This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-195 Schedule OR-WFHDC

for the current year.

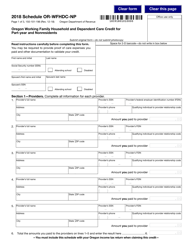

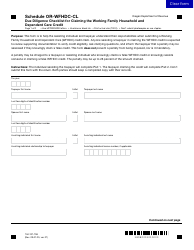

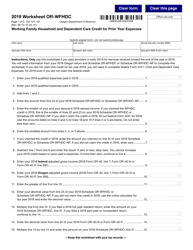

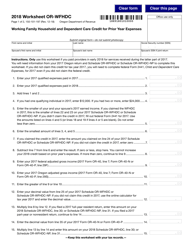

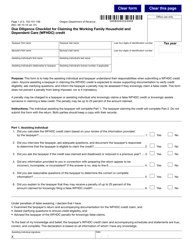

Instructions for Form 150-101-195 Schedule OR-WFHDC Oregon Working Family Household and Dependent Care Credit - Oregon

This document contains official instructions for Form 150-101-195 Schedule OR-WFHDC, Oregon Dependent Care Credit - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-195 Schedule OR-WFHDC is available for download through this link.

FAQ

Q: What is Form 150-101-195?

A: Form 150-101-195 is the schedule used to claim the Oregon Working Family Household and Dependent Care Credit in Oregon.

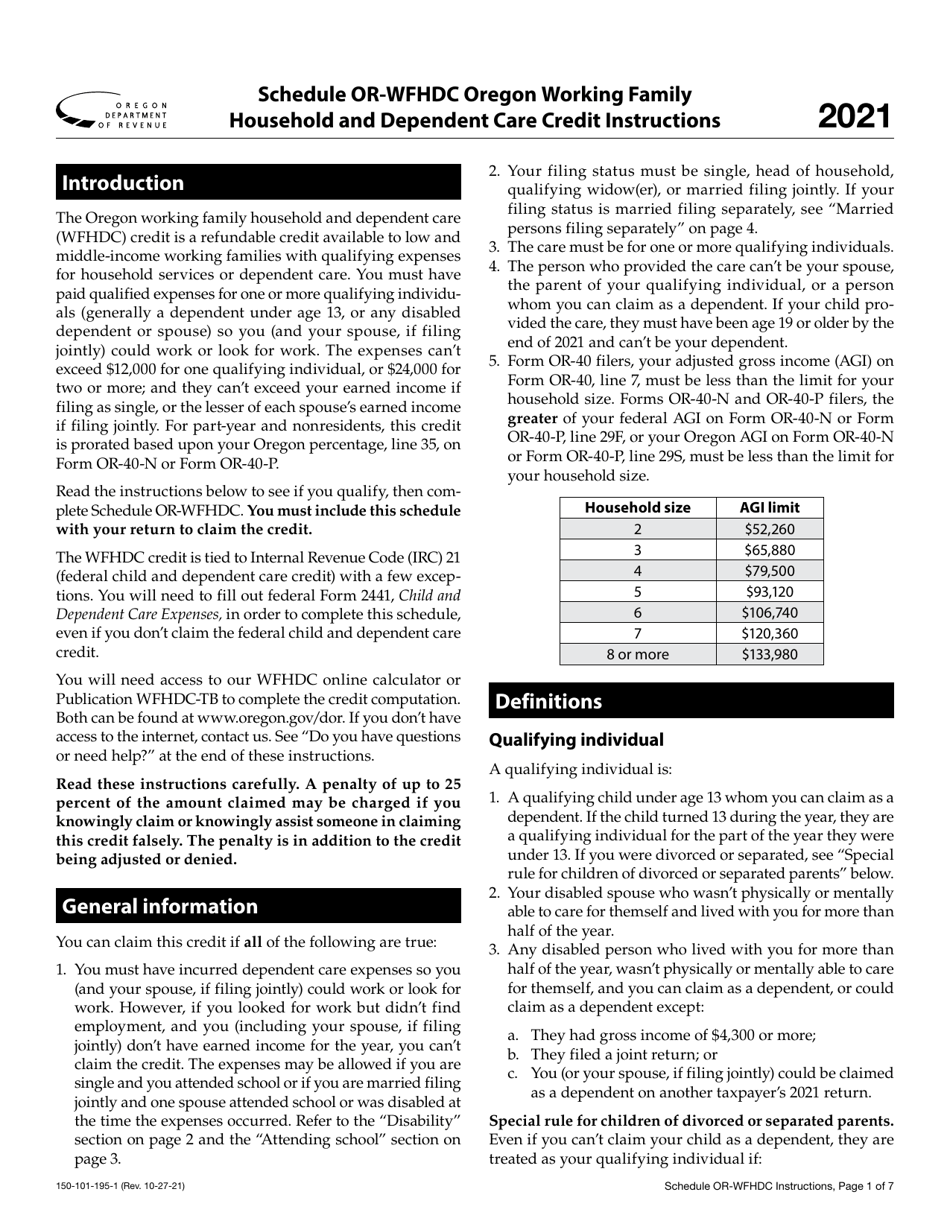

Q: What is the Oregon Working Family Household and Dependent Care Credit?

A: The Oregon Working Family Household and Dependent Care Credit is a tax credit available to Oregon residents who paid for childcare expenses in order to work or look for work.

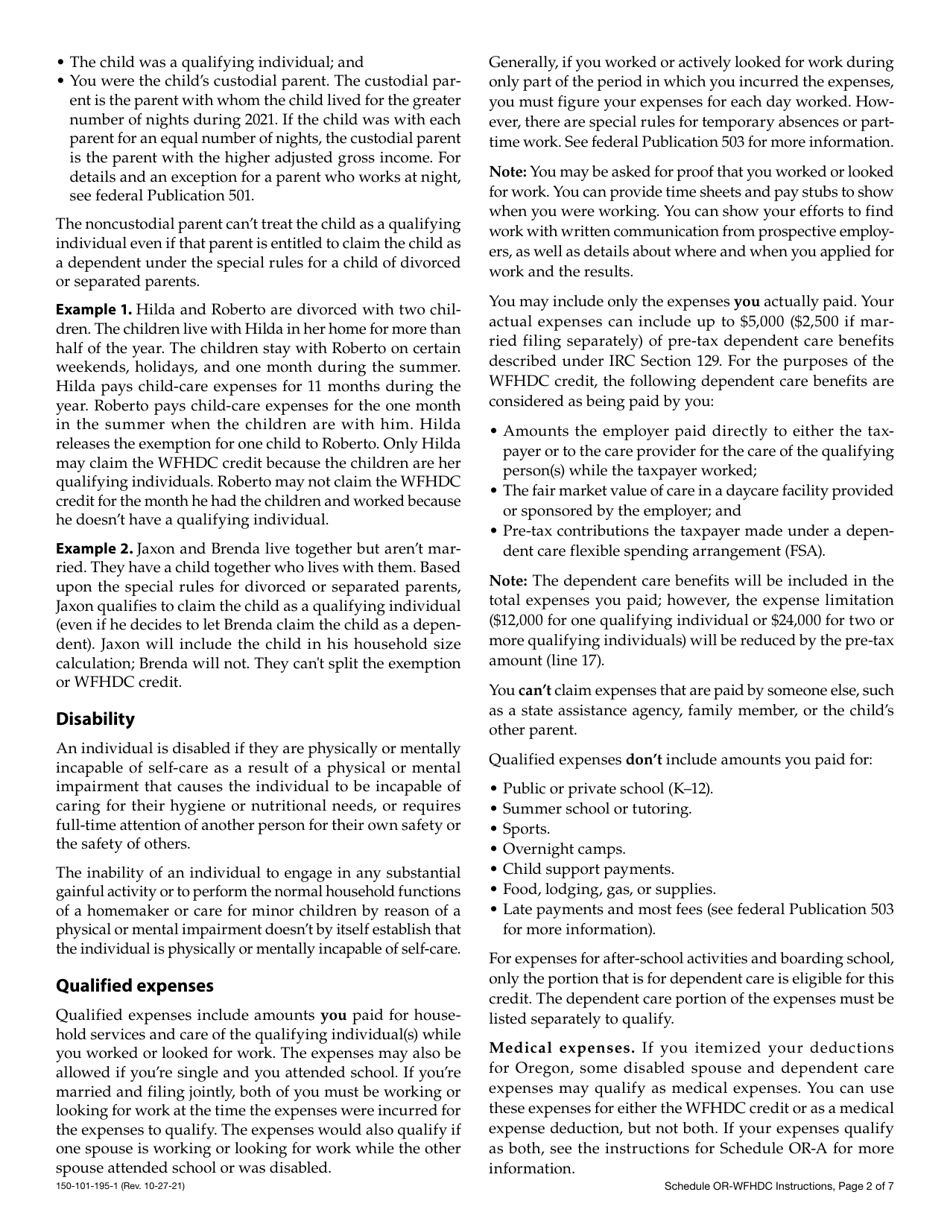

Q: What expenses can be eligible for the credit?

A: Expenses related to the care of a qualified dependent child or disabled spouse can be eligible for the credit.

Q: Who can claim this credit?

A: Oregon residents who meet certain income and eligibility requirements can claim the Oregon Working Family Household and Dependent Care Credit.

Q: How much is the credit?

A: The amount of the credit depends on several factors, including the taxpayer's income, the number of dependents, and the amount of qualifying expenses.

Q: How do I fill out Form 150-101-195?

A: Form 150-101-195 requires you to report your qualifying dependent care expenses and calculate the credit amount. Follow the instructions provided with the form to complete it accurately.

Q: When is the deadline to file this form?

A: The deadline to file Form 150-101-195 is the same as the deadline for filing your Oregon income tax return, typically April 15th.

Q: Can I claim this credit if I use a childcare provider who is not licensed?

A: No, the Oregon Working Family Household and Dependent Care Credit can only be claimed for expenses paid to licensed providers or providers who meet certain exemption criteria.

Q: Are there any other requirements to claim this credit?

A: Yes, you must have earned income and meet certain residency and dependent care expense conditions to qualify for this credit.

Instruction Details:

- This 7-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.