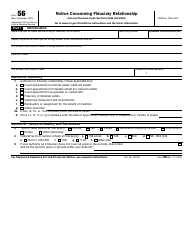

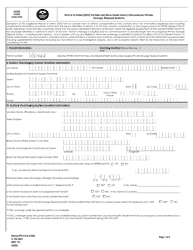

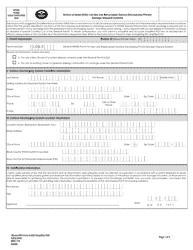

Instructions for Form IL-56 Notice of Fiduciary Relationship - Illinois

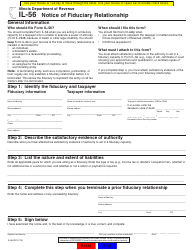

This document contains official instructions for Form IL-56 , Notice of Fiduciary Relationship - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-56 is available for download through this link.

FAQ

Q: What is Form IL-56?

A: Form IL-56 is a Notice of Fiduciary Relationship form required in Illinois.

Q: Who needs to file Form IL-56?

A: Individuals or entities acting as fiduciaries for Illinois estates or trusts must file Form IL-56.

Q: What is the purpose of Form IL-56?

A: Form IL-56 is used to notify the Illinois Department of Revenue about the existence of a fiduciary relationship.

Q: When should I file Form IL-56?

A: Form IL-56 must be filed within 90 days of the creation or existence of the fiduciary relationship.

Q: Is there a fee for filing Form IL-56?

A: No, there is no fee for filing Form IL-56.

Q: What information is required on Form IL-56?

A: Form IL-56 requires information about the fiduciary, the estate or trust, and any beneficiaries.

Q: Are there any penalties for not filing Form IL-56?

A: Yes, there are penalties for failure to file Form IL-56, including potential fines and interest charges.

Q: Can I file Form IL-56 electronically?

A: No, at this time, Form IL-56 must be filed by mail or in person.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.