This version of the form is not currently in use and is provided for reference only. Download this version of

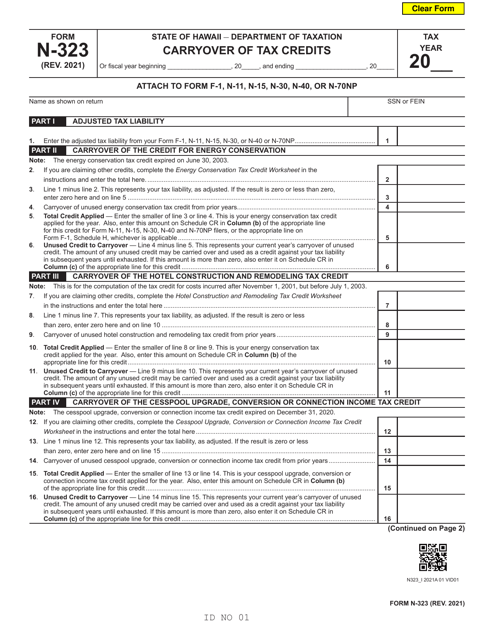

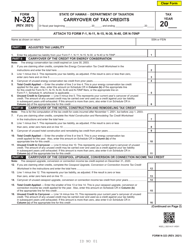

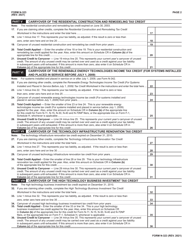

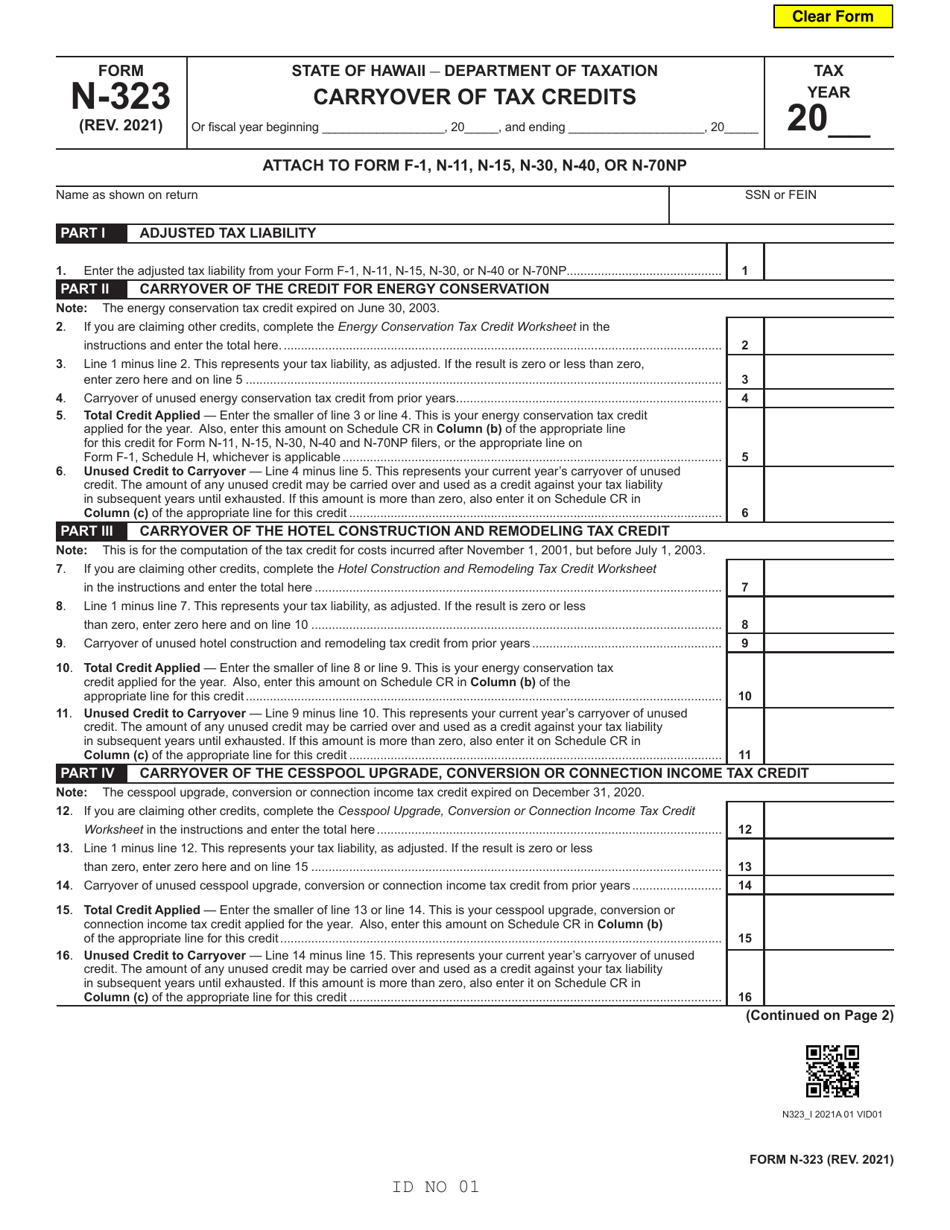

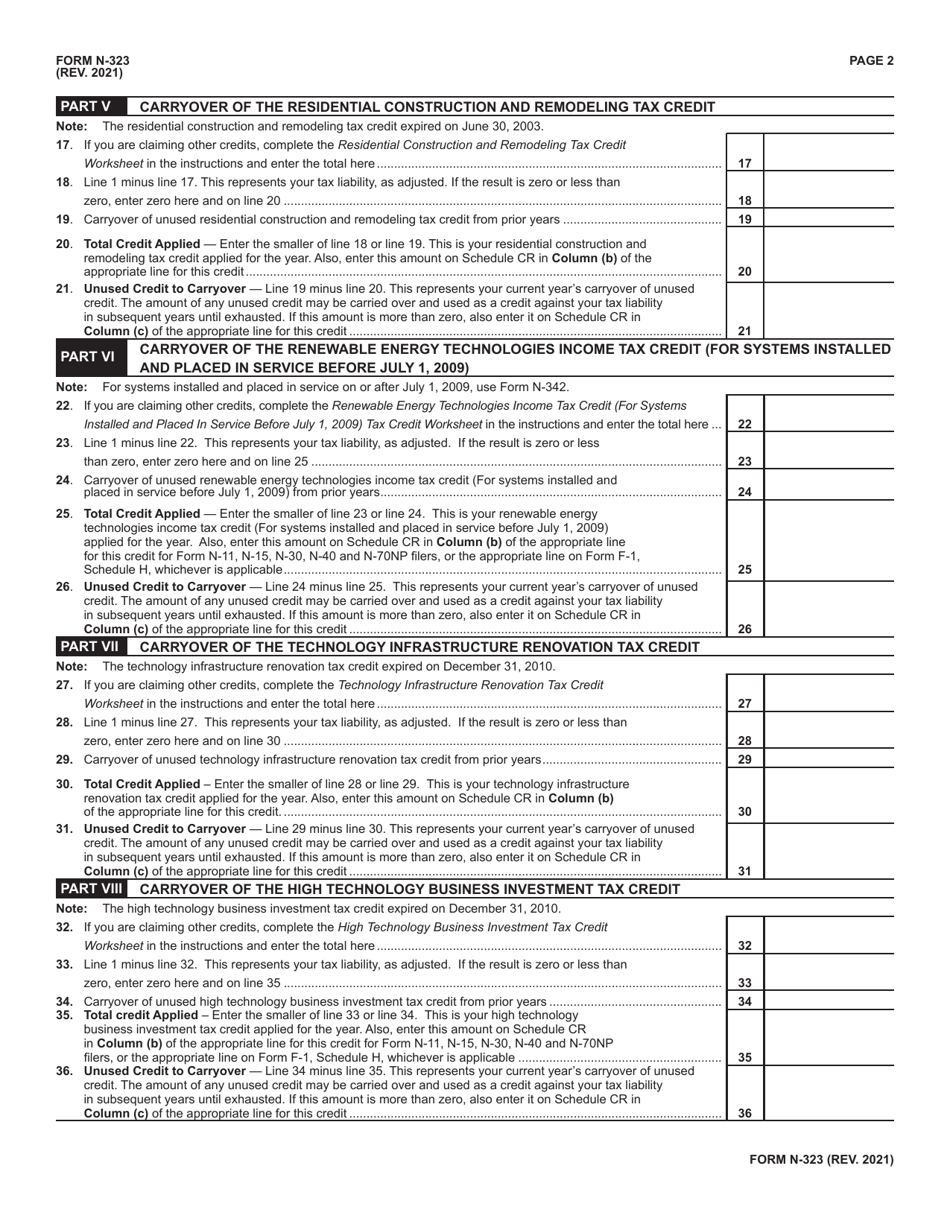

Form N-323

for the current year.

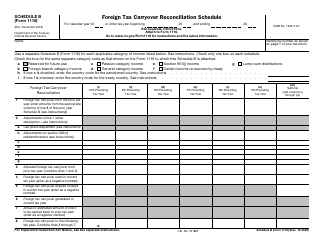

Form N-323 Carryover of Tax Credits - Hawaii

What Is Form N-323?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-323?

A: Form N-323 is the Carryover of Tax Credits form for individuals or corporations in Hawaii.

Q: What is the purpose of Form N-323?

A: The purpose of Form N-323 is to claim and carry over tax credits from a previous year.

Q: Who can file Form N-323?

A: Individuals or corporations who have tax credits to carry over from a previous year in Hawaii can file Form N-323.

Q: How do I complete Form N-323?

A: To complete Form N-323, you must provide your personal or business information, details of the tax credits being carried over, and any required documentation.

Q: When is Form N-323 due?

A: Form N-323 is due on the same day as your Hawaii individual or corporate tax return.

Q: Do I need to attach any documents to Form N-323?

A: Yes, you may need to attach documentation supporting your claim for carryover tax credits.

Q: What happens after I file Form N-323?

A: After filing Form N-323, the Hawaii Department of Taxation will review your claim for carryover tax credits and notify you of any adjustments or additional information required.

Q: What should I do if I have questions or need assistance with Form N-323?

A: If you have questions or need assistance with Form N-323, you should contact the Hawaii Department of Taxation or seek guidance from a tax professional.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-323 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.