This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form R-210R

for the current year.

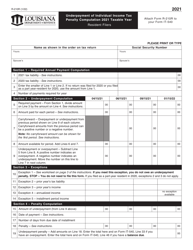

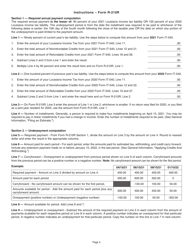

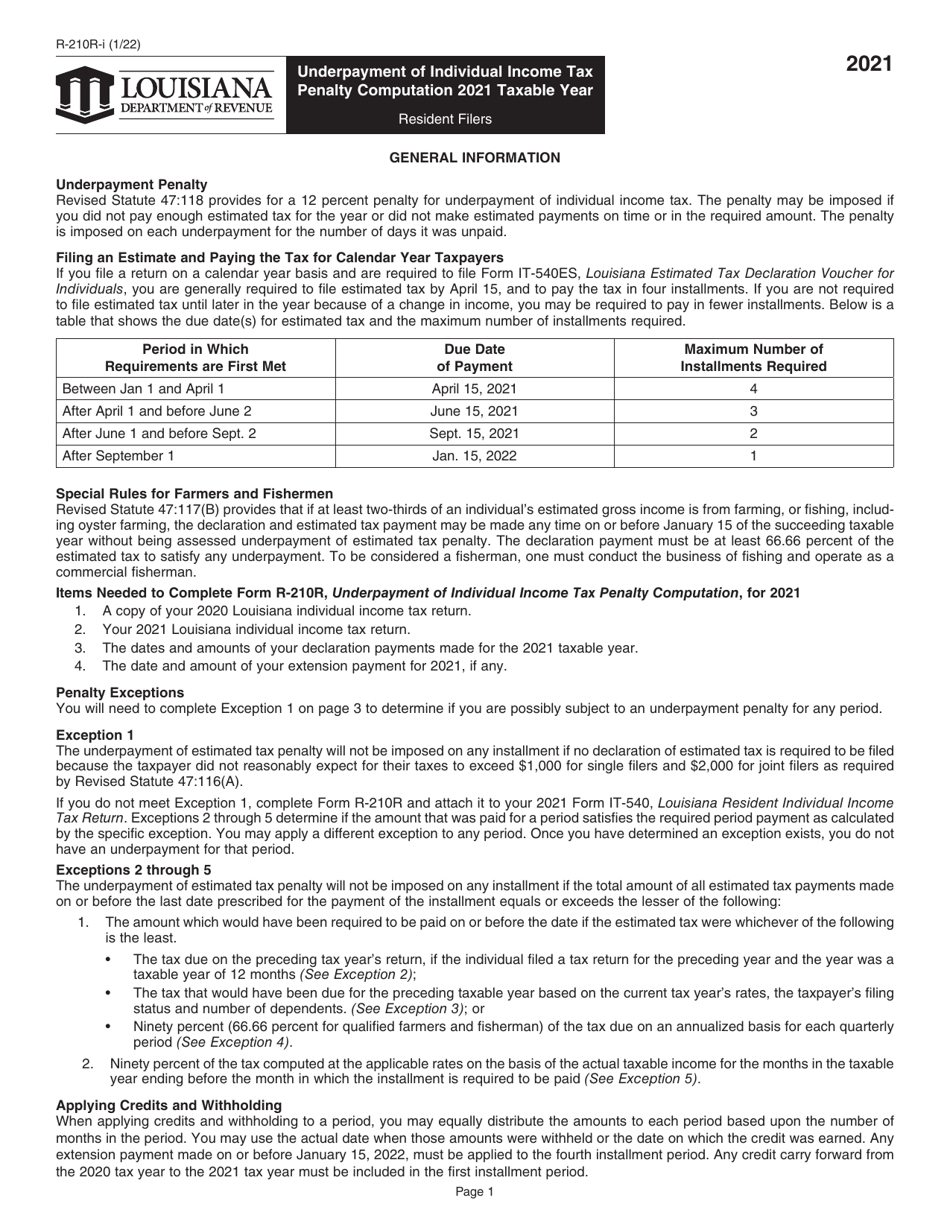

Instructions for Form R-210R Underpayment of Individual Income Tax Penalty Computation - Louisiana

This document contains official instructions for Form R-210R , Underpayment of Tax Penalty Computation - a form released and collected by the Louisiana Department of Revenue. An up-to-date fillable Form R-210R is available for download through this link.

FAQ

Q: What is Form R-210R?

A: Form R-210R is the form used by individuals to compute the underpayment penalty for Louisiana state income tax.

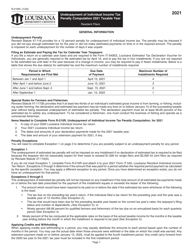

Q: What is the underpayment of individual income tax penalty?

A: The underpayment of individual income tax penalty is a penalty imposed on individuals who did not pay enough state income tax throughout the year.

Q: When is Form R-210R used?

A: Form R-210R is used when an individual owes an underpayment penalty for not paying enough Louisiana state income tax.

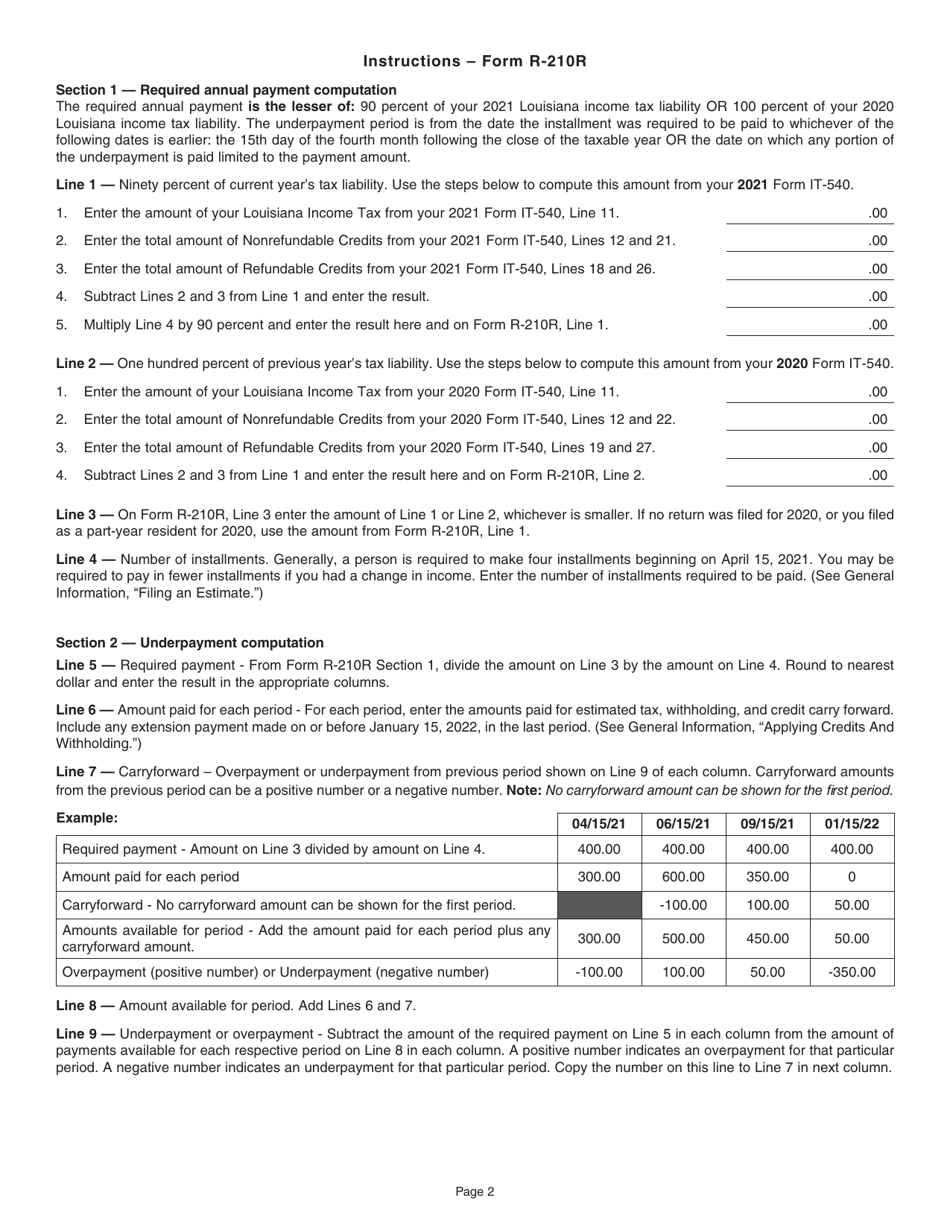

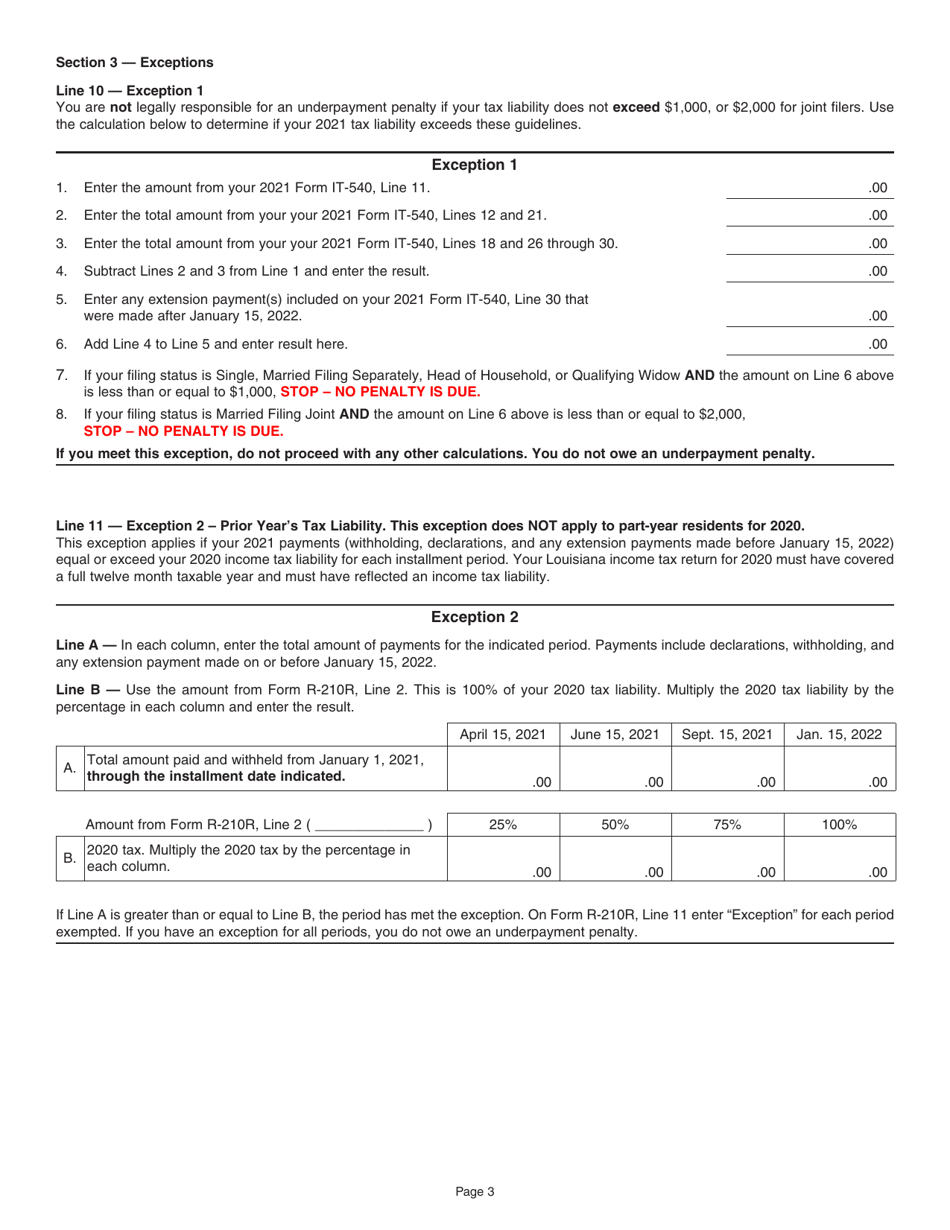

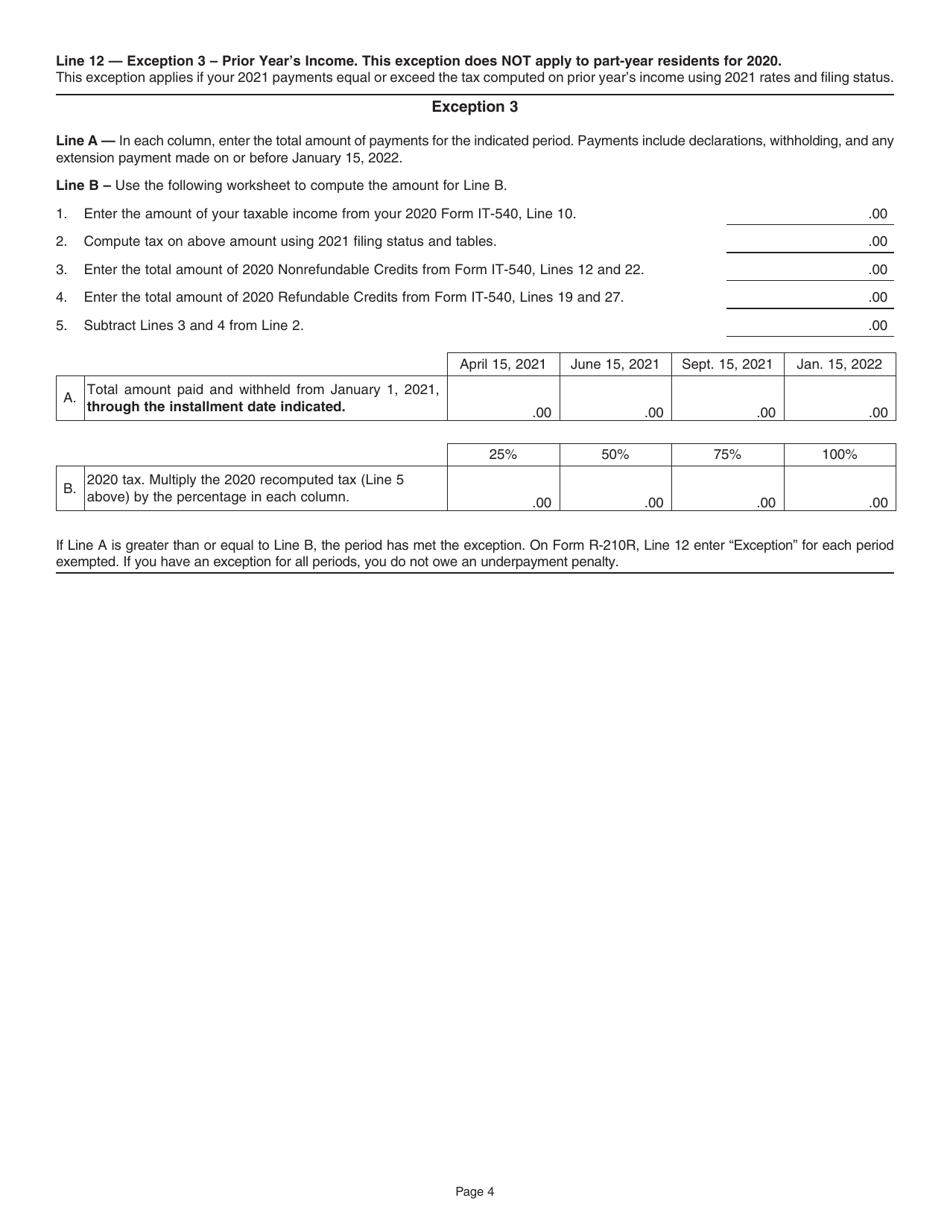

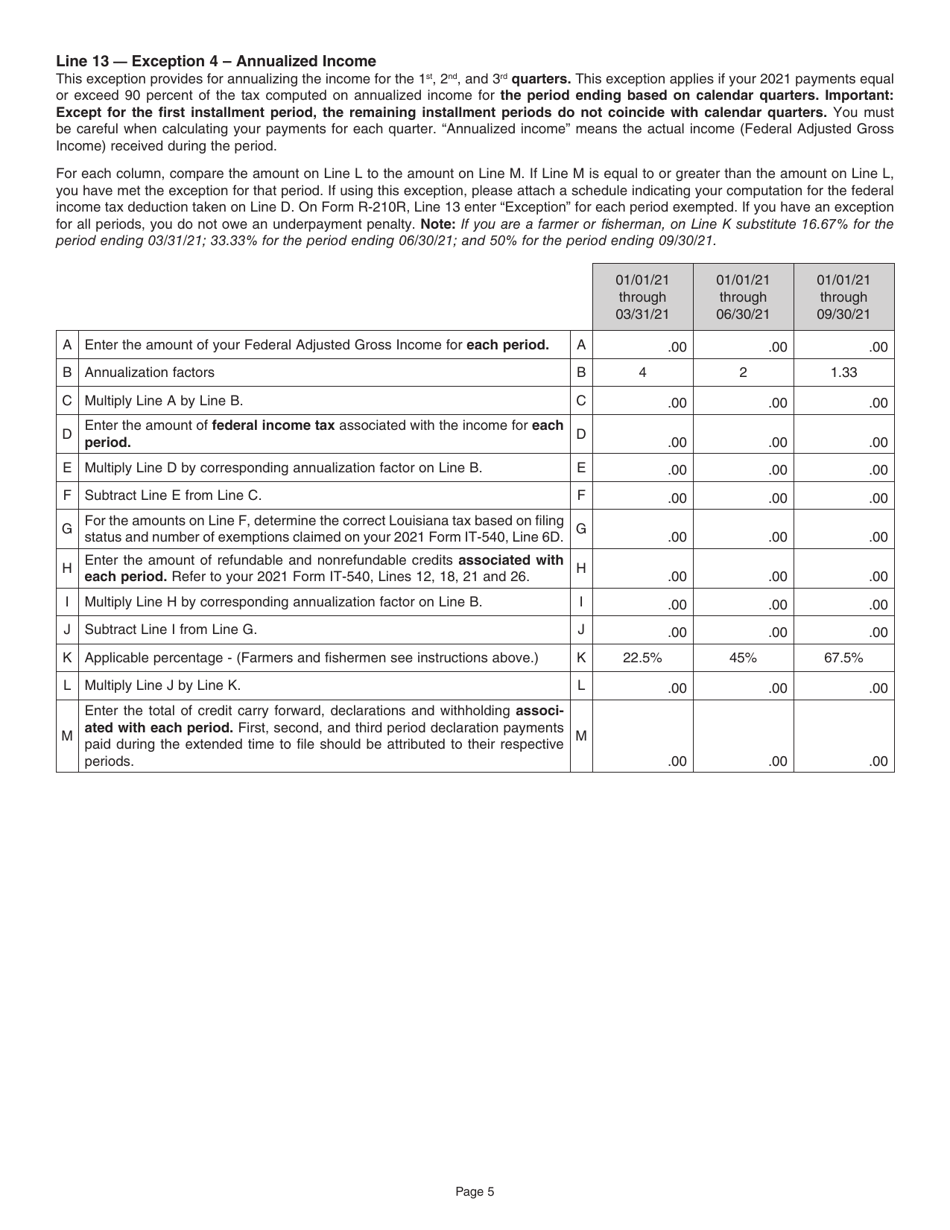

Q: How is the penalty computed?

A: The penalty is computed based on the amount of underpaid tax and the number of days it was underpaid.

Q: What information is needed to complete Form R-210R?

A: To complete Form R-210R, you will need information about your income, withholding, and estimated tax payments.

Q: Is there a deadline for filing Form R-210R?

A: Yes, Form R-210R must be filed by the due date of your Louisiana state income tax return, including extensions.

Q: Can I file Form R-210R electronically?

A: No, Form R-210R cannot be filed electronically. It must be filed by mail or in person.

Q: What should I do if I have questions about Form R-210R?

A: If you have questions about Form R-210R, you can contact the Louisiana Department of Revenue for assistance.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.