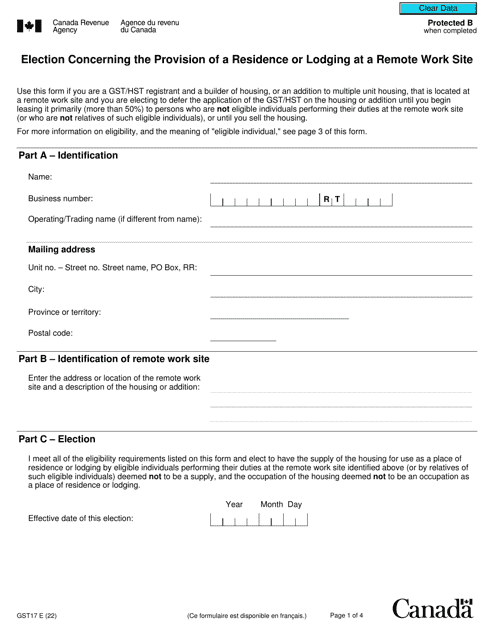

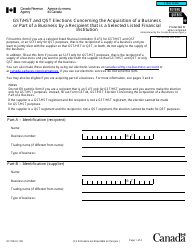

Form GST17 Election Concerning the Provision of a Residence or Lodging at a Remote Work Site - Canada

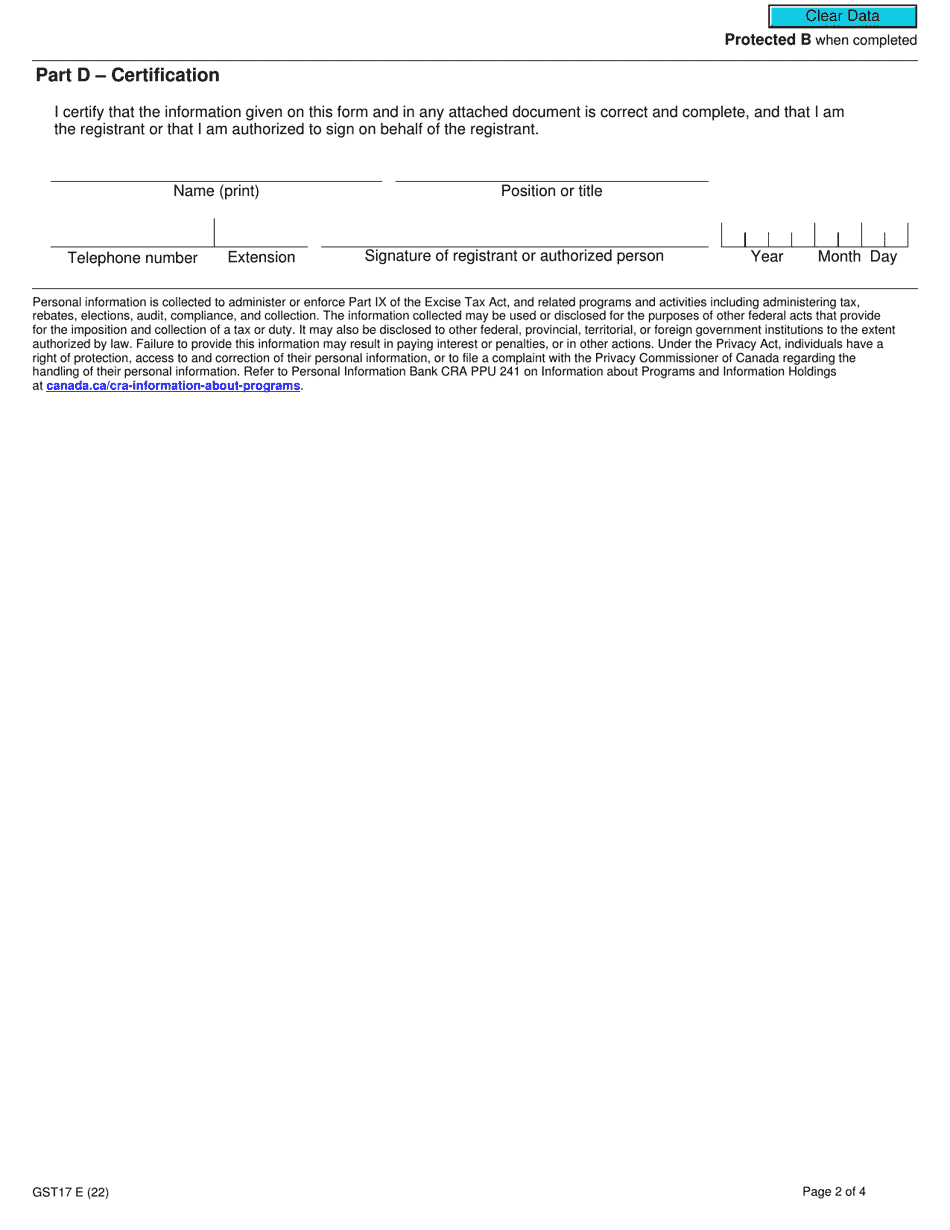

The employer files the Form GST17 Election Concerning the Provision of a Residence or Lodging at a Remote Work Site in Canada.

Form GST17 Election Concerning the Provision of a Residence or Lodging at a Remote Work Site - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST17?

A: Form GST17 is a form used in Canada to elect the provisions of a residence or lodging at a remote work site.

Q: What is the purpose of Form GST17?

A: The purpose of Form GST17 is to declare an election regarding the provision of a residence or lodging at a remote work site.

Q: Who should use Form GST17?

A: Individuals or businesses in Canada who provide residence or lodging at remote work sites should use Form GST17.

Q: What is meant by a remote work site?

A: A remote work site refers to a location where work is carried out and which is not readily accessible by road.

Q: Why would someone elect to provide a residence at a remote work site?

A: Someone may elect to provide a residence at a remote work site for tax purposes, as it may be eligible for certain tax benefits.

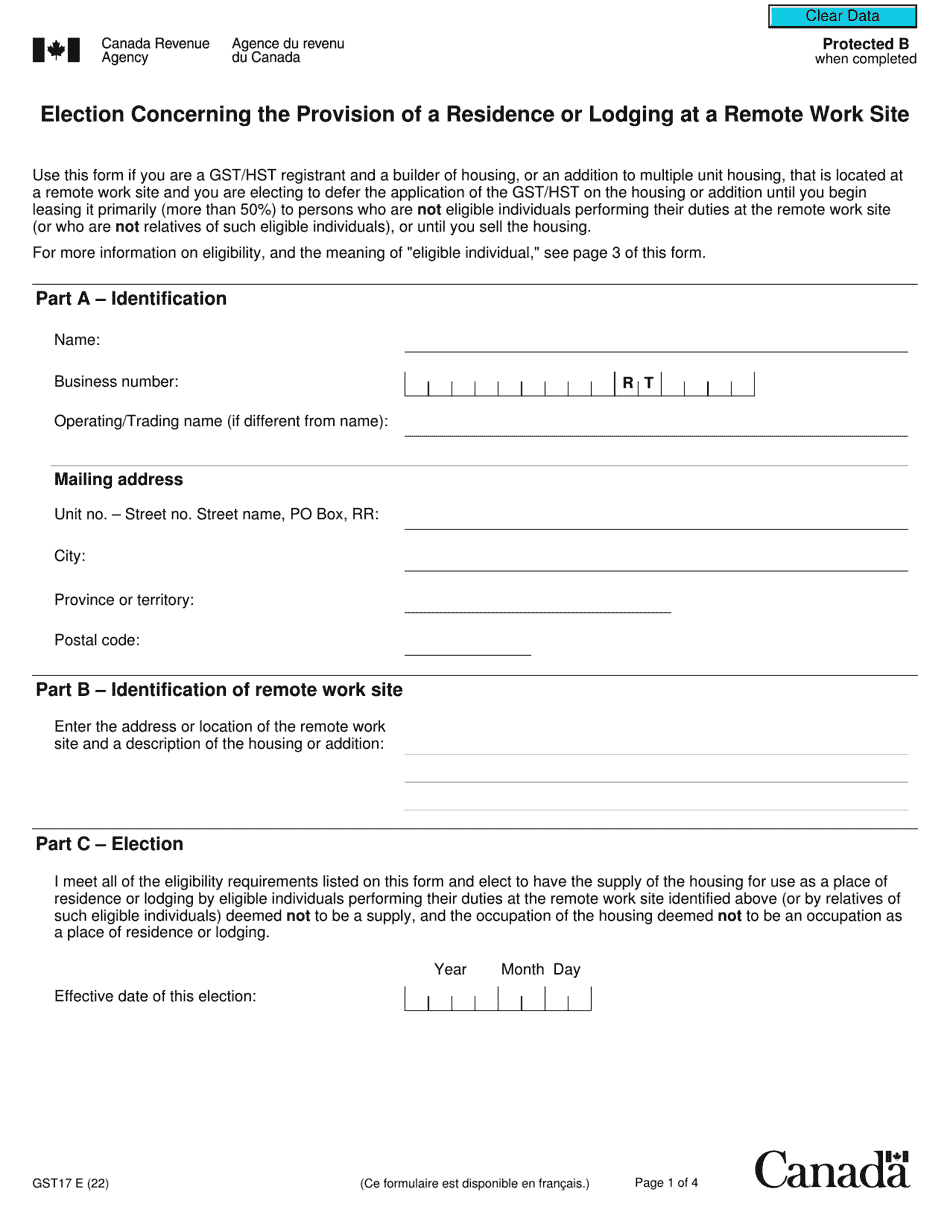

Q: When should I submit Form GST17?

A: Form GST17 should be submitted before the first day of the first reporting period in which the election is to be effective.

Q: What happens after I submit Form GST17?

A: After submitting Form GST17, the Canada Revenue Agency will review the election and notify you of its acceptance or any further requirements.