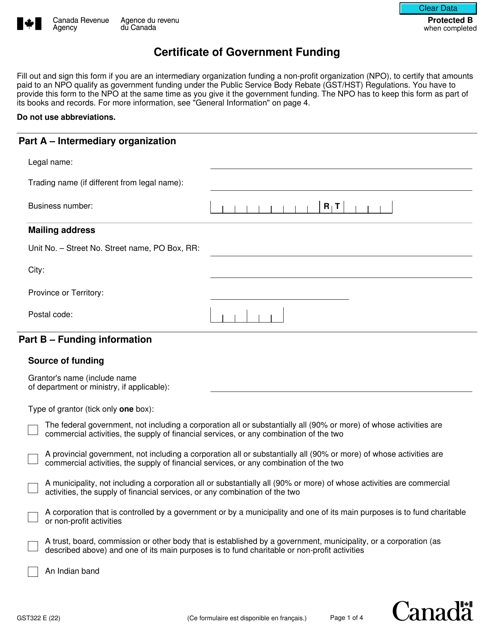

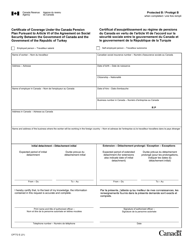

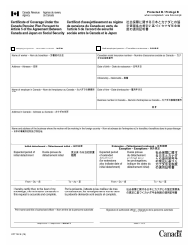

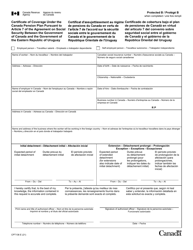

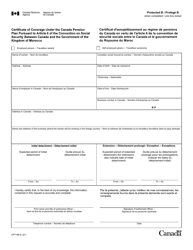

Form GST322 Certificate of Government Funding - Canada

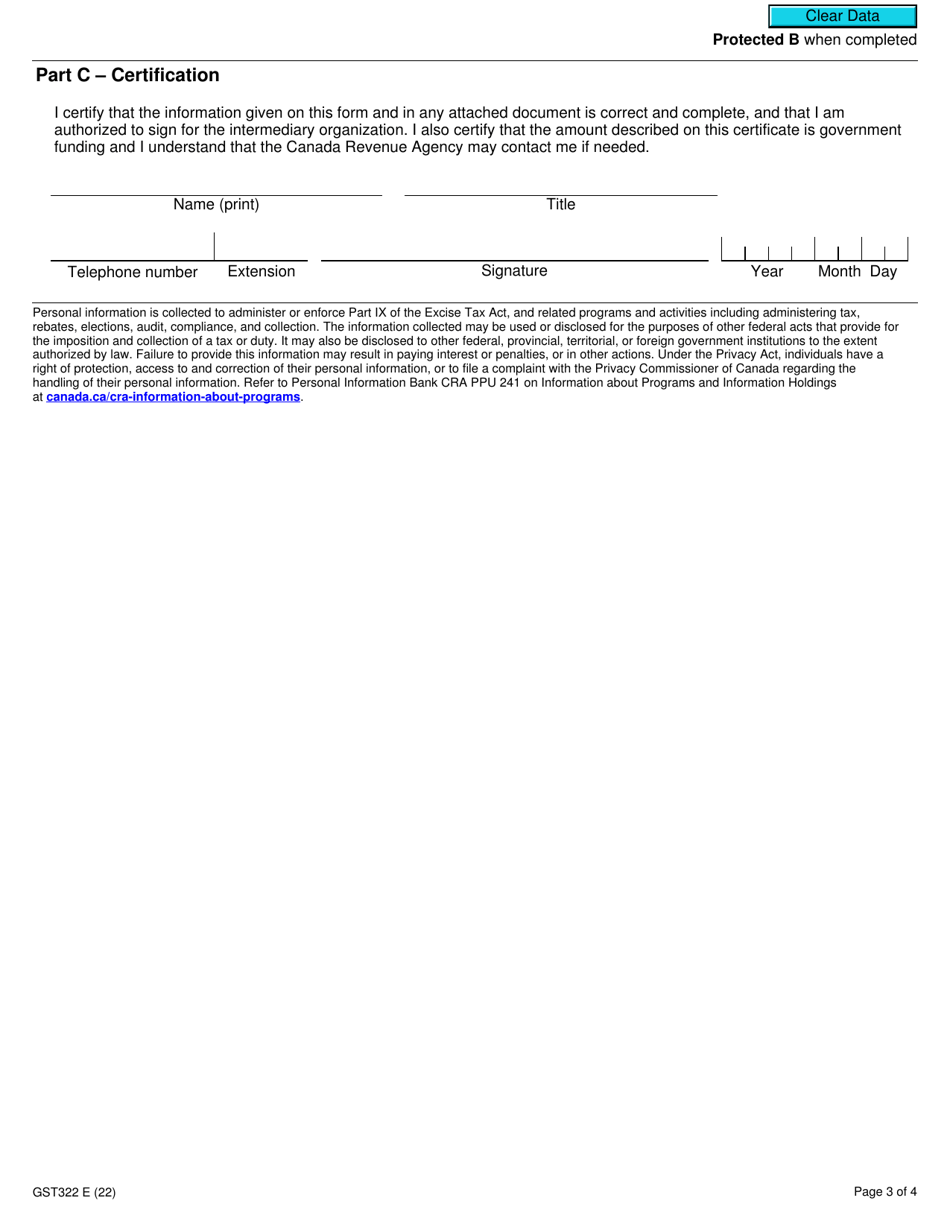

The Form GST322 Certificate of Government Funding in Canada is used to certify that government funding has been provided for a specific purpose or project.

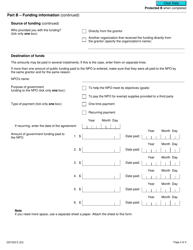

The Form GST322 Certificate of Government Funding in Canada is typically filed by the organization that has received government funding.

Form GST322 Certificate of Government Funding - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST322?

A: Form GST322 is the Certificate of Government Funding in Canada.

Q: What is the purpose of Form GST322?

A: The purpose of Form GST322 is to certify that the organization has received government funding and is eligible for a reduction of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

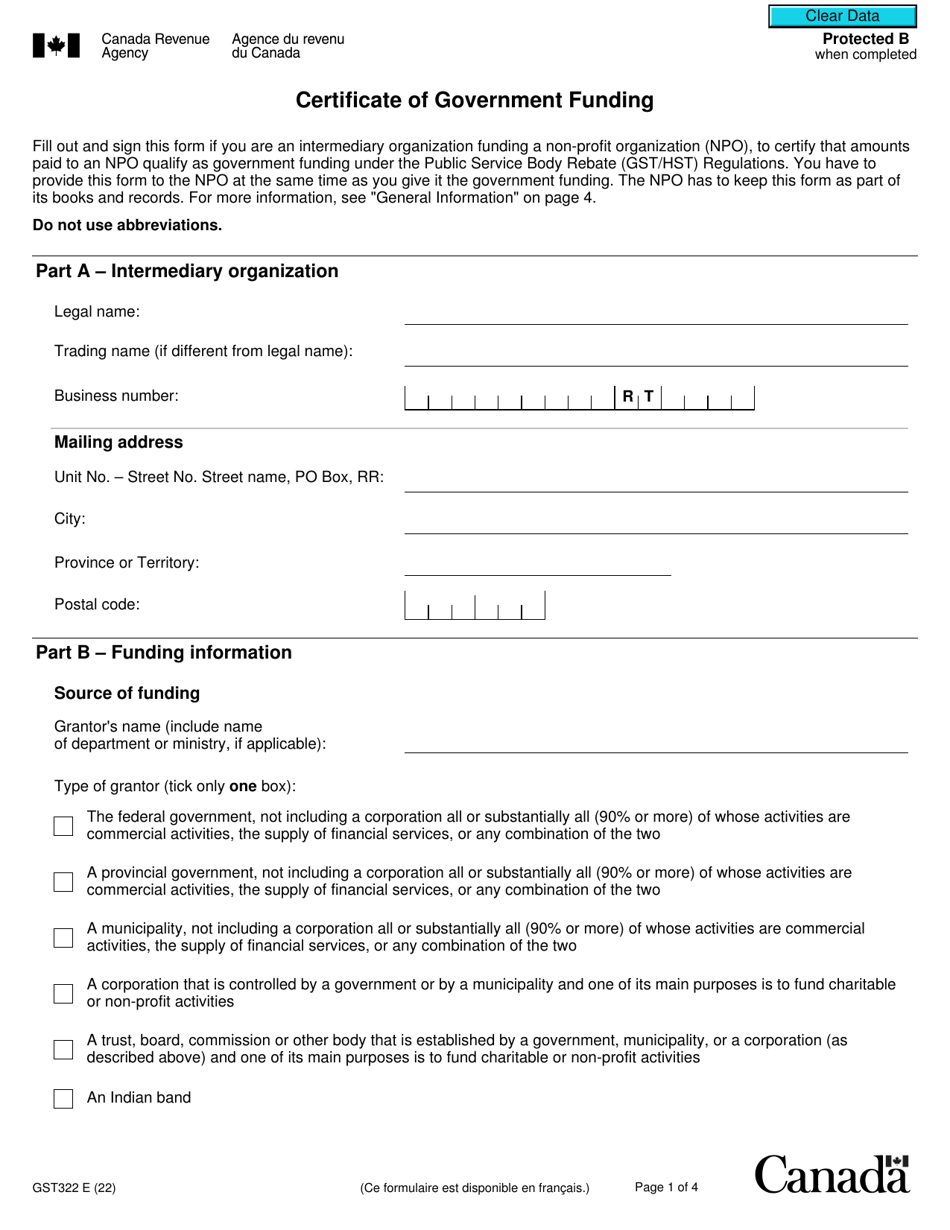

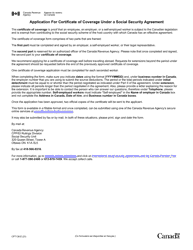

Q: Who needs to complete Form GST322?

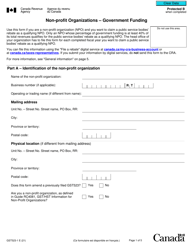

A: Organizations that have received government funding and want to claim a reduction in GST or HST need to complete Form GST322.

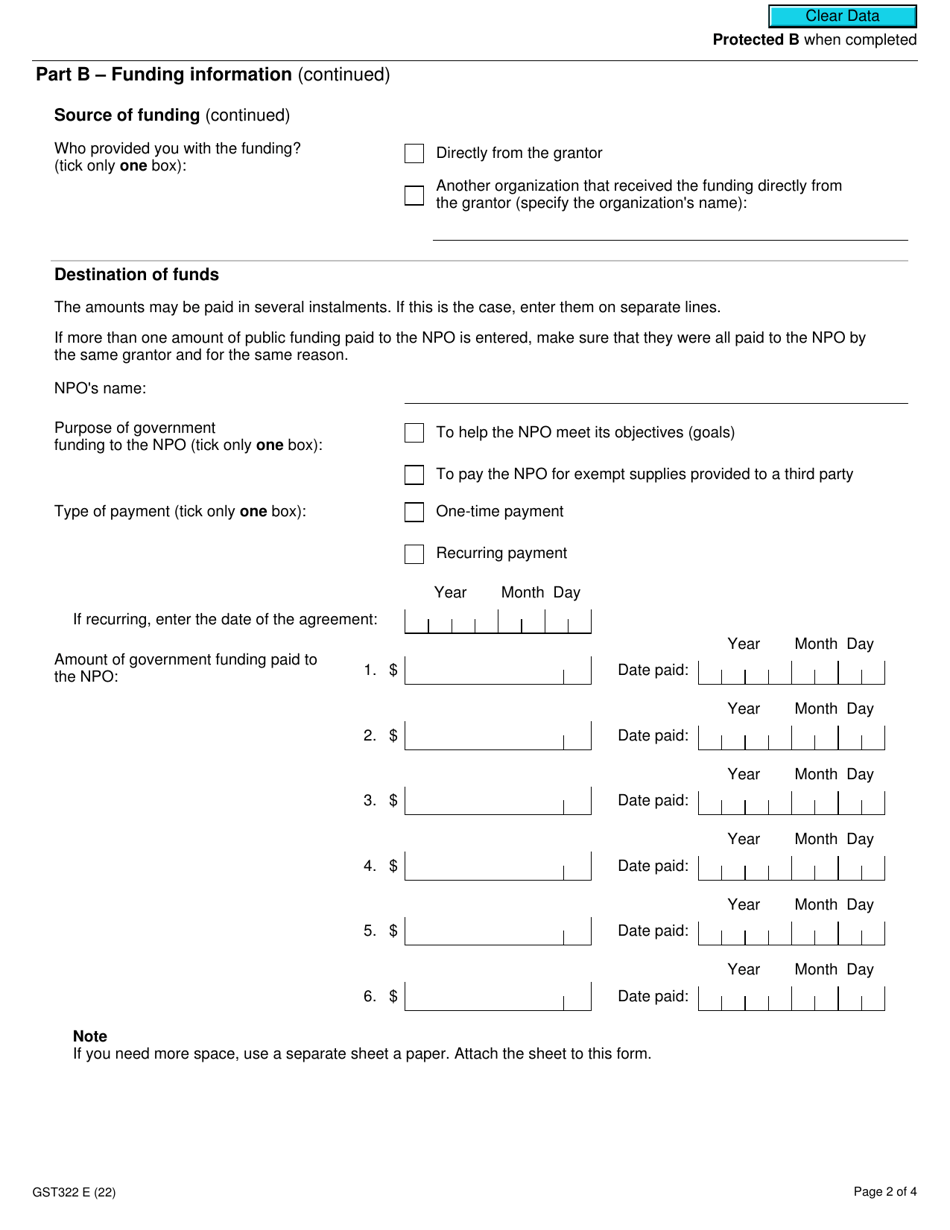

Q: How do I complete Form GST322?

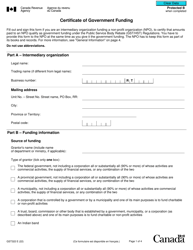

A: Form GST322 requires organizations to provide details about the government funding they have received, including the amount and the funding program.

Q: When should I submit Form GST322?

A: Form GST322 should be submitted as soon as possible after receiving government funding, in order to claim the GST or HST reduction.

Q: Is there a deadline for submitting Form GST322?

A: There is no specific deadline for submitting Form GST322, but it is recommended to submit it as soon as possible.

Q: What are the consequences of not submitting Form GST322?

A: If Form GST322 is not submitted, the organization will not be eligible for the GST or HST reduction on the government-funded expenses.

Q: Can I submit Form GST322 by mail?

A: Yes, Form GST322 can be submitted by mail to the CRA tax center responsible for the organization's GST/HST account.