This version of the form is not currently in use and is provided for reference only. Download this version of

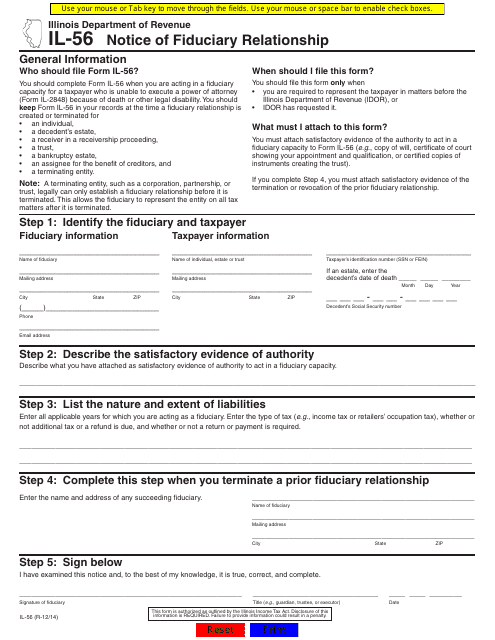

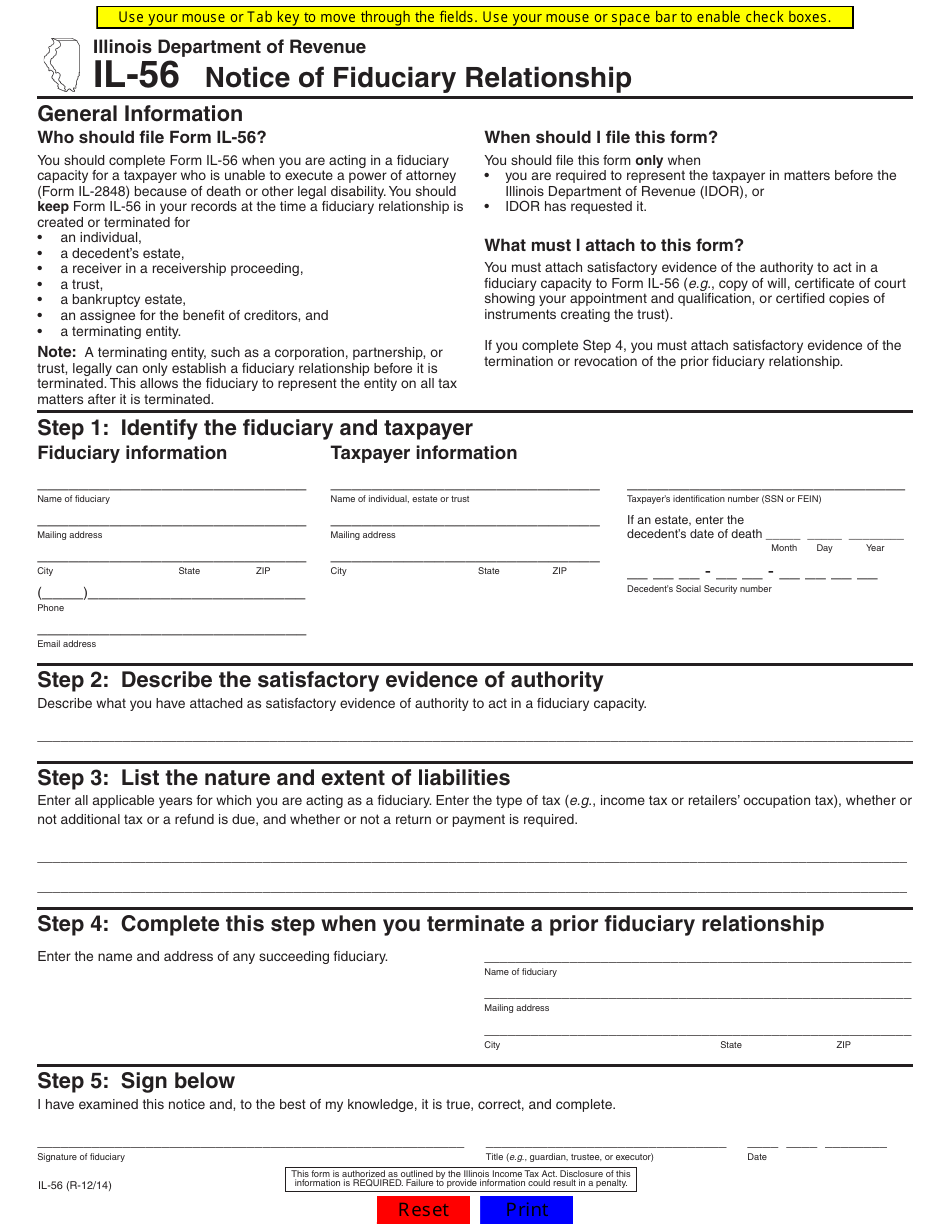

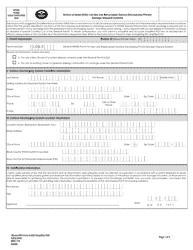

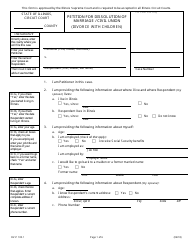

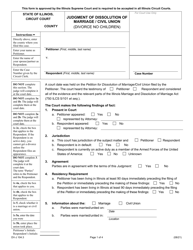

Form IL-56

for the current year.

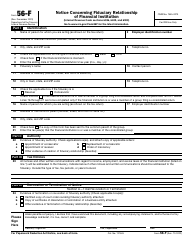

Form IL-56 Notice of Fiduciary Relationship - Illinois

What Is Form IL-56?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form IL-56 Notice of Fiduciary Relationship?

A: Form IL-56 is a document used in Illinois to notify the state of the existence of a fiduciary relationship.

Q: Who needs to file Form IL-56?

A: The person or entity acting as a fiduciary, such as an executor or trustee, needs to file Form IL-56.

Q: When should Form IL-56 be filed?

A: Form IL-56 should be filed within 30 days of the fiduciary relationship being established.

Q: What information is required on Form IL-56?

A: Form IL-56 requires information about the fiduciary, the beneficiary, and the estate or trust being administered.

Q: Are there any filing fees for Form IL-56?

A: No, there are no filing fees for Form IL-56.

Q: What happens if Form IL-56 is not filed?

A: Failure to file Form IL-56 can result in penalties and interest being assessed.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-56 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.