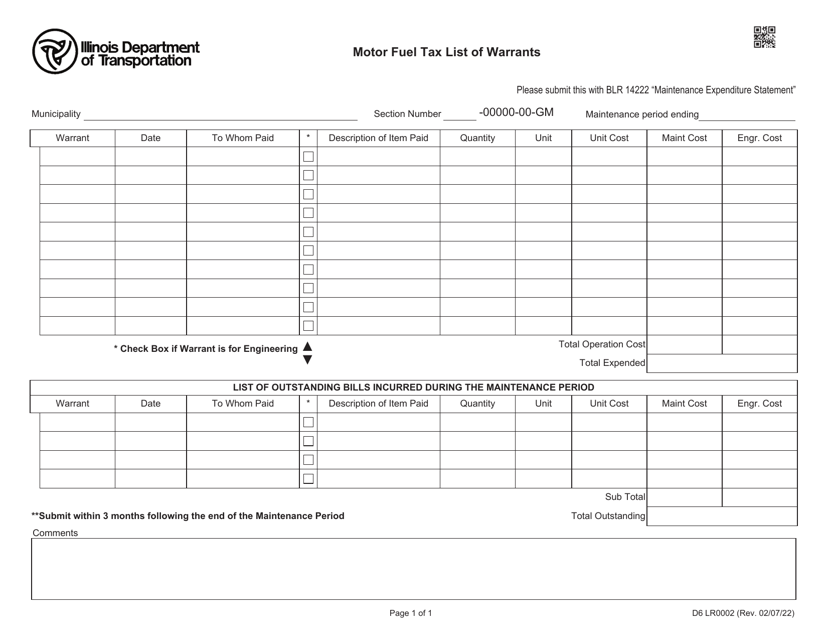

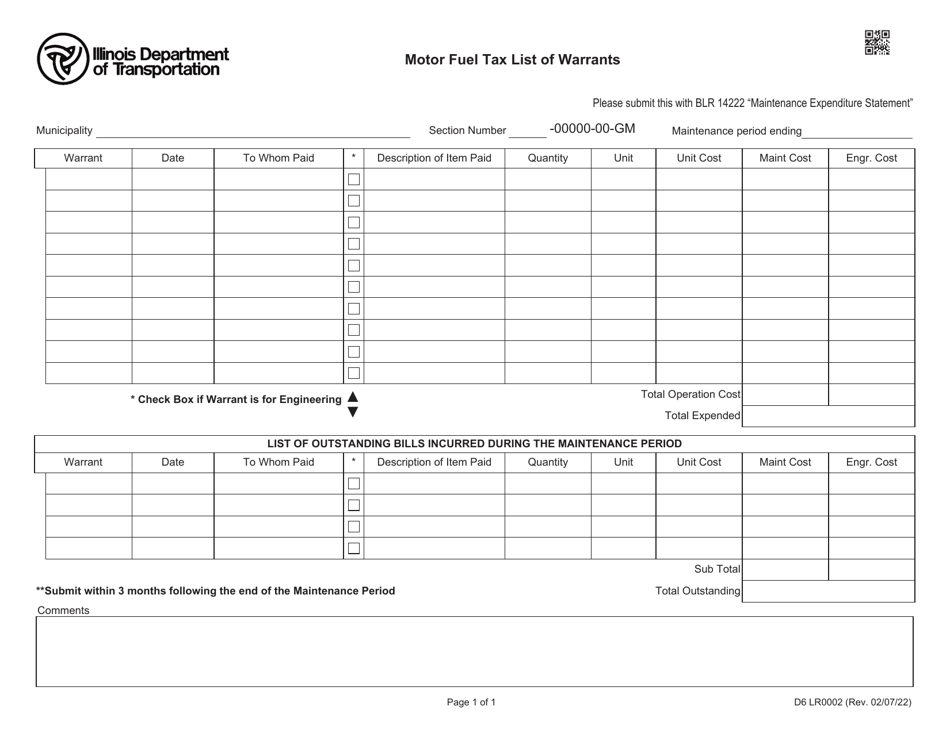

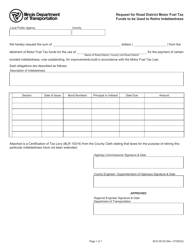

Form D6LR0002 Motor Fuel Tax List of Warrants - Illinois

What Is Form D6LR0002?

This is a legal form that was released by the Illinois Department of Transportation - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D6LR0002?

A: Form D6LR0002 is the Motor Fuel Tax List of Warrants in Illinois.

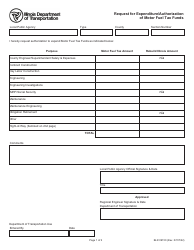

Q: What is Motor Fuel Tax?

A: Motor Fuel Tax is a tax imposed on the sale or use of motor fuel in Illinois.

Q: What is a List of Warrants?

A: A List of Warrants is a document that provides information about warrants issued by the government.

Q: Why is the Motor Fuel Tax List of Warrants important?

A: The Motor Fuel Tax List of Warrants is important for tracking motor fuel tax payments and ensuring compliance with tax laws.

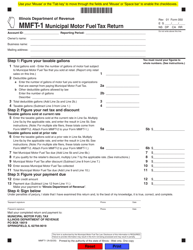

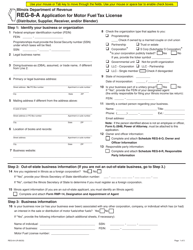

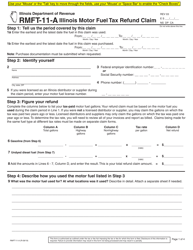

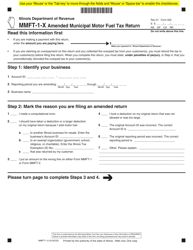

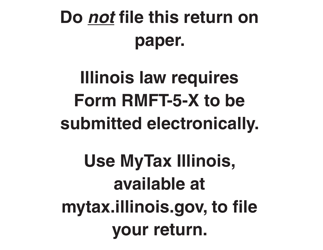

Q: Who needs to file Form D6LR0002?

A: Motor fuel distributors in Illinois need to file Form D6LR0002.

Q: What information is required on Form D6LR0002?

A: Form D6LR0002 requires information such as the distributor's name, address, license number, and the amount of tax owed.

Q: When is Form D6LR0002 due?

A: Form D6LR0002 is due on a monthly basis, with the deadline typically falling on the 20th of the month.

Q: What are the consequences of not filing Form D6LR0002?

A: Failure to file Form D6LR0002 or underreporting motor fuel tax can result in penalties, interest, and potential legal action.

Form Details:

- Released on February 7, 2022;

- The latest edition provided by the Illinois Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D6LR0002 by clicking the link below or browse more documents and templates provided by the Illinois Department of Transportation.