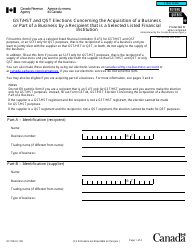

This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST17

for the current year.

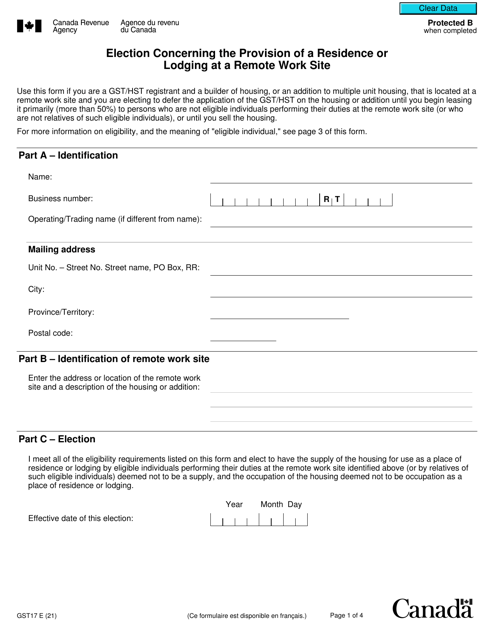

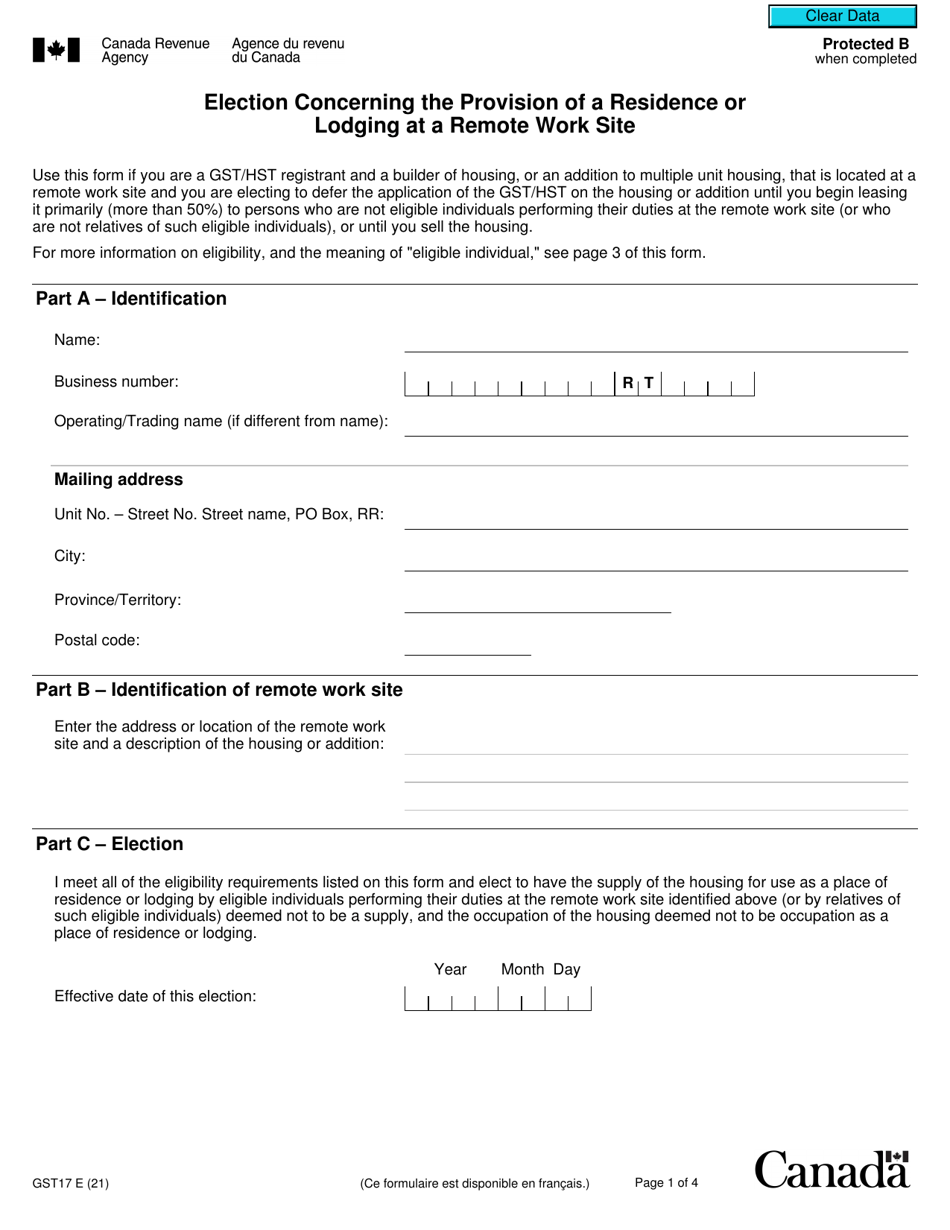

Form GST17 Election Concerning the Provision of a Residence or Lodging at a Remote Work Site - Canada

The Form GST17 in Canada is used for election concerning the provision of a residence or lodging at a remote work site. It is related to the Goods and Services Tax (GST) and allows individuals to claim input tax credits for the GST paid on expenses related to providing a residence or lodging at a remote work site.

The employer files the Form GST17 Election Concerning the Provision of a Residence or Lodging at a Remote Work Site in Canada.

FAQ

Q: What is Form GST17?

A: Form GST17 is a form used in Canada concerning the provision of a residence or lodging at a remote work site.

Q: Who needs to fill out Form GST17?

A: Individuals or businesses who provide a residence or lodging at a remote work site in Canada need to fill out Form GST17.

Q: What is a remote work site?

A: A remote work site refers to a location where work is being conducted and is located away from the usual place of business.

Q: What is the purpose of Form GST17?

A: The purpose of Form GST17 is to elect whether to charge or not charge the goods and services tax/harmonized sales tax (GST/HST) on the provision of a residence or lodging at a remote work site.

Q: How do I complete Form GST17?

A: To complete Form GST17, you need to provide information about the remote work site, the type of lodging being provided, and make an election regarding the GST/HST.

Q: When is Form GST17 due?

A: Form GST17 is due on the date indicated on the form or within 30 days of receiving the form, whichever is later.