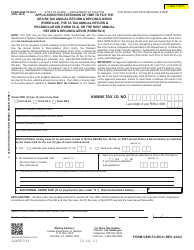

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TA-2

for the current year.

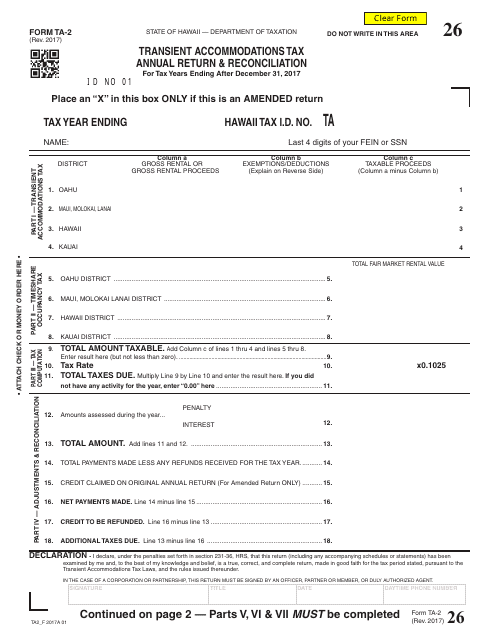

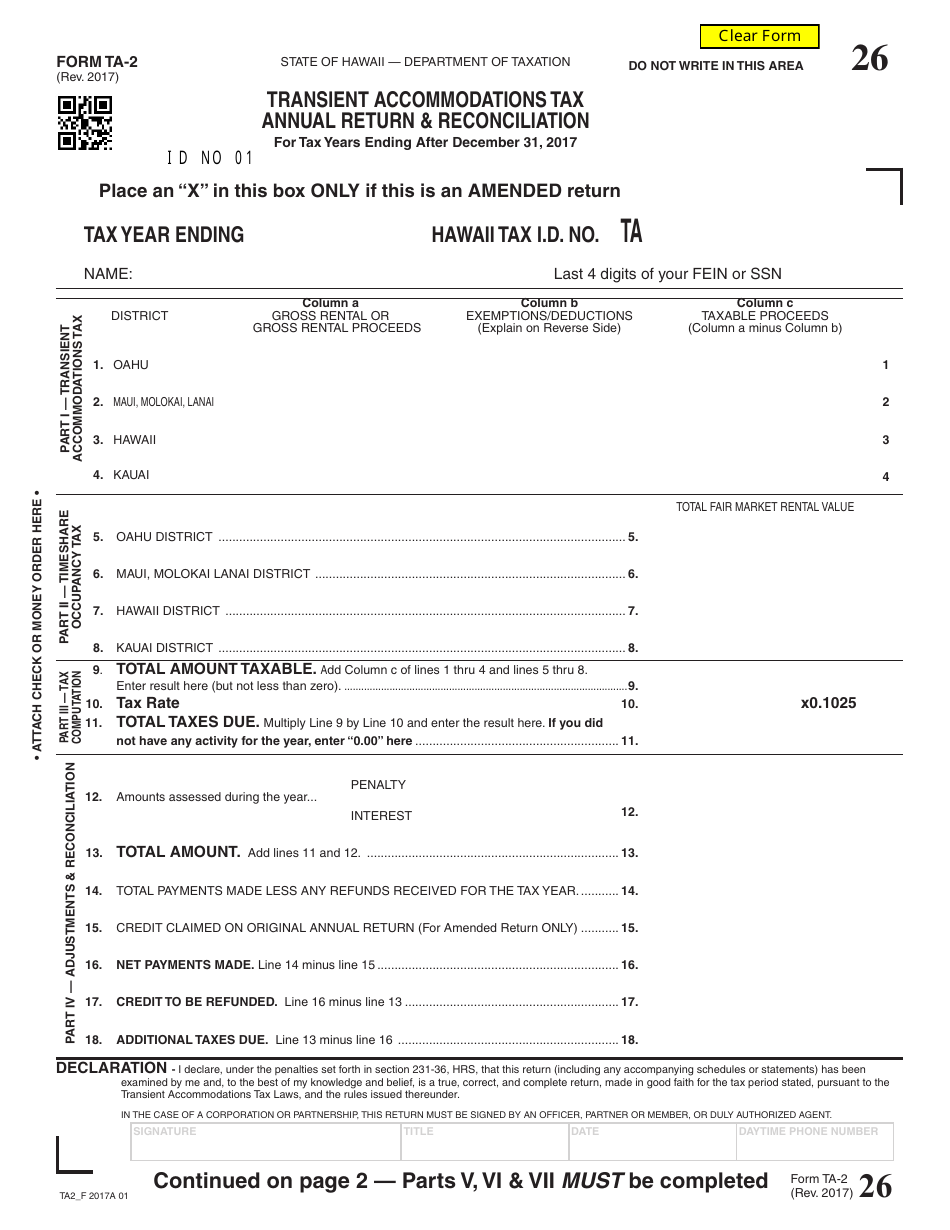

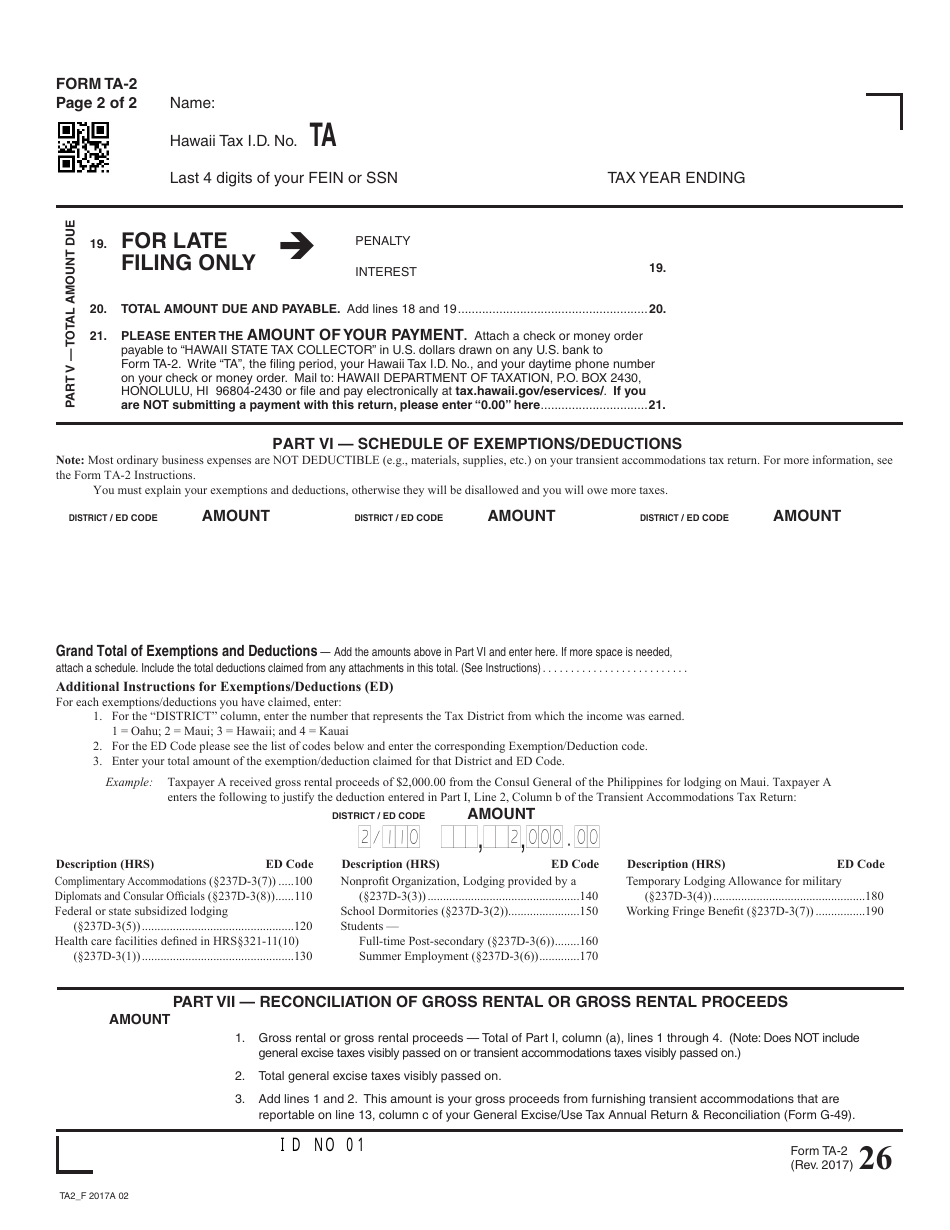

Form TA-2 Transient Accommodations Tax Annual Return & Reconciliation - Hawaii

What Is Form TA-2?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form TA-2?

A: Form TA-2 is the Transient Accommodations Tax Annual Return & Reconciliation form for the state of Hawaii.

Q: What is Transient Accommodations Tax (TAT)?

A: Transient Accommodations Tax (TAT) is a tax imposed on the gross rental proceeds from transient accommodations in Hawaii.

Q: Who needs to file Form TA-2?

A: Owners and operators of transient accommodations in Hawaii need to file Form TA-2.

Q: How often should Form TA-2 be filed?

A: Form TA-2 should be filed annually.

Q: What is the purpose of Form TA-2?

A: The purpose of Form TA-2 is to report and reconcile the TAT collected and remitted by owners and operators of transient accommodations.

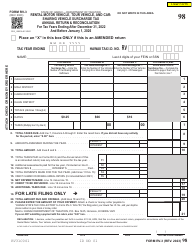

Q: What information is required to complete Form TA-2?

A: To complete Form TA-2, you will need to provide information such as the total rental proceeds, TAT collected, and any deductions or exemptions that apply.

Q: What is the deadline for filing Form TA-2?

A: The deadline for filing Form TA-2 is normally on or before the last day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form TA-2?

A: Yes, there are penalties for late filing of Form TA-2, so it is important to file on time.

Q: Is there any tax payable when filing Form TA-2?

A: Yes, the TAT collected on rental proceeds is subject to tax, and you may need to pay any remaining tax balance when filing Form TA-2.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TA-2 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.