This version of the form is not currently in use and is provided for reference only. Download this version of

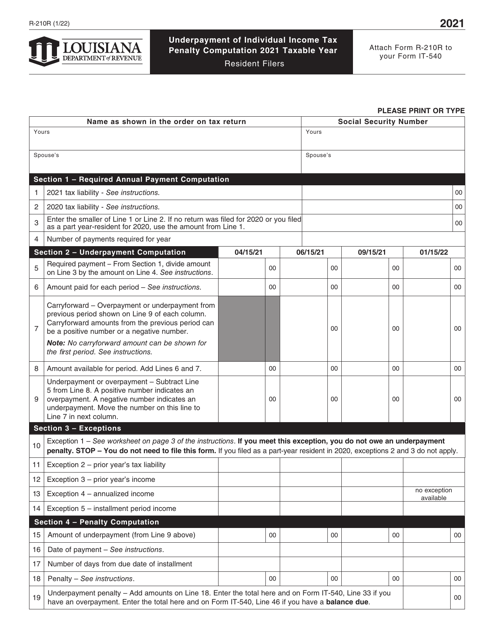

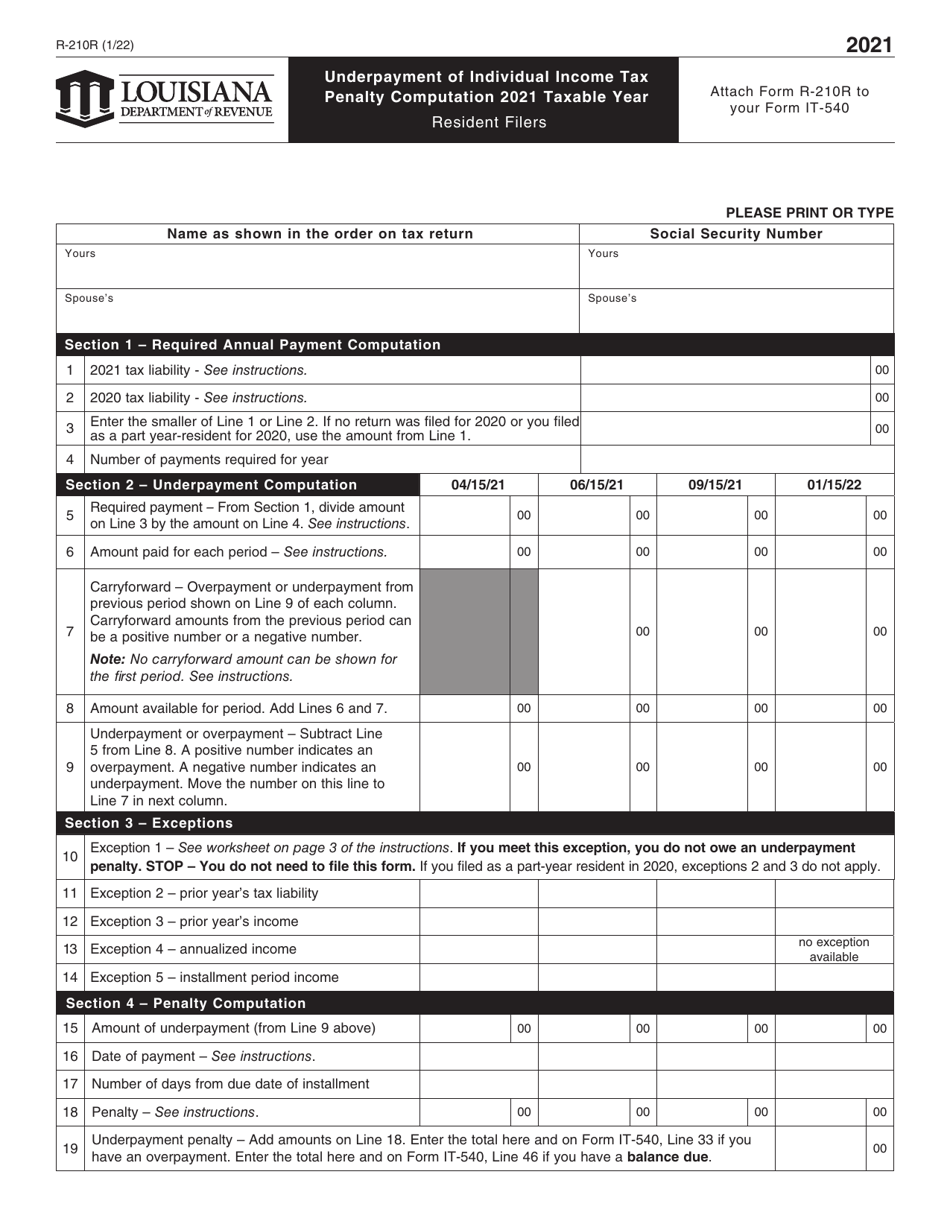

Form R-210R

for the current year.

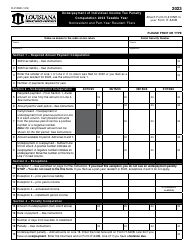

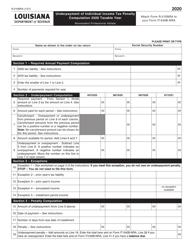

Form R-210R Underpayment of Individual Income Tax Penalty Computation - Non-resident and Part-Year Resident - Louisiana

What Is Form R-210R?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-210R?

A: Form R-210R is a tax form used to calculate the underpayment penalty for non-resident and part-year resident individuals in Louisiana.

Q: Who needs to fill out Form R-210R?

A: Non-resident and part-year resident individuals in Louisiana who have underpaid their individual income tax may need to fill out Form R-210R.

Q: What is the purpose of Form R-210R?

A: The purpose of Form R-210R is to calculate the underpayment penalty for non-resident and part-year resident individuals in Louisiana.

Q: How do I fill out Form R-210R?

A: You need to provide your personal details, calculate your tax due, and calculate the underpayment penalty on Form R-210R.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-210R by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.