This version of the form is not currently in use and is provided for reference only. Download this version of

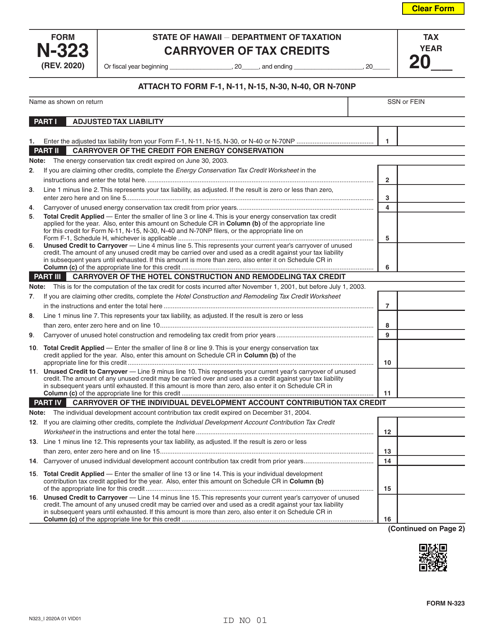

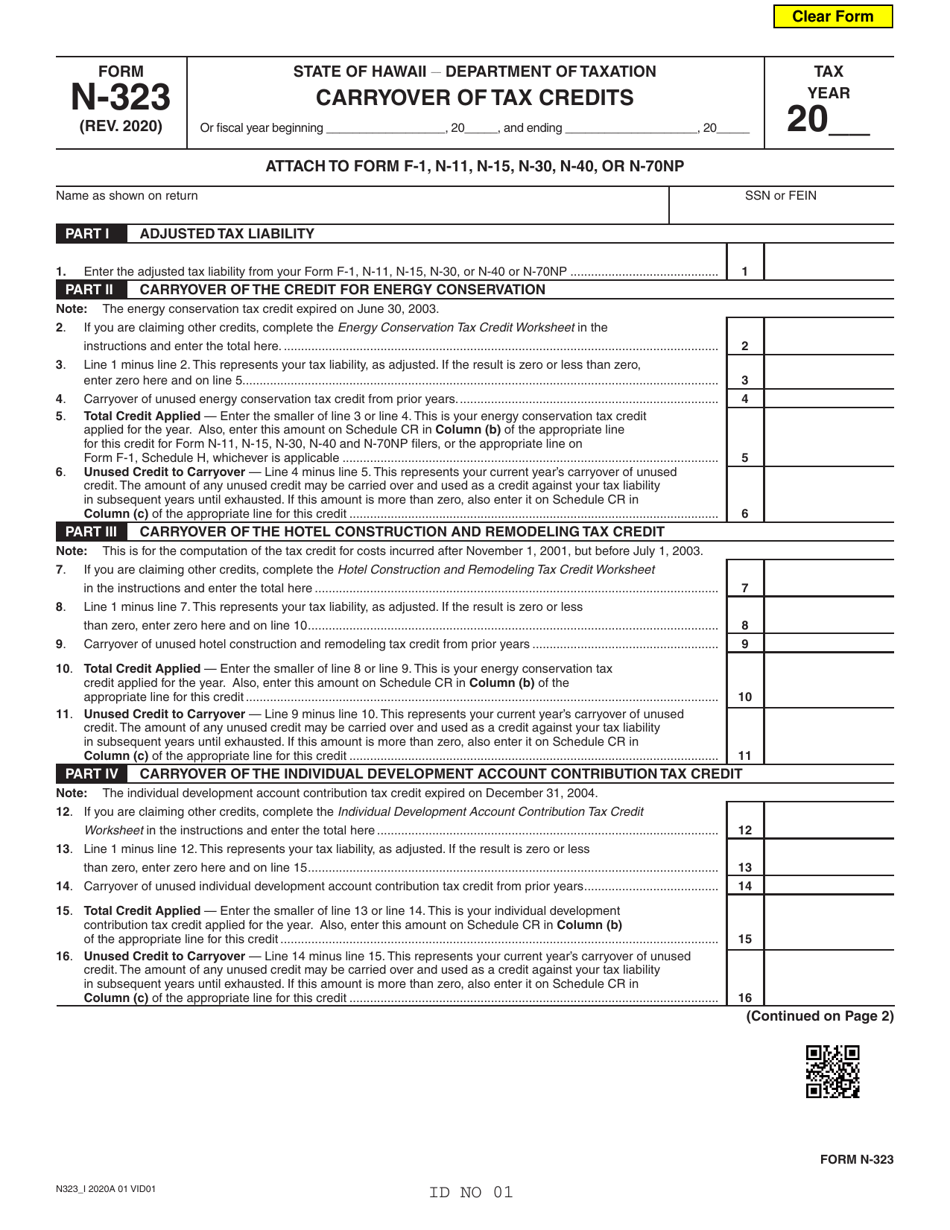

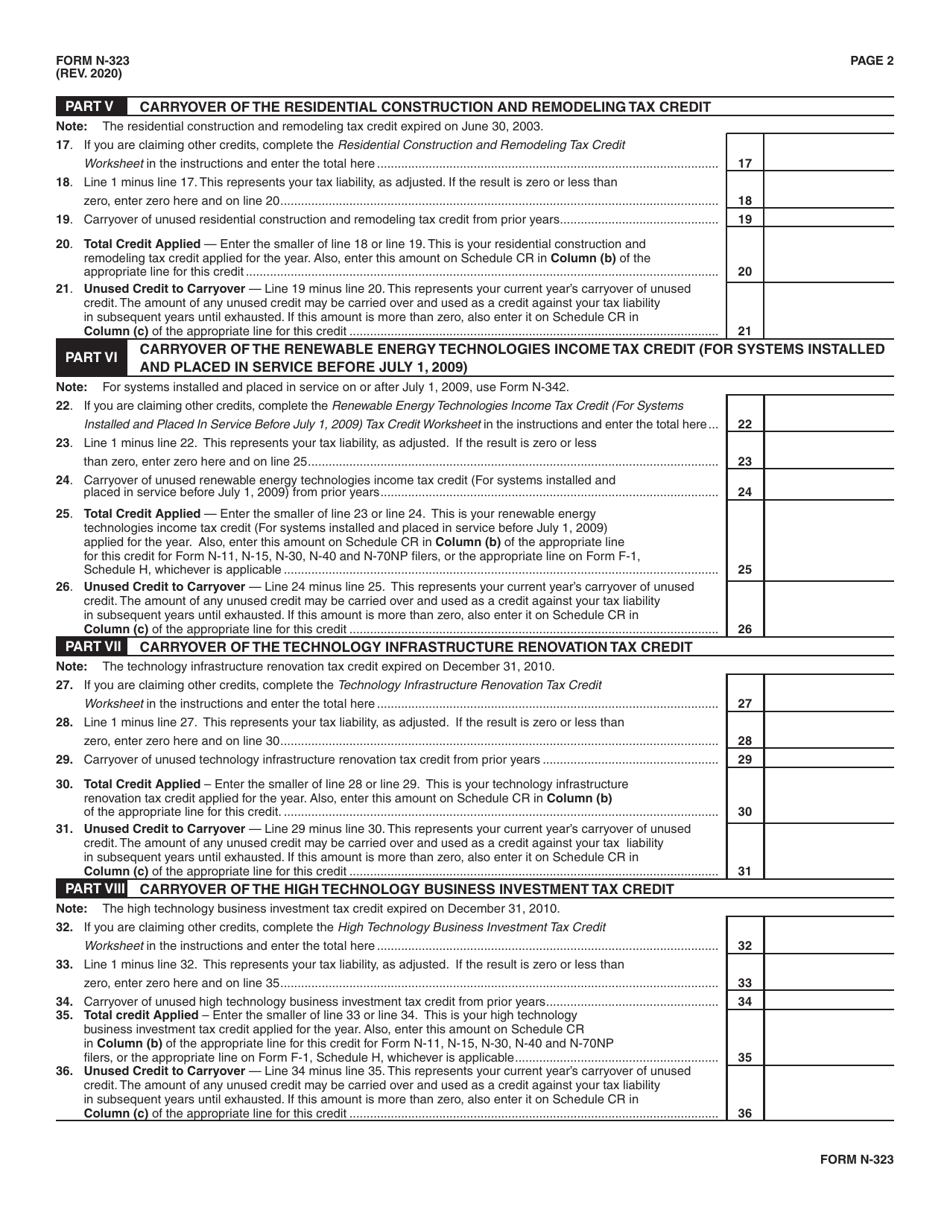

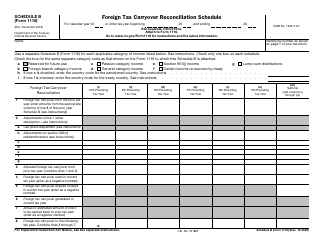

Form N-323

for the current year.

Form N-323 Carryover of Tax Credits - Hawaii

What Is Form N-323?

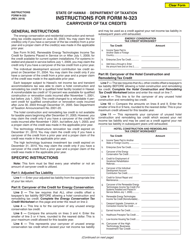

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-323?

A: Form N-323 is a form used in Hawaii to carry over tax credits from previous years.

Q: What are tax credits?

A: Tax credits are dollar-for-dollar reductions in the amount of tax you owe.

Q: Why would I need to carry over tax credits?

A: You may need to carry over tax credits if you have more credits than you can use in one year.

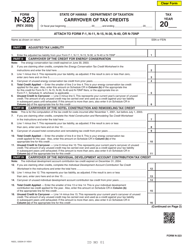

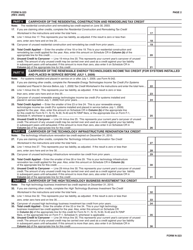

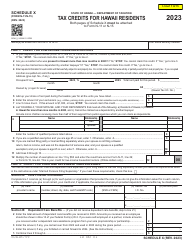

Q: What types of tax credits can be carried over?

A: Certain types of tax credits, such as the renewable energy technologies income tax credit and the motion picture, digital media, and film production income tax credit, can be carried over.

Q: How do I fill out Form N-323?

A: You will need to provide information about the specific tax credit being carried over and the amount being carried over.

Q: Is there a deadline for filing Form N-323?

A: Yes, Form N-323 must be filed by the due date of your tax return for the year you are carrying over the credits.

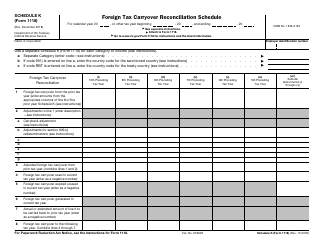

Q: Can I carry over tax credits from other states?

A: No, Form N-323 is specific to Hawaii tax credits and cannot be used to carry over credits from other states.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-323 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.