Instructions for Bankruptcy Forms for Non-individuals

Instructions for Bankruptcy Forms for Non-individuals is a 20-page legal document that was released by the United States Bankruptcy Court on April 1, 2022 and used nation-wide.

FAQ

Q: What are bankruptcy forms for non-individuals?

A: Bankruptcy forms for non-individuals are documents used by businesses, corporations, and other non-individual entities to file for bankruptcy.

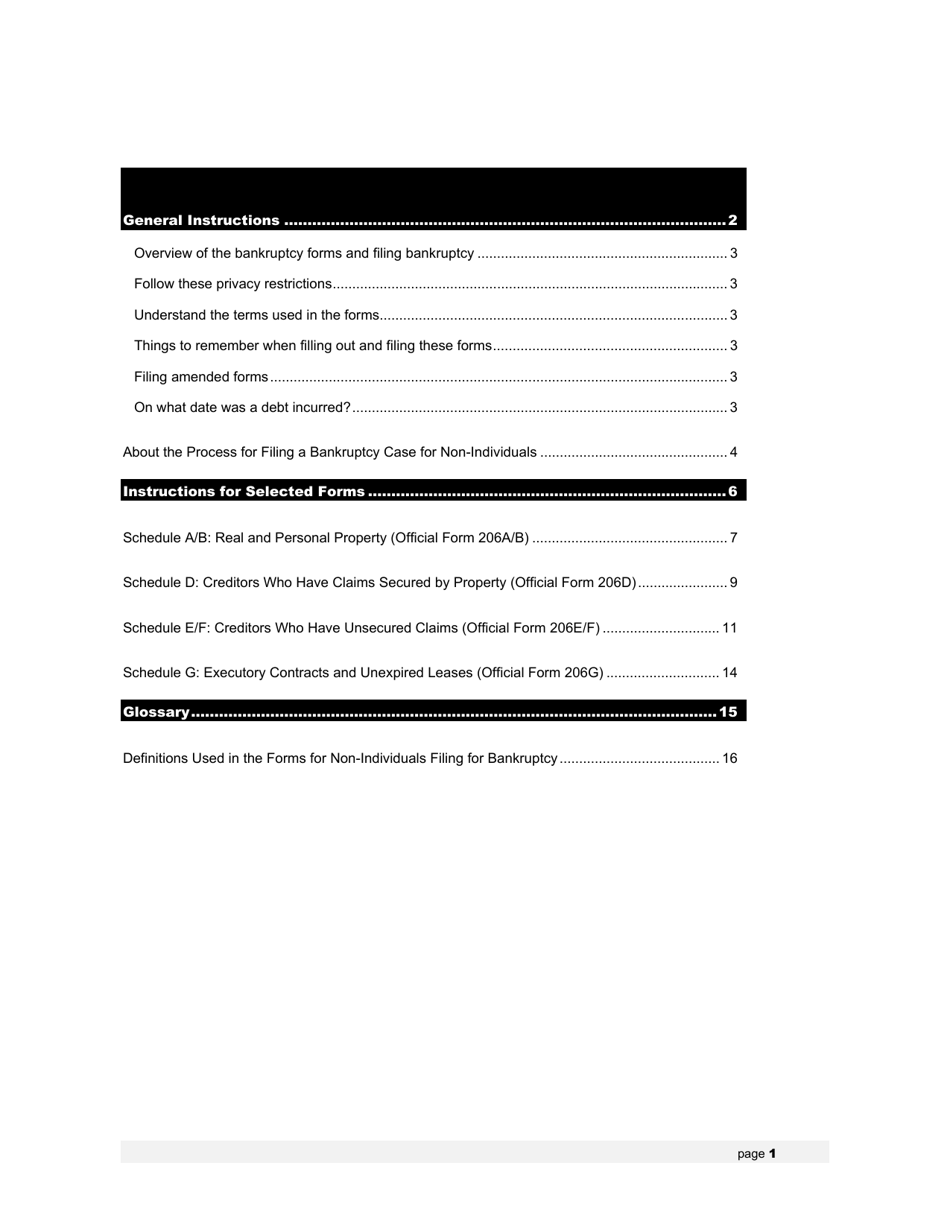

Q: Which forms are commonly used for non-individual bankruptcy filings?

A: Commonly used forms for non-individual bankruptcy filings include Form 201, Form 204, and Form 205.

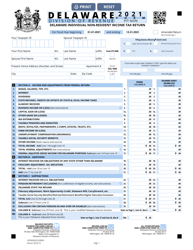

Q: What information is required to complete these forms?

A: These forms require information about the debtor's financial situation, assets, liabilities, income, and expenses.

Q: Are there any fees associated with filing these forms?

A: Yes, filing a bankruptcy petition for non-individuals requires the payment of filing fees, which may vary depending on the type and size of the entity.

Q: Do I need legal assistance to complete these forms?

A: While legal assistance is not required, it is recommended to consult with a bankruptcy attorney or seek professional advice to ensure accurate and complete completion of the forms.

Form Details:

- The latest edition currently provided by the United States Bankruptcy Court;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.