This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for

for the current year.

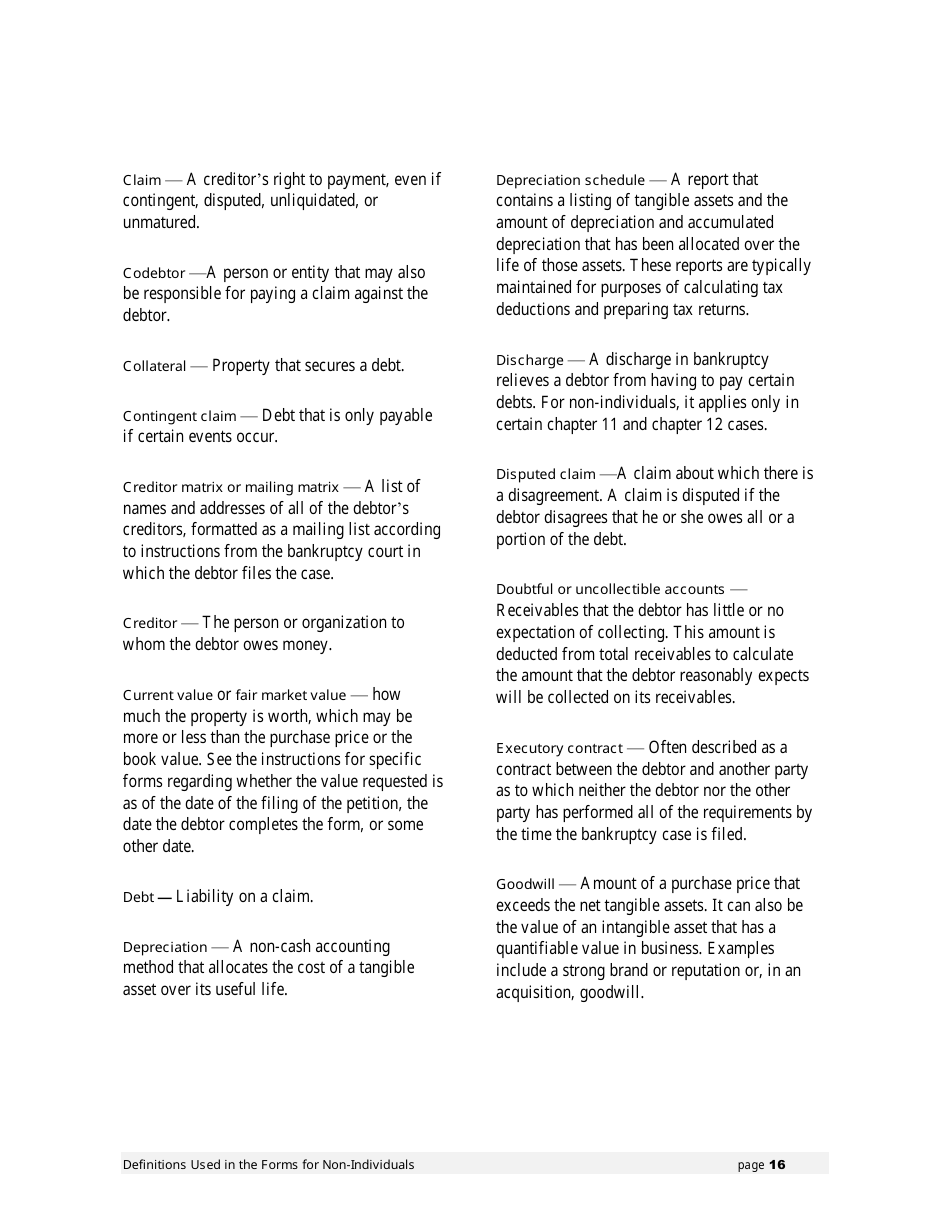

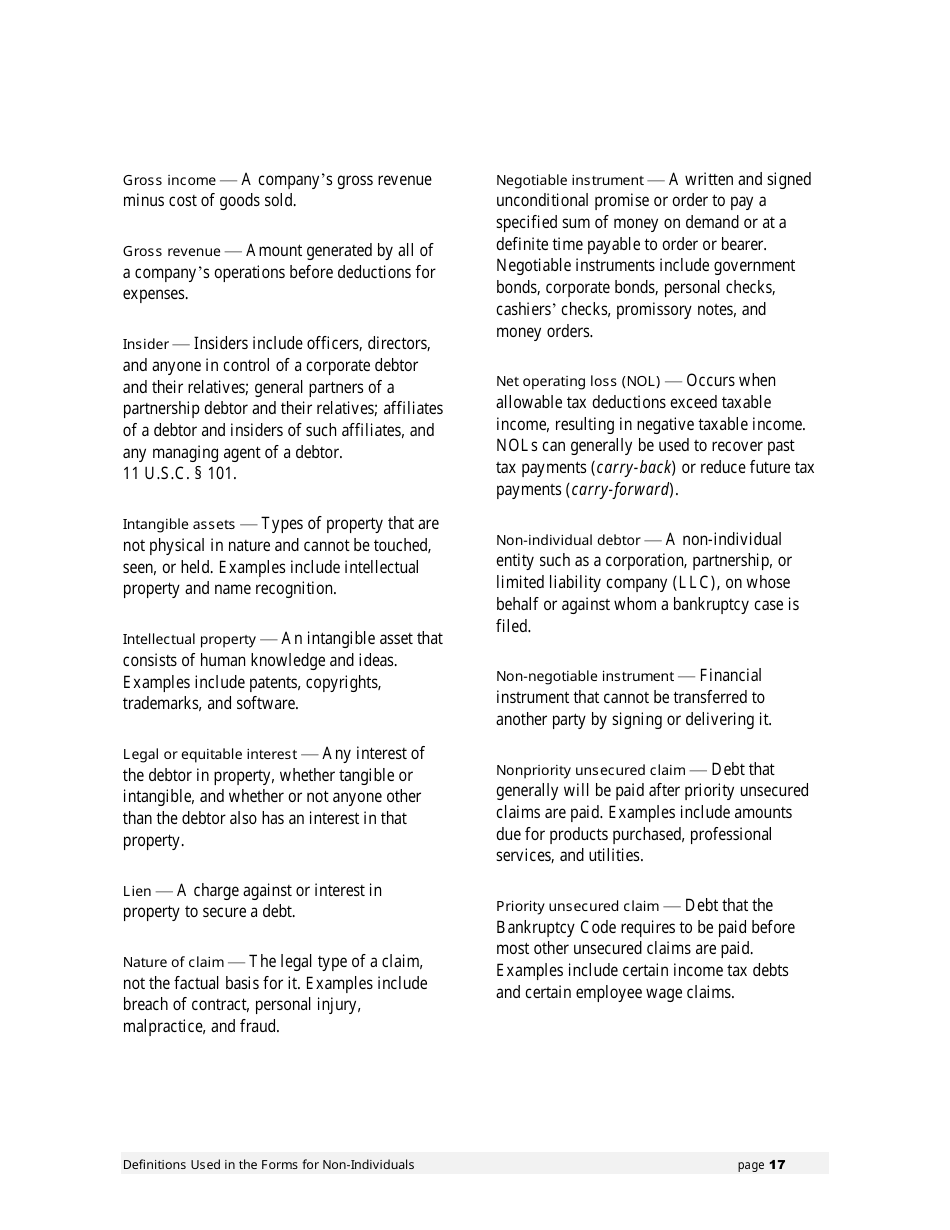

Instructions for Bankruptcy Forms for Non-individuals

This legal document was released by the United States Courts and contains official instructions for Bankruptcy Forms for Non-individuals .

FAQ

Q: Who can file bankruptcy as a non-individual?

A: Non-individual entities such as corporations, partnerships, and LLCs can file bankruptcy.

Q: What forms are required for non-individual bankruptcy?

A: Forms such as the Petition, Schedules, and Statement of Financial Affairs are required for non-individual bankruptcy.

Q: Are there any filing fees for non-individual bankruptcy?

A: Yes, there are filing fees associated with non-individual bankruptcy filings. The fees vary depending on the type and size of the entity.

Q: What are the steps to complete the bankruptcy forms for non-individuals?

A: The steps include gathering financial information, completing the required forms accurately, and filing the forms with the appropriate bankruptcy court.

Q: Do I need an attorney to file bankruptcy as a non-individual?

A: While it is not required, it is highly recommended to seek the assistance of an attorney familiar with bankruptcy laws when filing as a non-individual.

Q: How long does the non-individual bankruptcy process take?

A: The duration of the non-individual bankruptcy process can vary depending on the complexity of the case and court availability. It typically takes several months to a year to complete.

Q: What happens after the non-individual bankruptcy forms are filed?

A: After the forms are filed, the court will review the case, and creditors will be notified. A bankruptcy trustee may be appointed to oversee the proceedings.

Q: What are the potential outcomes of non-individual bankruptcy?

A: Potential outcomes include liquidation of assets, reorganization of debts, or the closure of the entity.

Q: Can non-individual bankruptcy filings be challenged by creditors?

A: Yes, creditors have the right to challenge non-individual bankruptcy filings under certain circumstances.

Q: What are the consequences of non-individual bankruptcy?

A: Consequences may include the loss of assets, damage to credit, and the need to comply with court-ordered debt repayment plans.

Instruction Details:

- These 19-page instructions are available for download in PDF;

- Released on April 1, 2016 - the latest version provided by the issuing department;

- Up-to-date, printable, and free to use.

Download your copy of the instructions by clicking the link below or browse more forms, instructions and templates in our online library.