This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form TA-2

for the current year.

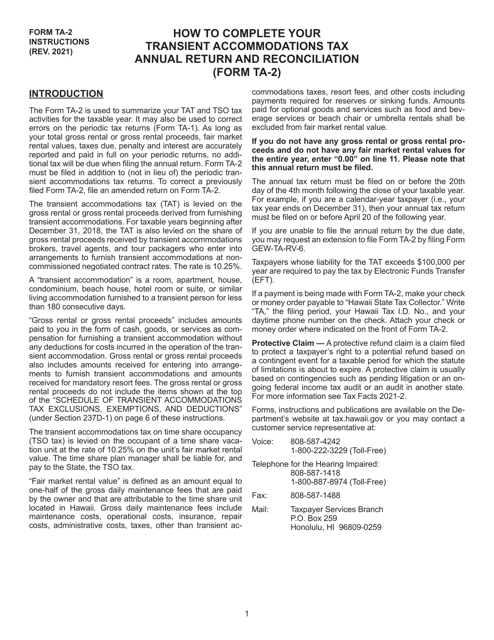

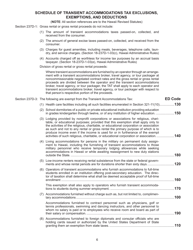

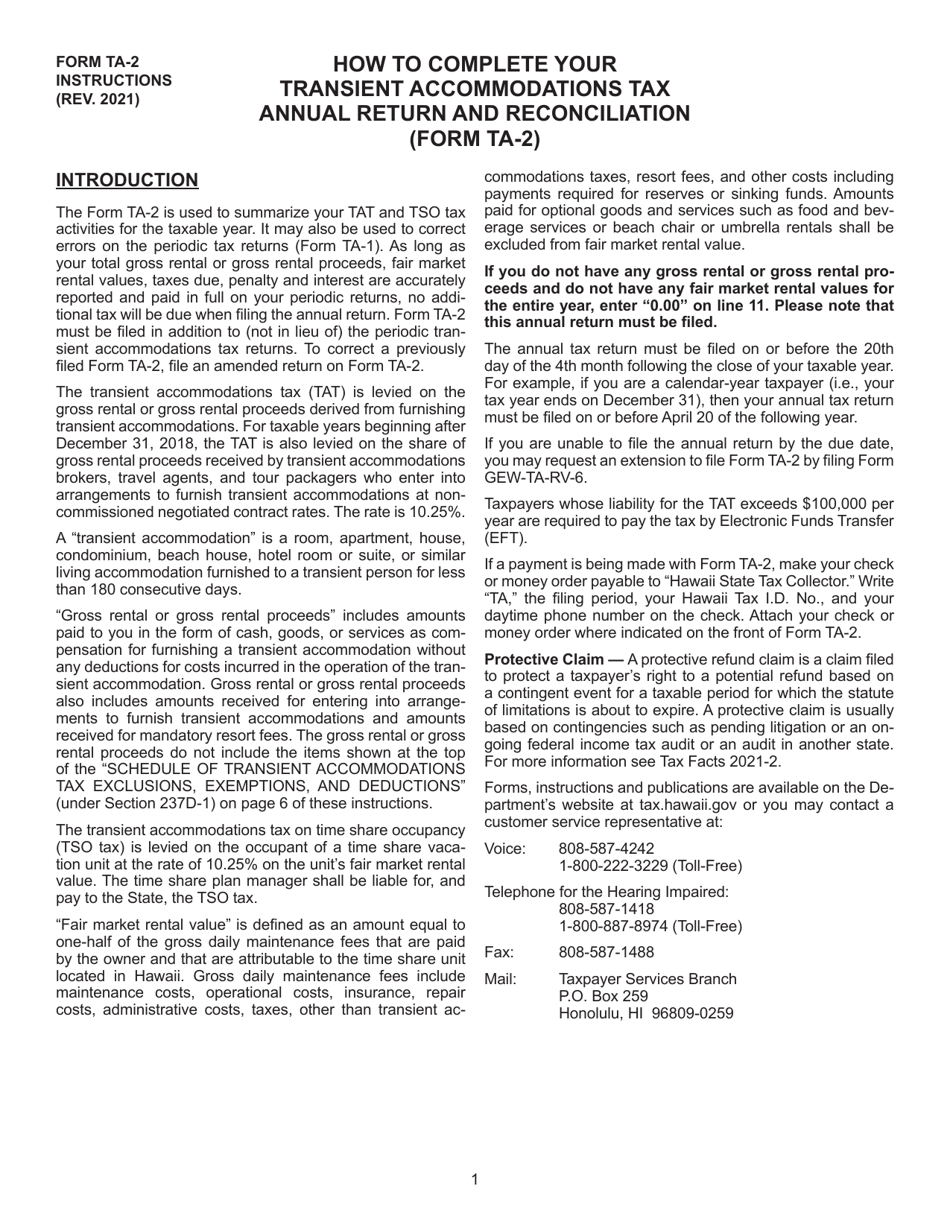

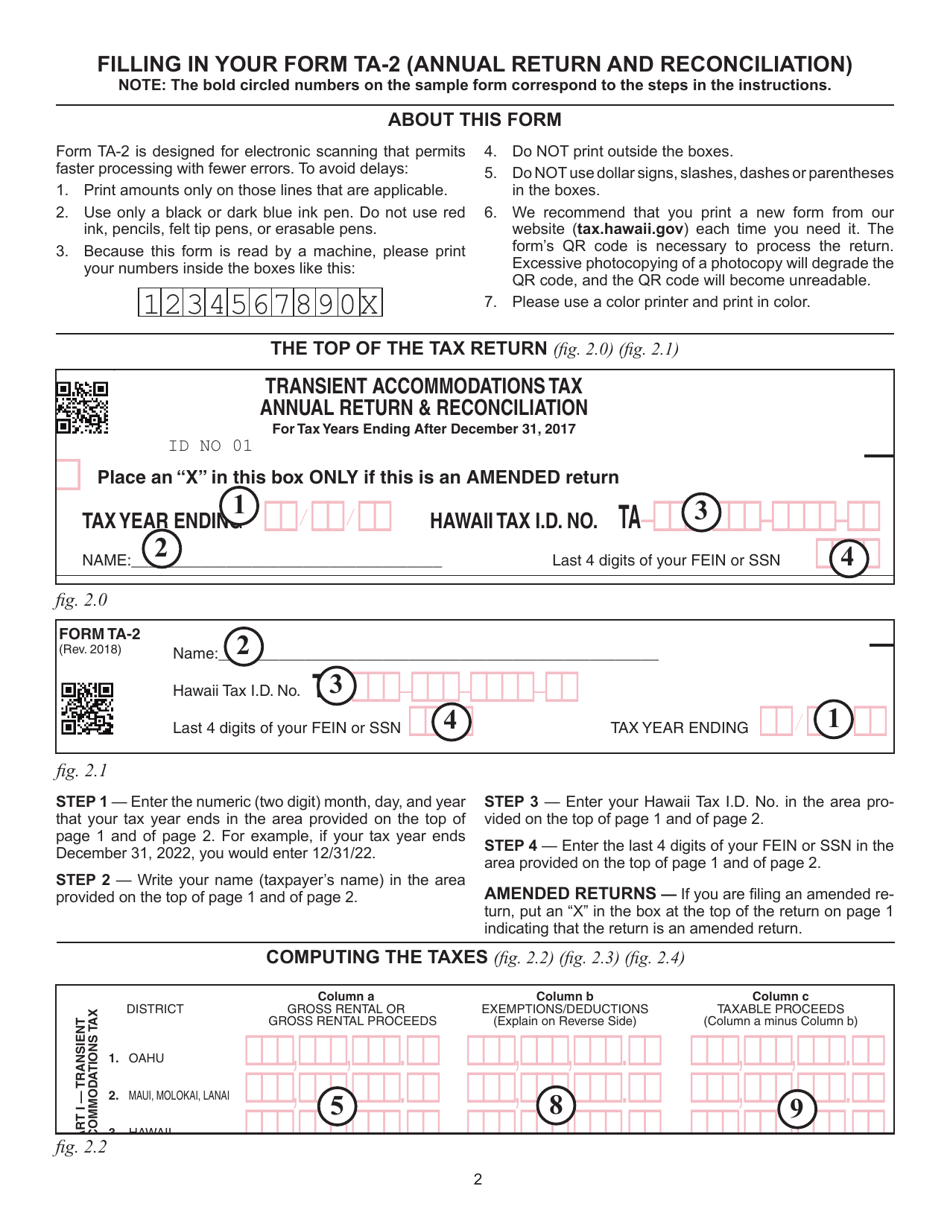

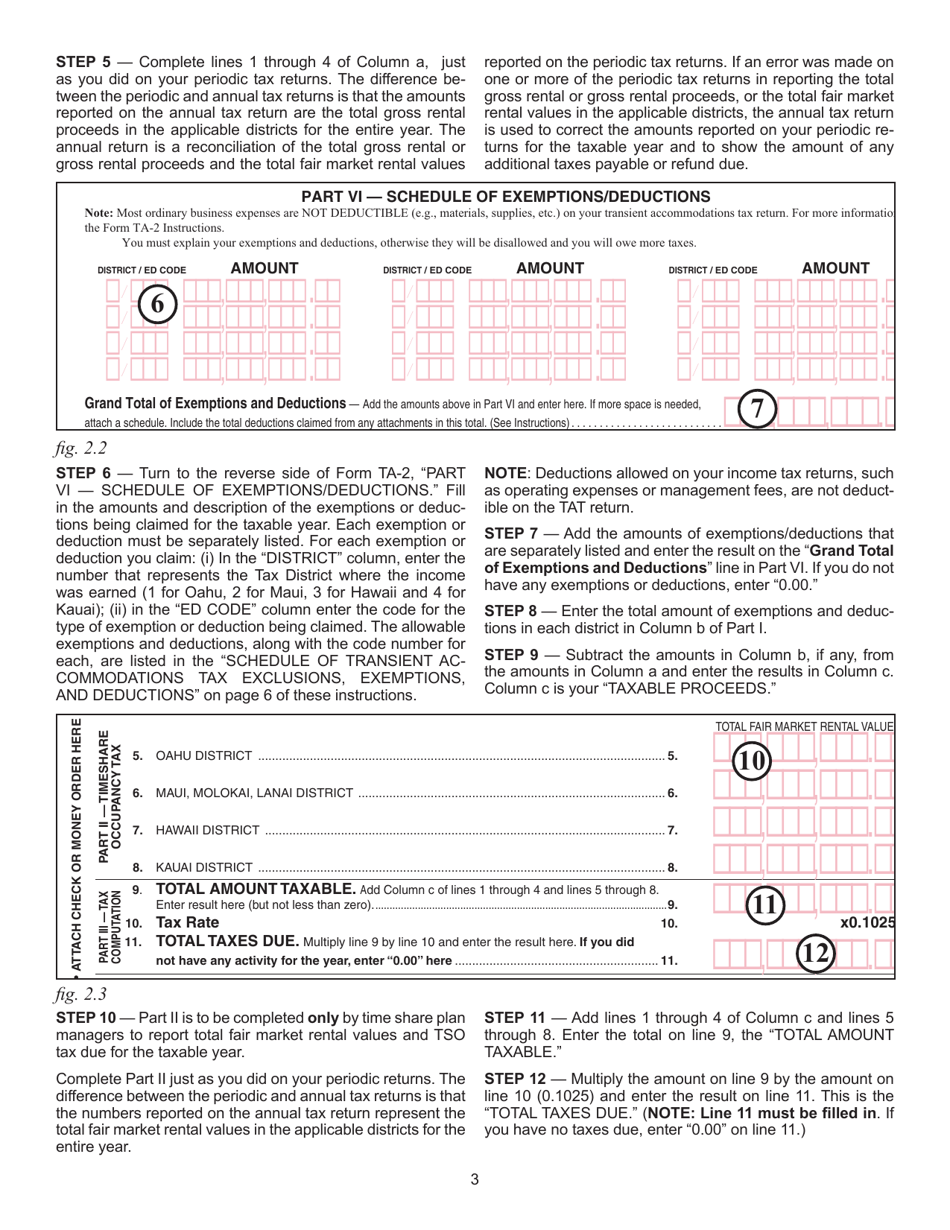

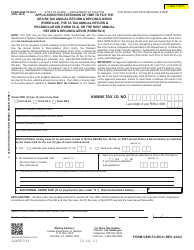

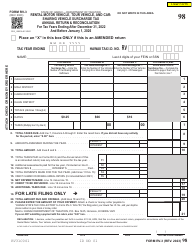

Instructions for Form TA-2 Transient Accommodations Tax Annual Return and Reconciliation - Hawaii

This document contains official instructions for Form TA-2 , Transient Accommodations Tax Annual Return and Reconciliation - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form TA-2 is available for download through this link.

FAQ

Q: What is Form TA-2?

A: Form TA-2 is the Transient Accommodations Tax Annual Return and Reconciliation form.

Q: Who needs to file Form TA-2?

A: Any individual or business in Hawaii that operates a transient accommodation must file Form TA-2.

Q: What is Transient Accommodations Tax?

A: Transient Accommodations Tax is a tax imposed on the gross rental proceeds generated from the furnishing of transient accommodations.

Q: What information is required on Form TA-2?

A: Form TA-2 requires information on gross rental proceeds, deductions, and payments, along with other relevant details.

Q: When is Form TA-2 due?

A: Form TA-2 is due on or before the last day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including potential fines and interest charges.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.