This version of the form is not currently in use and is provided for reference only. Download this version of

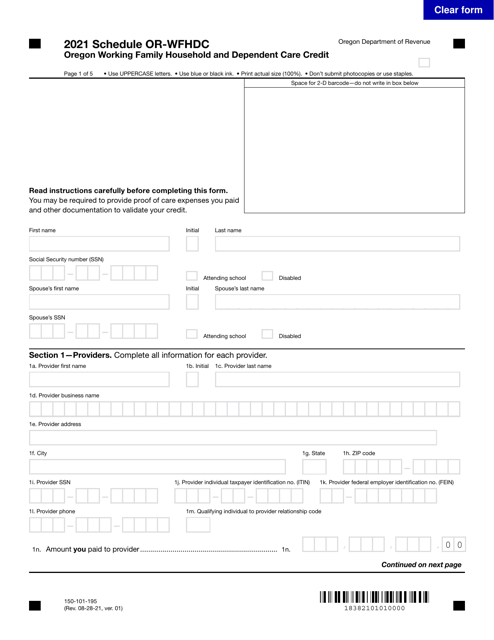

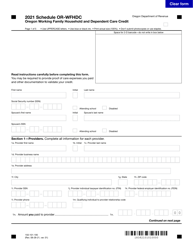

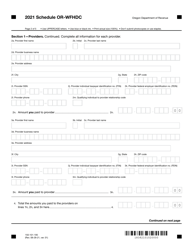

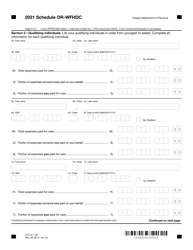

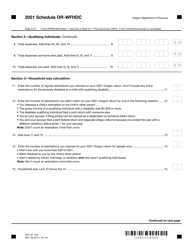

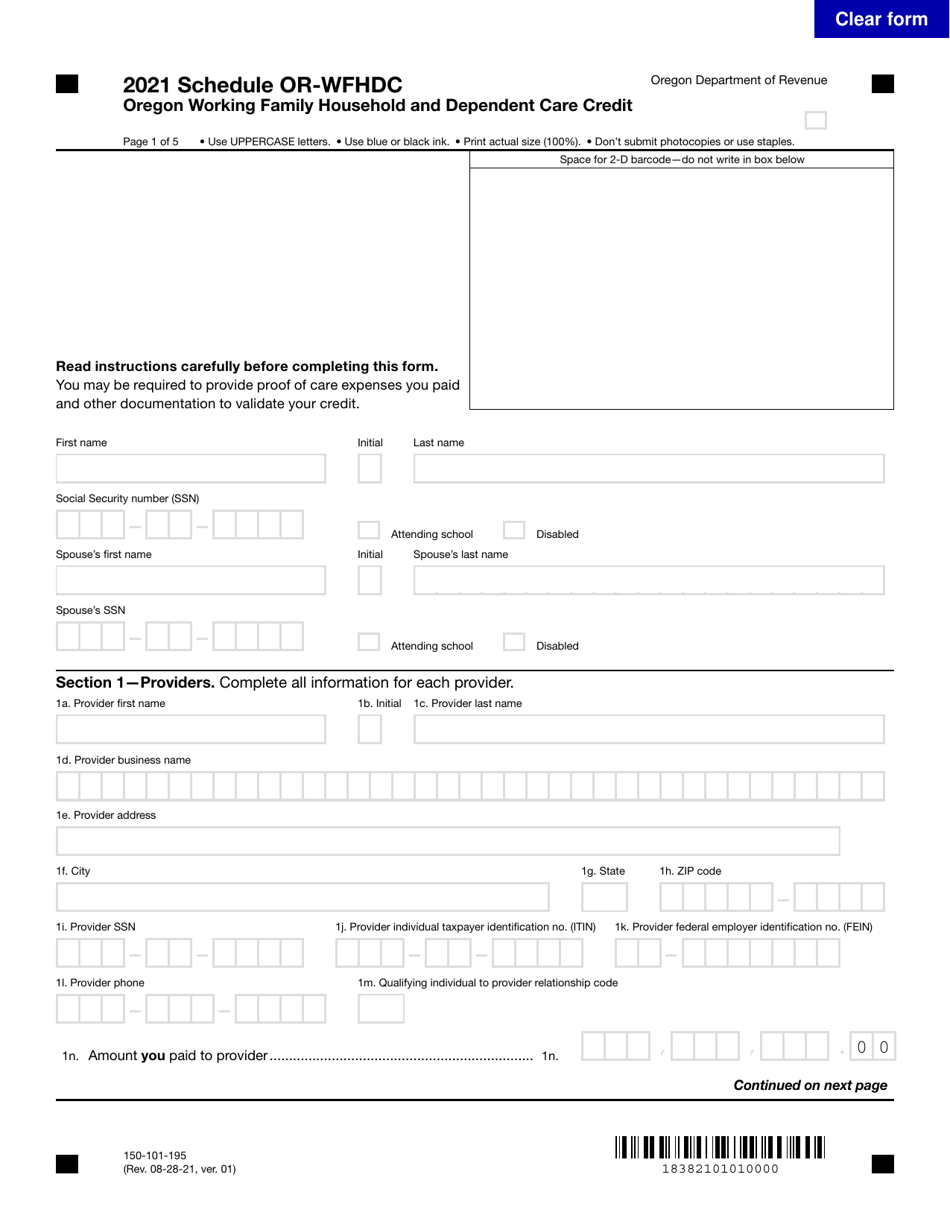

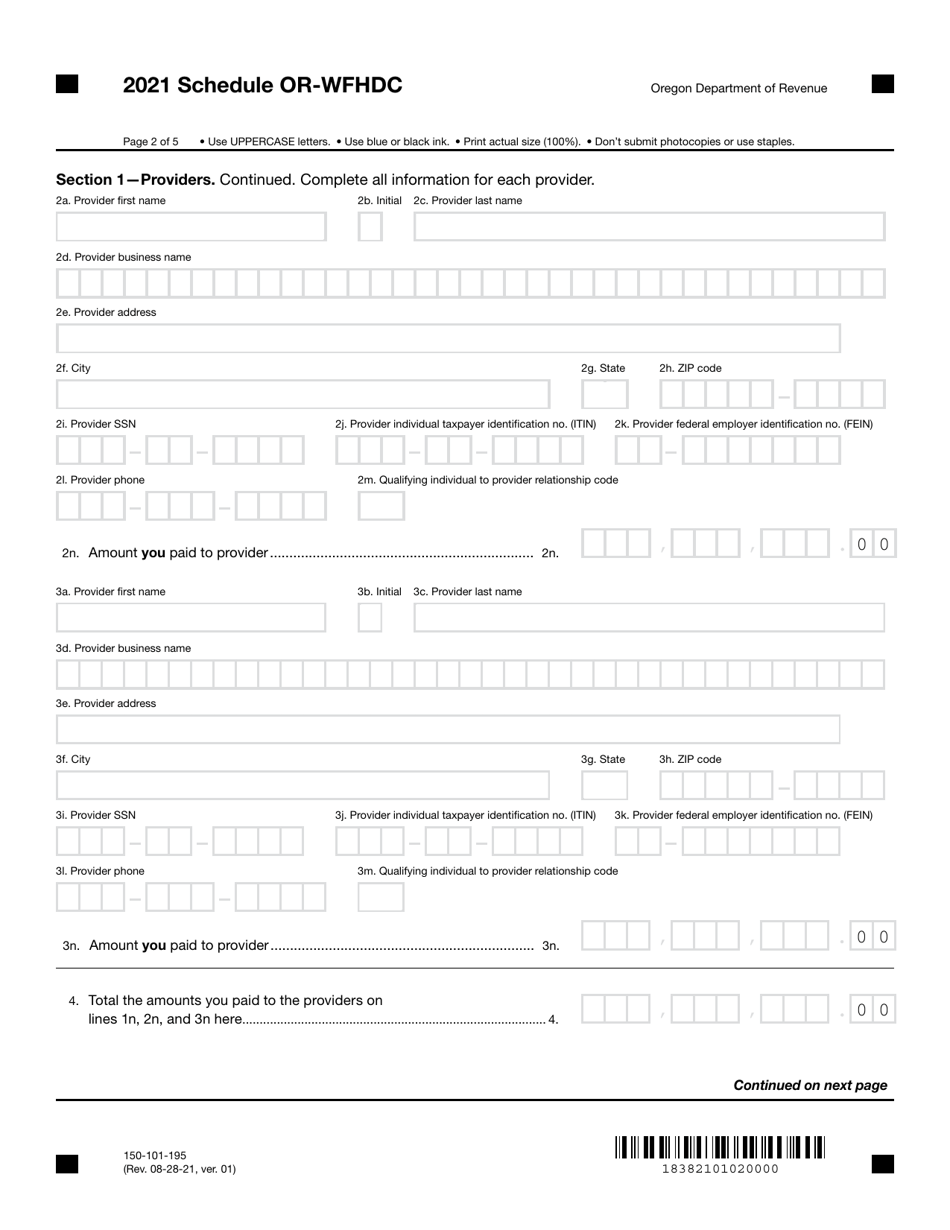

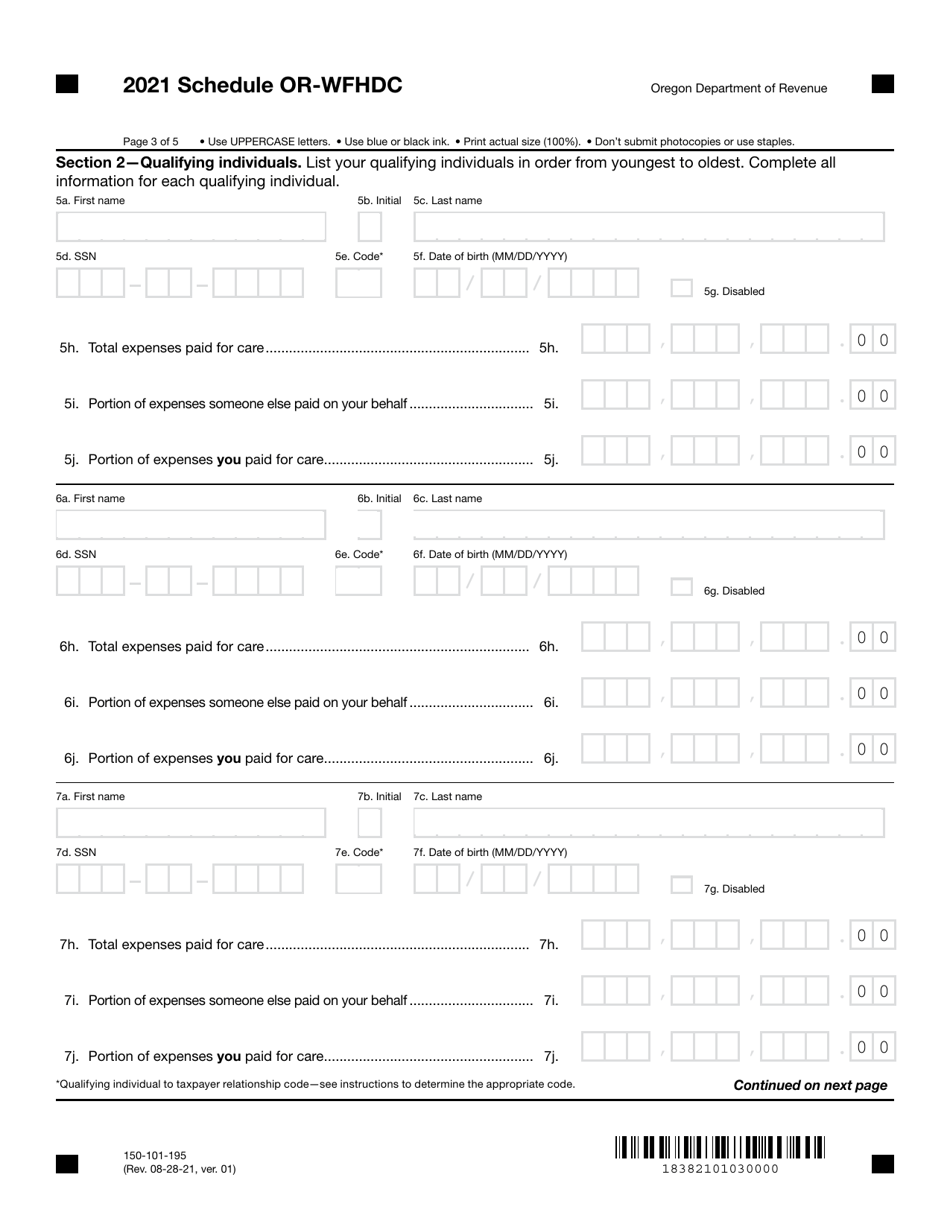

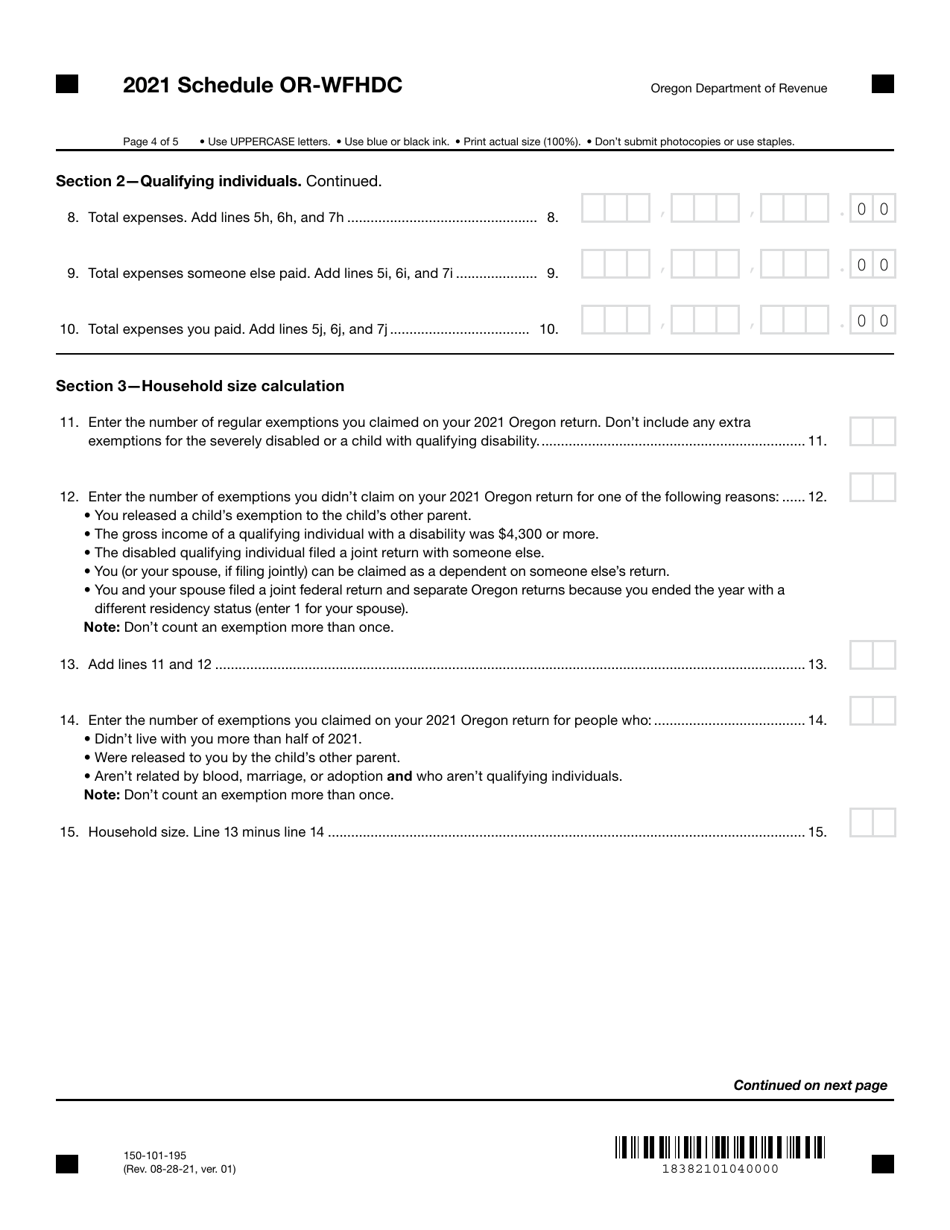

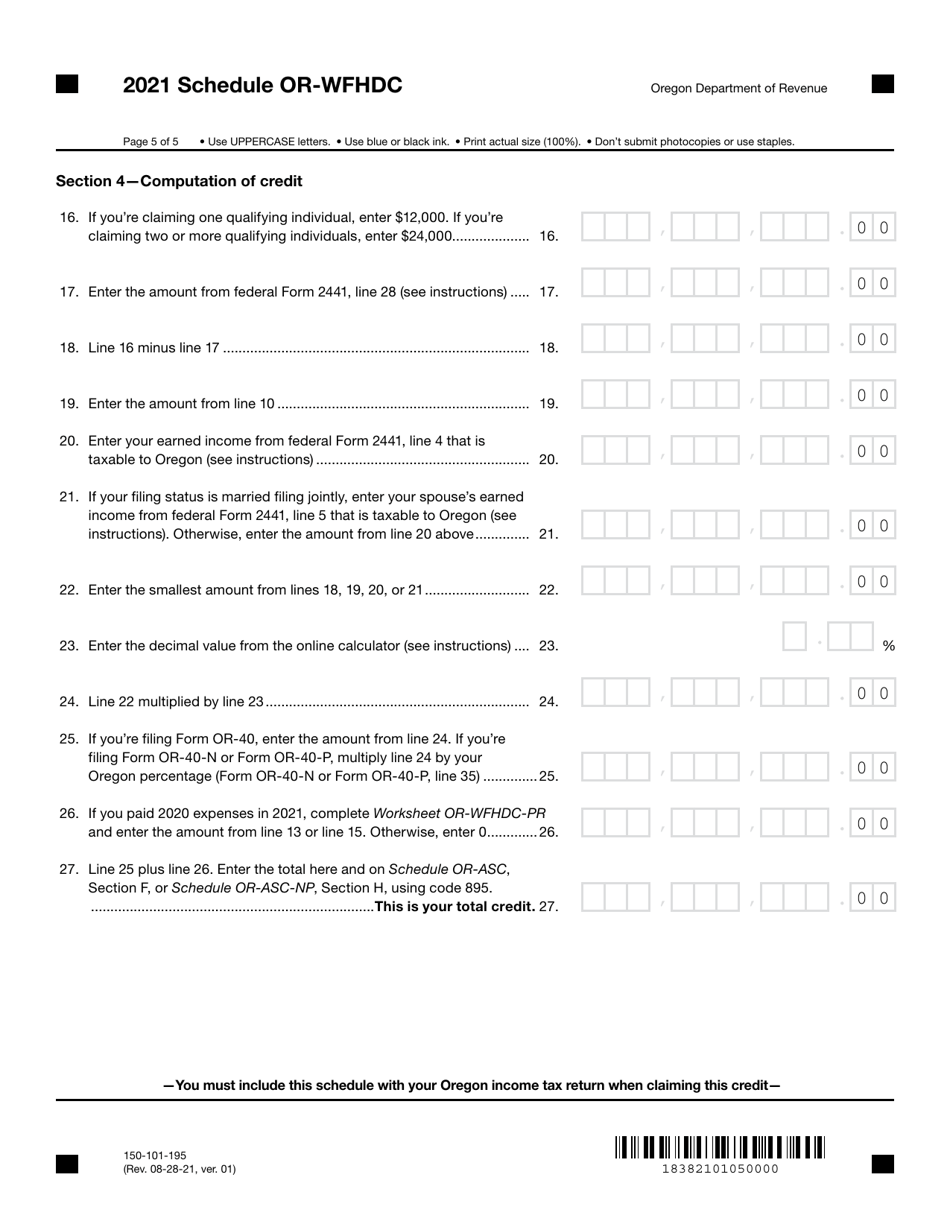

Form 150-101-195 Schedule OR-WFHDC

for the current year.

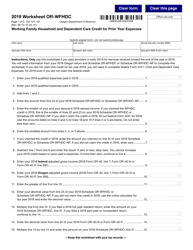

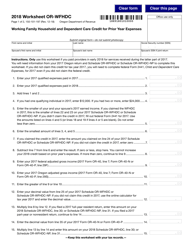

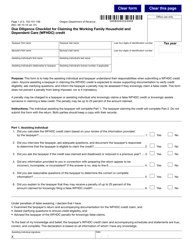

Form 150-101-195 Schedule OR-WFHDC Oregon Working Family Household and Dependent Care Credit - Oregon

What Is Form 150-101-195 Schedule OR-WFHDC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-195?

A: Form 150-101-195 is the Schedule OR-WFHDC for claiming the Oregon Working Family Household and Dependent Care Credit.

Q: What is the Oregon Working Family Household and Dependent Care Credit?

A: The Oregon Working Family Household and Dependent Care Credit is a tax credit that helps eligible taxpayers with the costs of childcare and dependent care expenses.

Q: Who can claim the Oregon Working Family Household and Dependent Care Credit?

A: Oregon residents who have earned income and incur qualified childcare or dependent care expenses can claim this credit.

Q: What expenses qualify for the Oregon Working Family Household and Dependent Care Credit?

A: Expenses such as childcare expenses, adult dependent care expenses, and expenses for care of a disabled spouse may qualify for this credit.

Q: How can I claim the Oregon Working Family Household and Dependent Care Credit?

A: To claim this credit, you need to complete Form 150-101-195 Schedule OR-WFHDC and include it with your Oregon income tax return.

Q: Are there income limits for claiming the Oregon Working Family Household and Dependent Care Credit?

A: Yes, there are income limits to qualify for this credit. The credit amount gradually decreases as your income exceeds certain thresholds.

Form Details:

- Released on August 28, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-195 Schedule OR-WFHDC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.