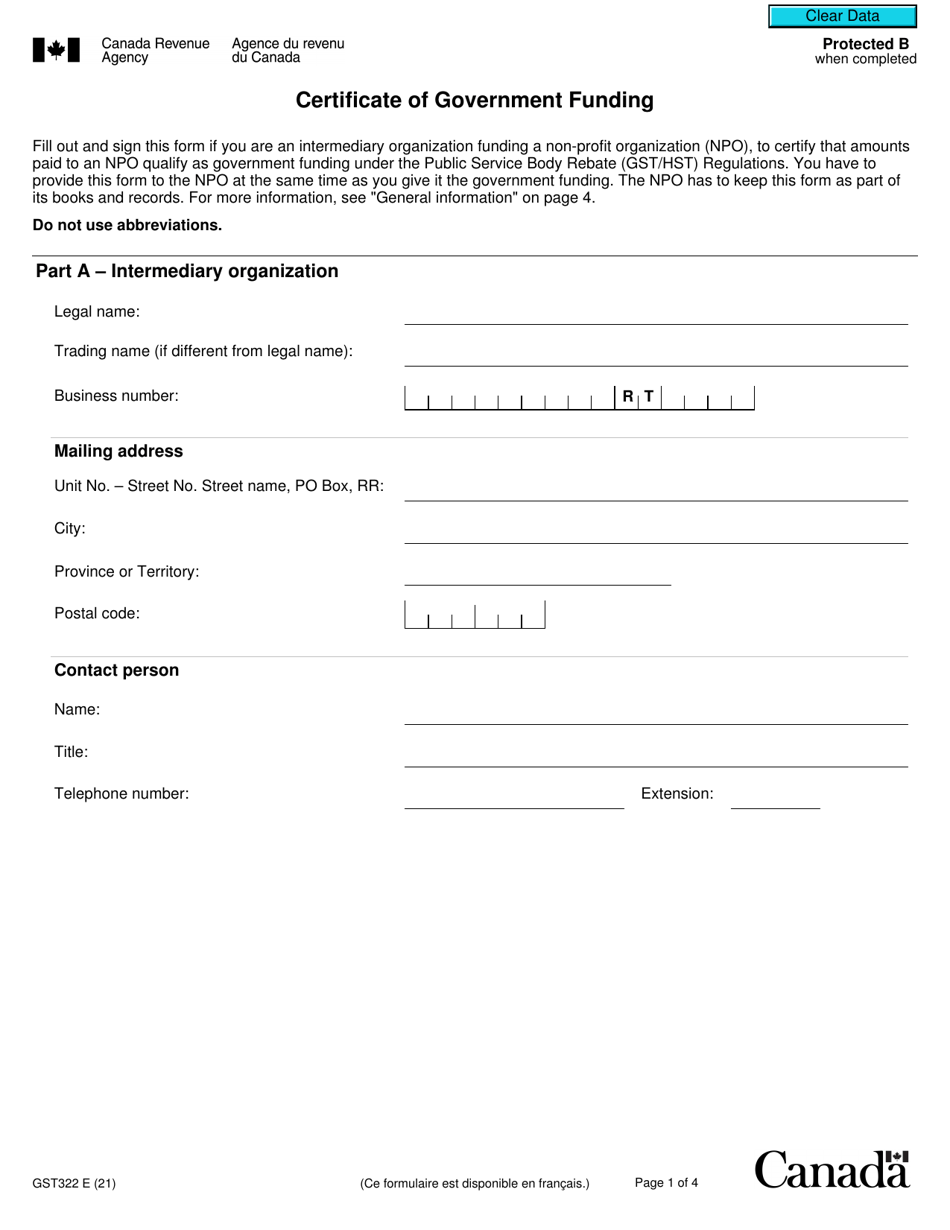

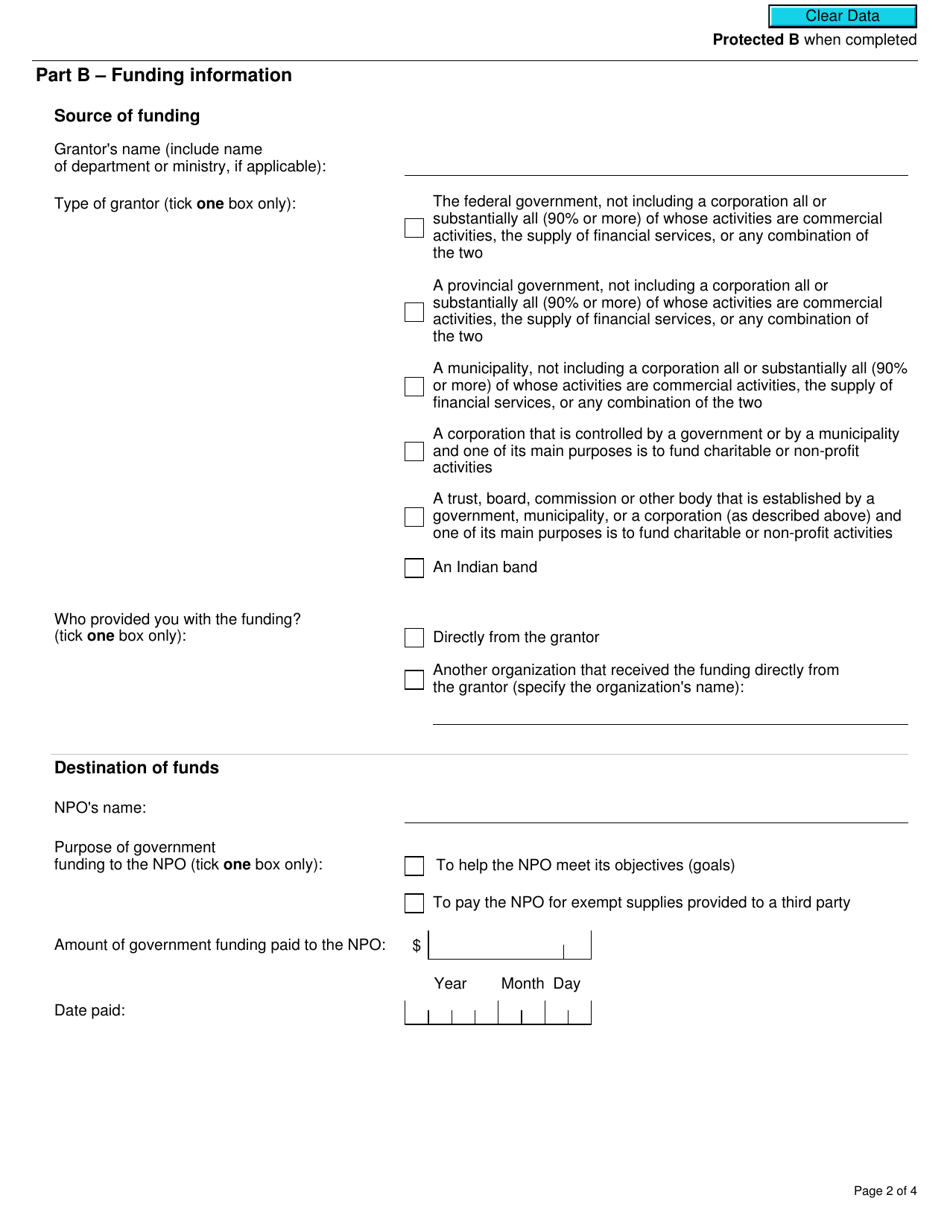

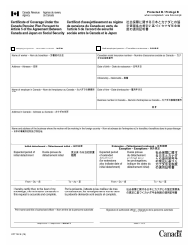

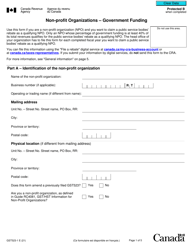

Q: What information is required on Form GST322?

A: Form GST322 requires information such as the recipient's name, address, business number, and details of the government funding received.

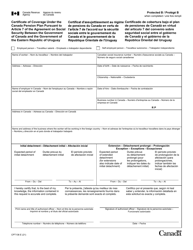

Q: How do I fill out Form GST322?

A: You should carefully fill out all the required fields on Form GST322, including providing accurate information about the government funding received.

Q: Do I need to submit supporting documents with Form GST322?

A: In some cases, you may need to submit supporting documents with Form GST322, such as copies of funding contracts or agreements.

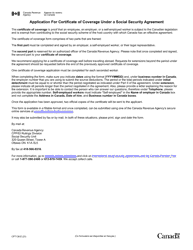

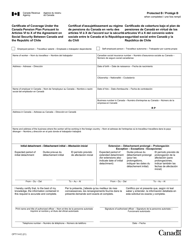

Q: Are there any deadlines for submitting Form GST322?

A: Specific deadlines for submitting Form GST322 may vary depending on the nature of the government funding and the applicable tax rules.

Q: What should I do if I need help filling out Form GST322?

A: If you need help filling out Form GST322, you can contact the Canada Revenue Agency or consult a tax professional for assistance.