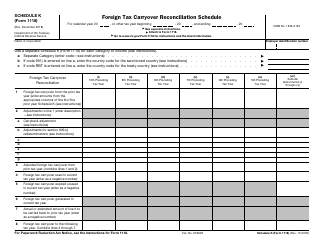

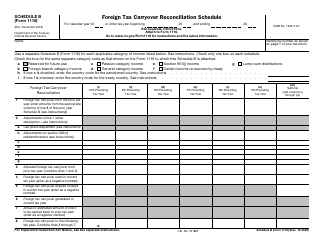

This version of the form is not currently in use and is provided for reference only. Download this version of

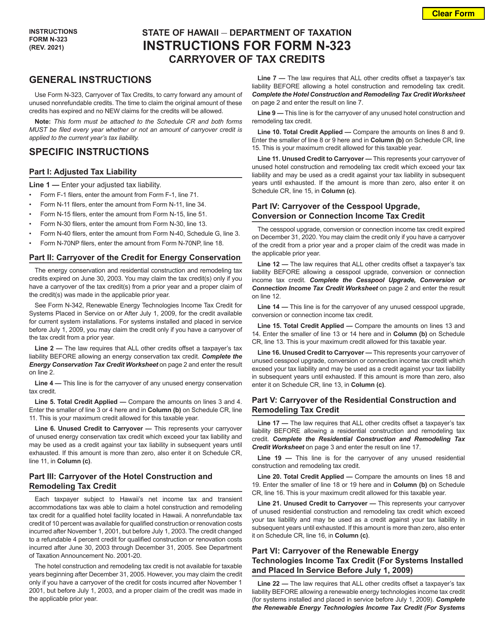

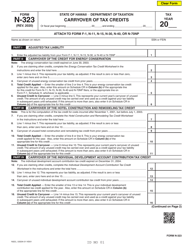

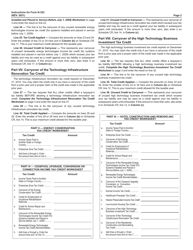

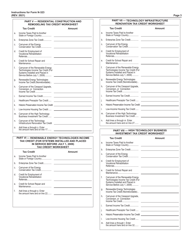

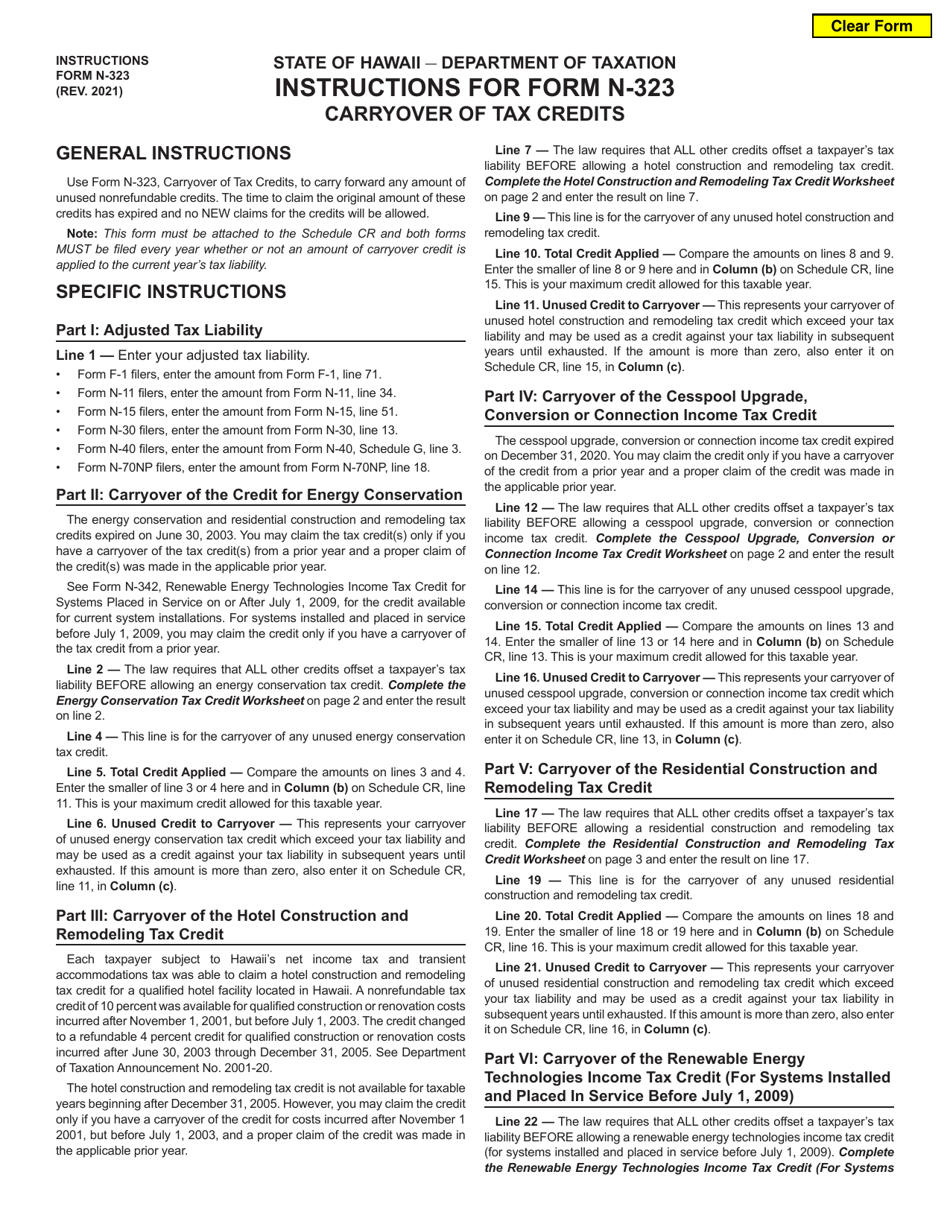

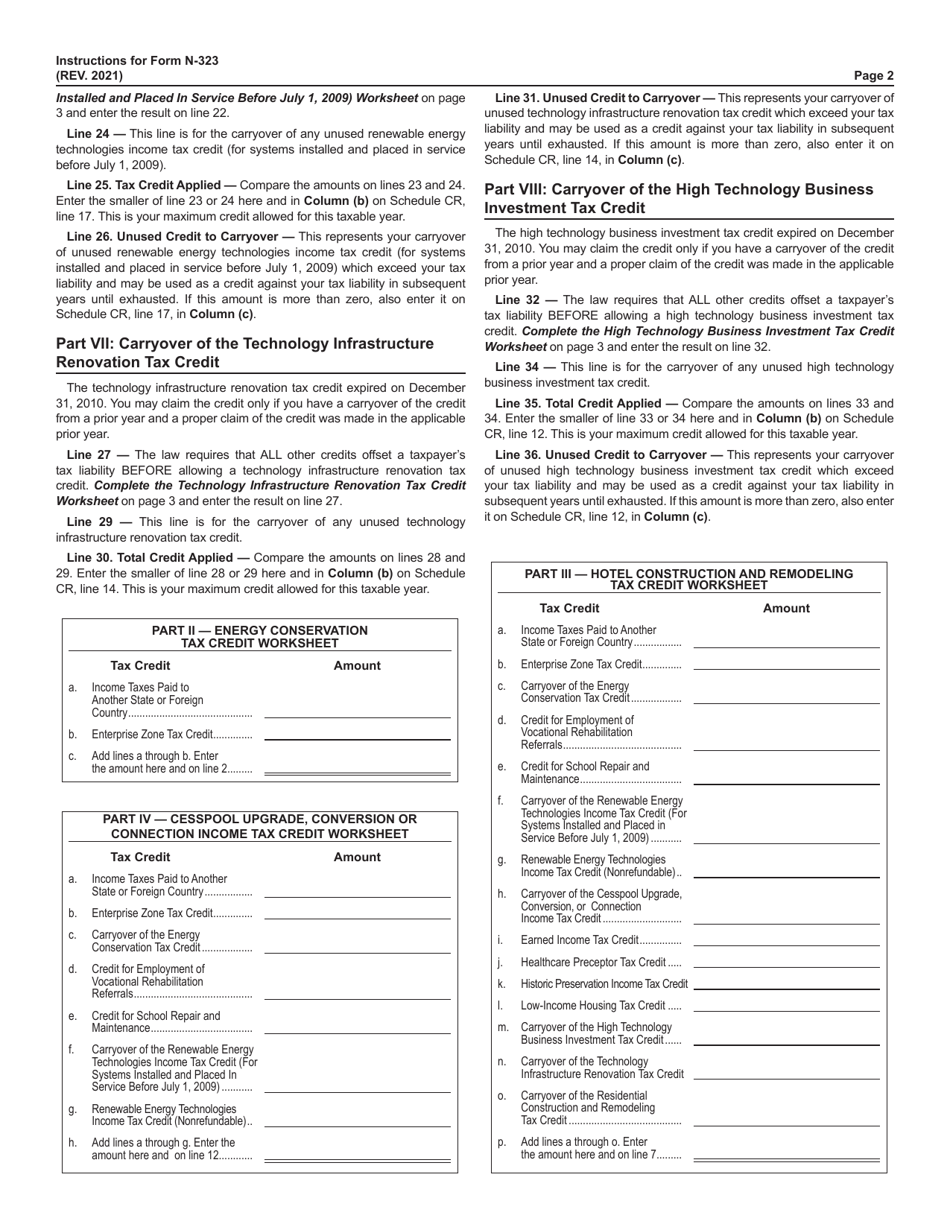

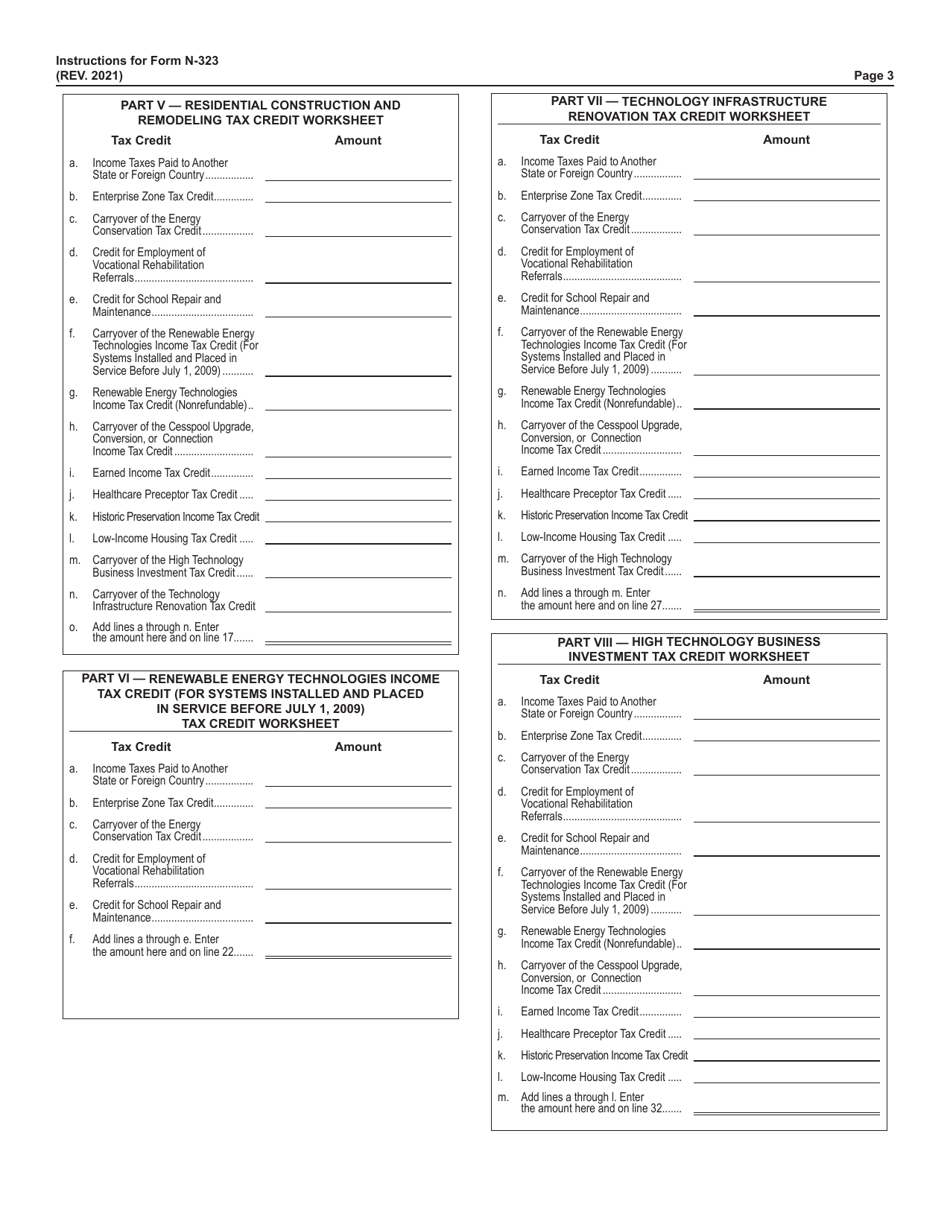

Instructions for Form N-323

for the current year.

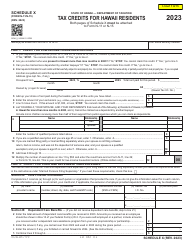

Instructions for Form N-323 Carryover of Tax Credits - Hawaii

This document contains official instructions for Form N-323 , Carryover of Tax Credits - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-323 is available for download through this link.

FAQ

Q: What is Form N-323?

A: Form N-323 is a form used in Hawaii to claim a carryover of tax credits.

Q: What are tax credits?

A: Tax credits are reductions in the amount of taxes owed.

Q: What is a carryover of tax credits?

A: A carryover of tax credits allows taxpayers to use unused tax credits from a previous year.

Q: Who can use Form N-323?

A: Individuals and businesses in Hawaii who have unused tax credits from a previous year can use Form N-323.

Q: How do I fill out Form N-323?

A: You need to provide information such as your name, social security number, and the amount of tax credits being carried over.

Q: When is the deadline for filing Form N-323?

A: The deadline for filing Form N-323 is the same as the deadline for filing your annual tax return in Hawaii.

Q: What if I have questions or need help with Form N-323?

A: If you have questions or need help with Form N-323, you can contact the Hawaii Department of Taxation for assistance.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.