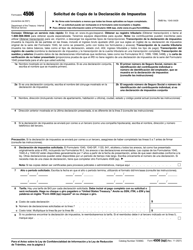

This version of the form is not currently in use and is provided for reference only. Download this version of

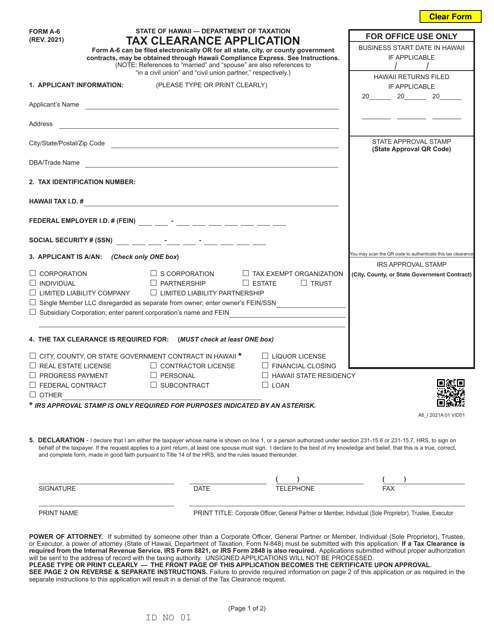

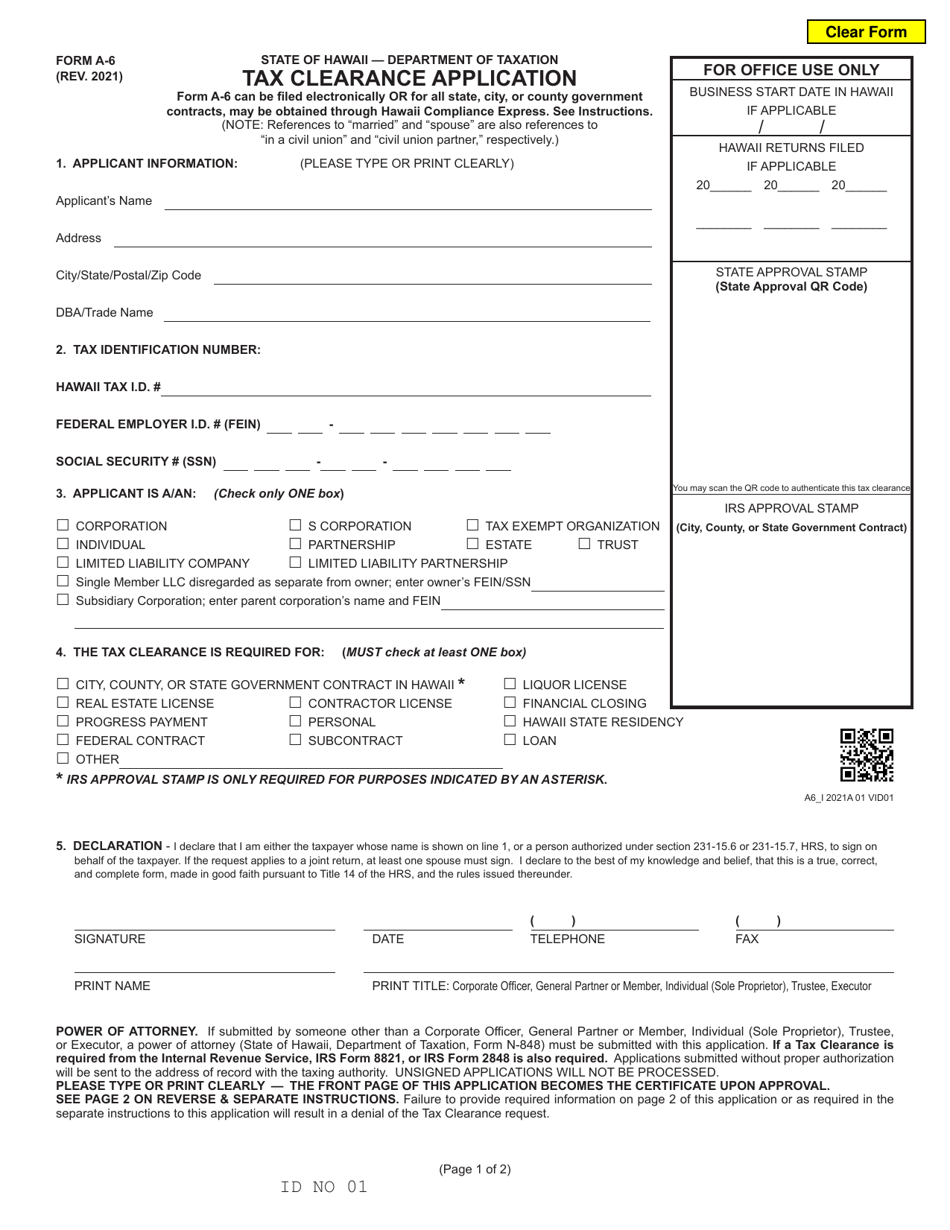

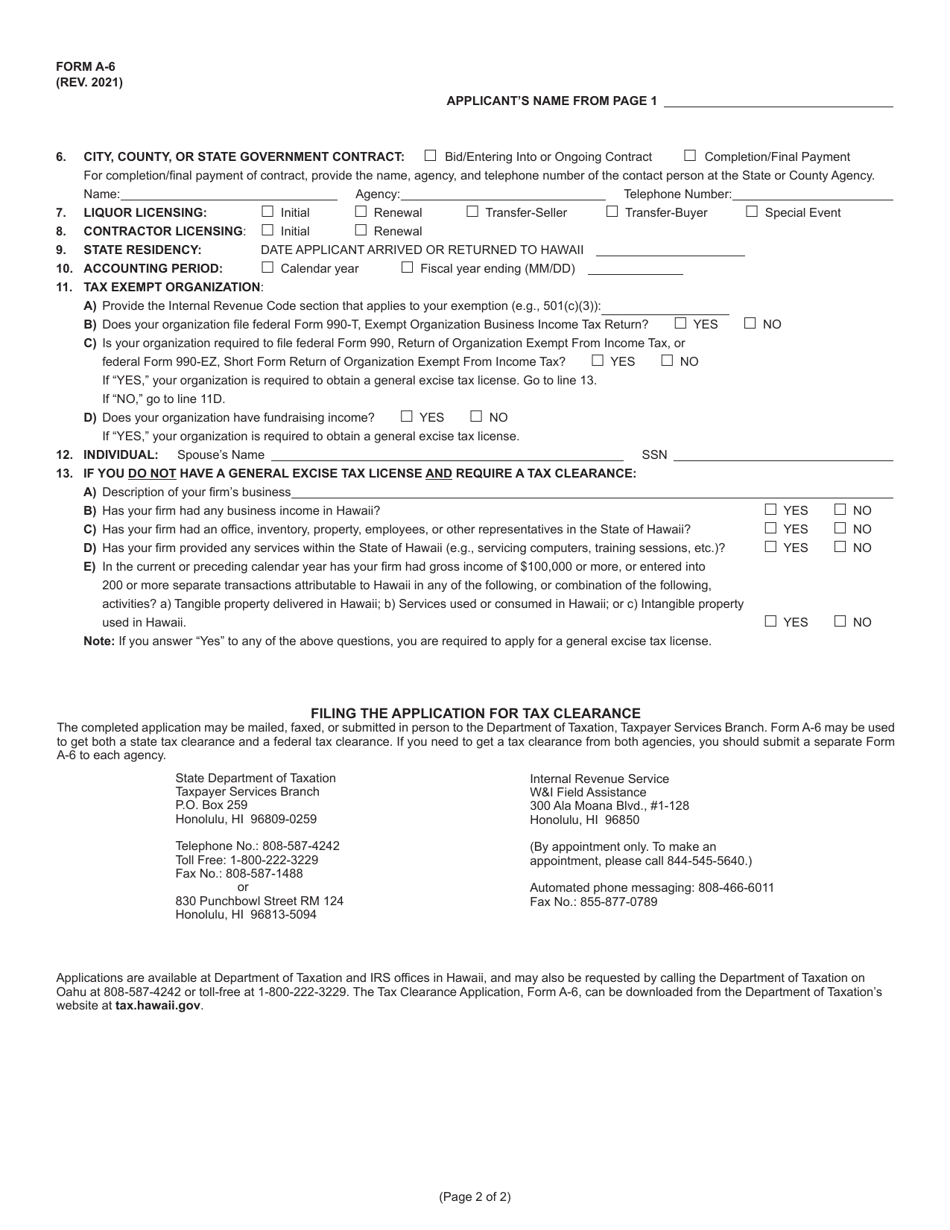

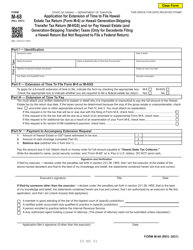

Form A-6

for the current year.

Form A-6 Tax Clearance Application - Hawaii

What Is Form A-6?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

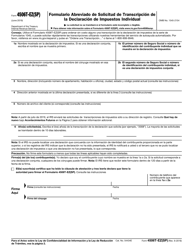

Q: What is Form A-6?

A: Form A-6 is a tax clearance application in Hawaii.

Q: Why do I need to file Form A-6?

A: You need to file Form A-6 to obtain a tax clearance certificate in Hawaii.

Q: What is a tax clearance certificate?

A: A tax clearance certificate is a document that verifies that you have paid all your taxes and have no outstanding tax liabilities in Hawaii.

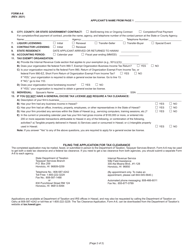

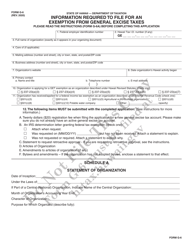

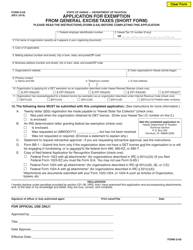

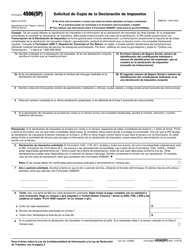

Q: How do I fill out Form A-6?

A: To fill out Form A-6, you will need to provide personal information and details about your tax obligations in Hawaii.

Q: Are there any fees for filing Form A-6?

A: Yes, there is a fee for filing Form A-6 in Hawaii. The fee amount may vary.

Q: When should I file Form A-6?

A: You should file Form A-6 at least 10 business days before you need the tax clearance certificate.

Q: What if I have outstanding tax liabilities?

A: If you have outstanding tax liabilities, you may need to resolve them before you can obtain a tax clearance certificate.

Q: How long does it take to process Form A-6?

A: The processing time for Form A-6 may vary, but it typically takes a few weeks.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.