This version of the form is not currently in use and is provided for reference only. Download this version of

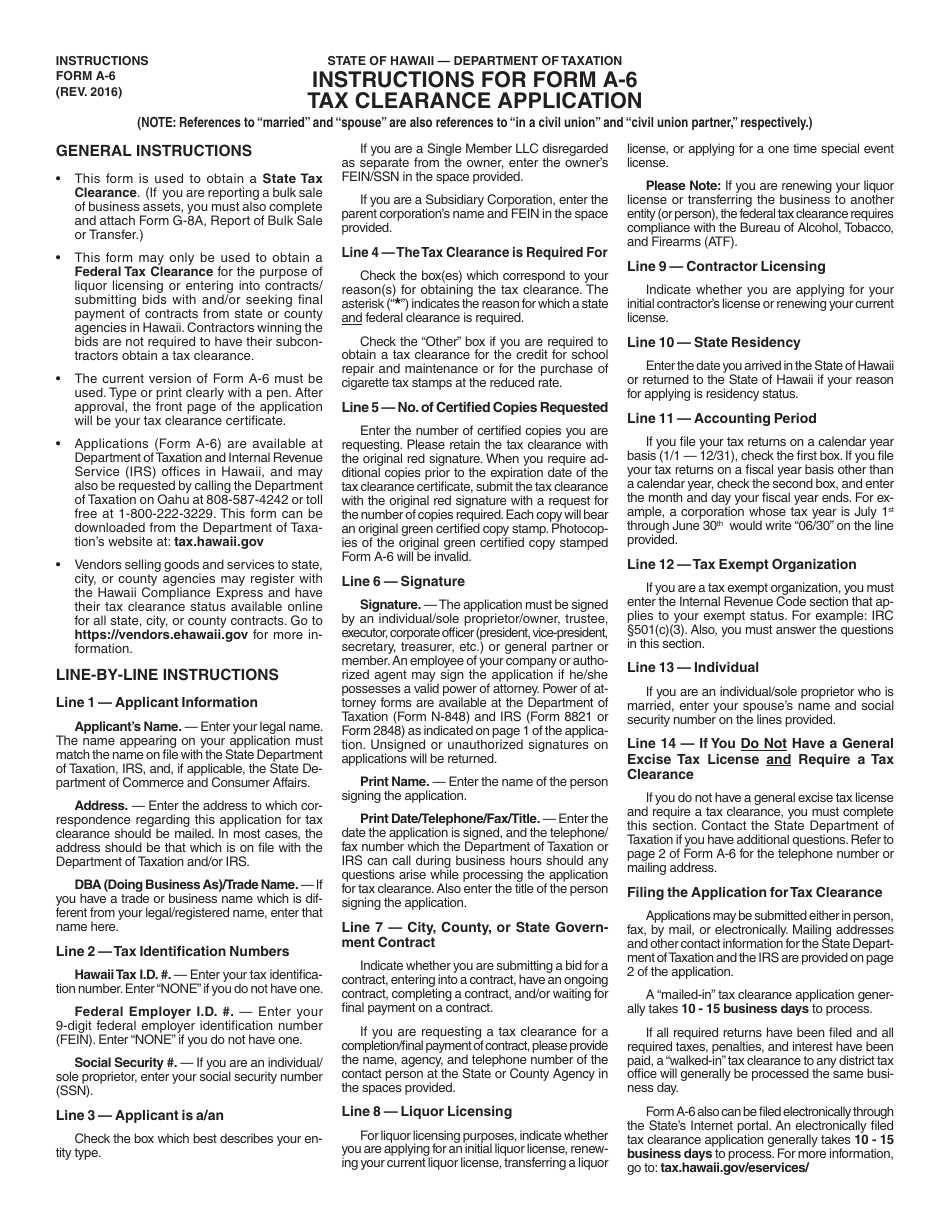

Instructions for Form A-6

for the current year.

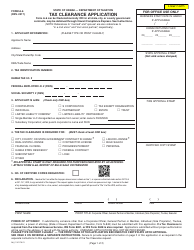

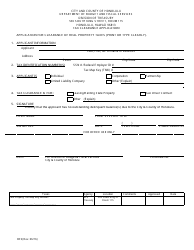

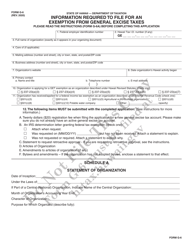

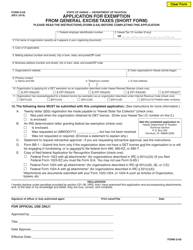

Instructions for Form A-6 Tax Clearance Application - Hawaii

This document contains official instructions for Form A-6 , Tax Clearance Application - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form A-6 is available for download through this link.

FAQ

Q: What is Form A-6?

A: Form A-6 is the Tax Clearance Application for Hawaii.

Q: What is the purpose of Form A-6?

A: The purpose of Form A-6 is to apply for tax clearance in the state of Hawaii.

Q: Who should use Form A-6?

A: Form A-6 should be used by individuals or businesses who need to obtain tax clearance in Hawaii.

Q: What information is required on Form A-6?

A: Form A-6 requires information such as taxpayer name, social security number or taxpayer identification number, and details of tax obligations.

Q: Is there a fee for submitting Form A-6?

A: No, there is no fee for submitting Form A-6.

Q: How long does it take to process Form A-6?

A: The processing time for Form A-6 varies, but it typically takes several business days.

Q: What happens after Form A-6 is processed?

A: After Form A-6 is processed, the Hawaii Department of Taxation will issue a tax clearance certificate if all tax obligations are satisfied.

Q: Why do I need a tax clearance certificate?

A: A tax clearance certificate is often required for various purposes, such as applying for certain licenses or permits.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.