This version of the form is not currently in use and is provided for reference only. Download this version of

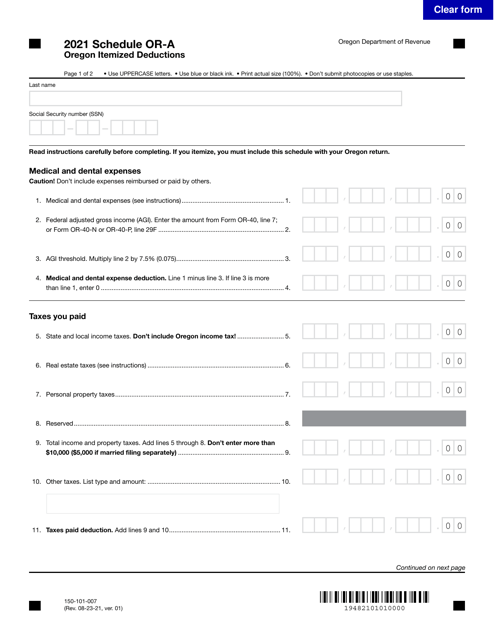

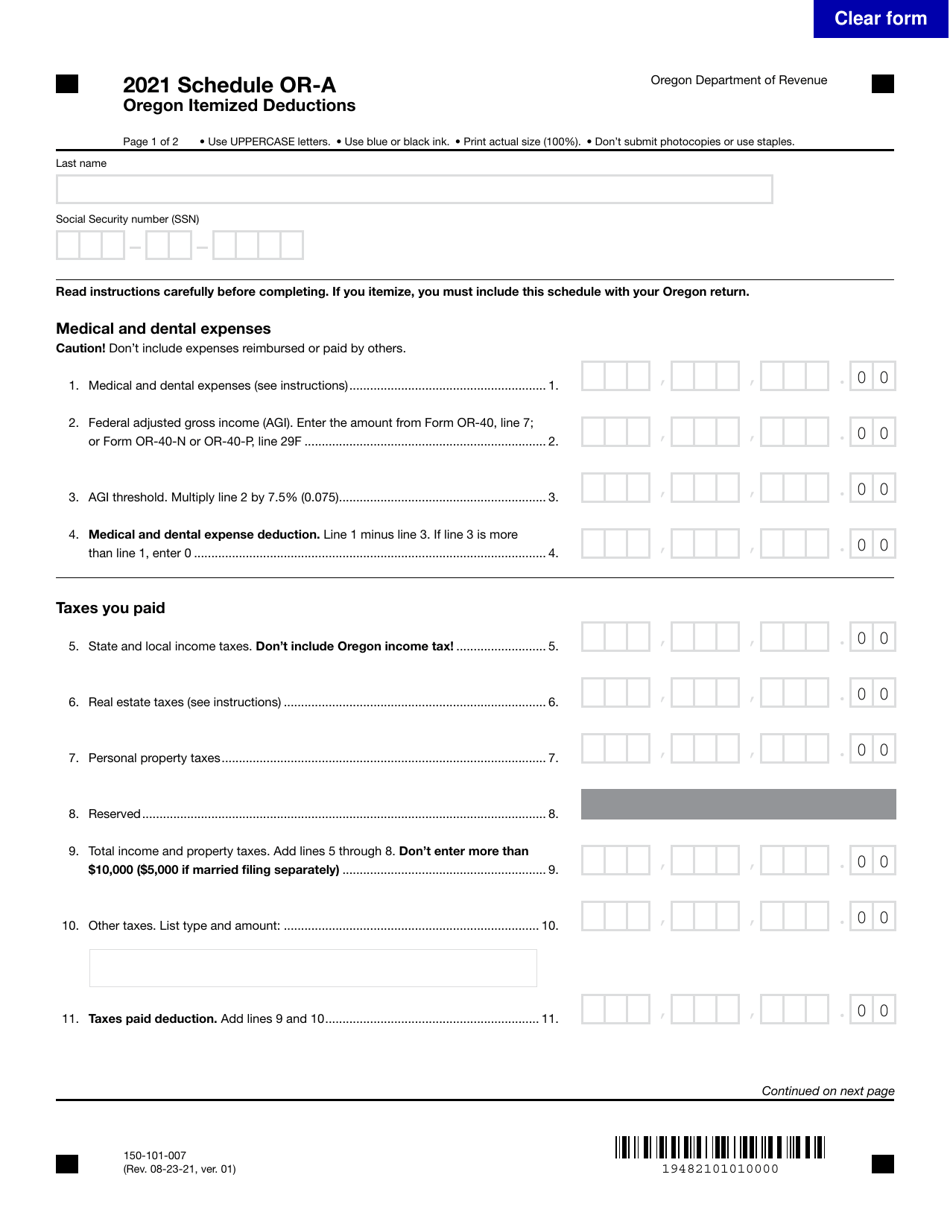

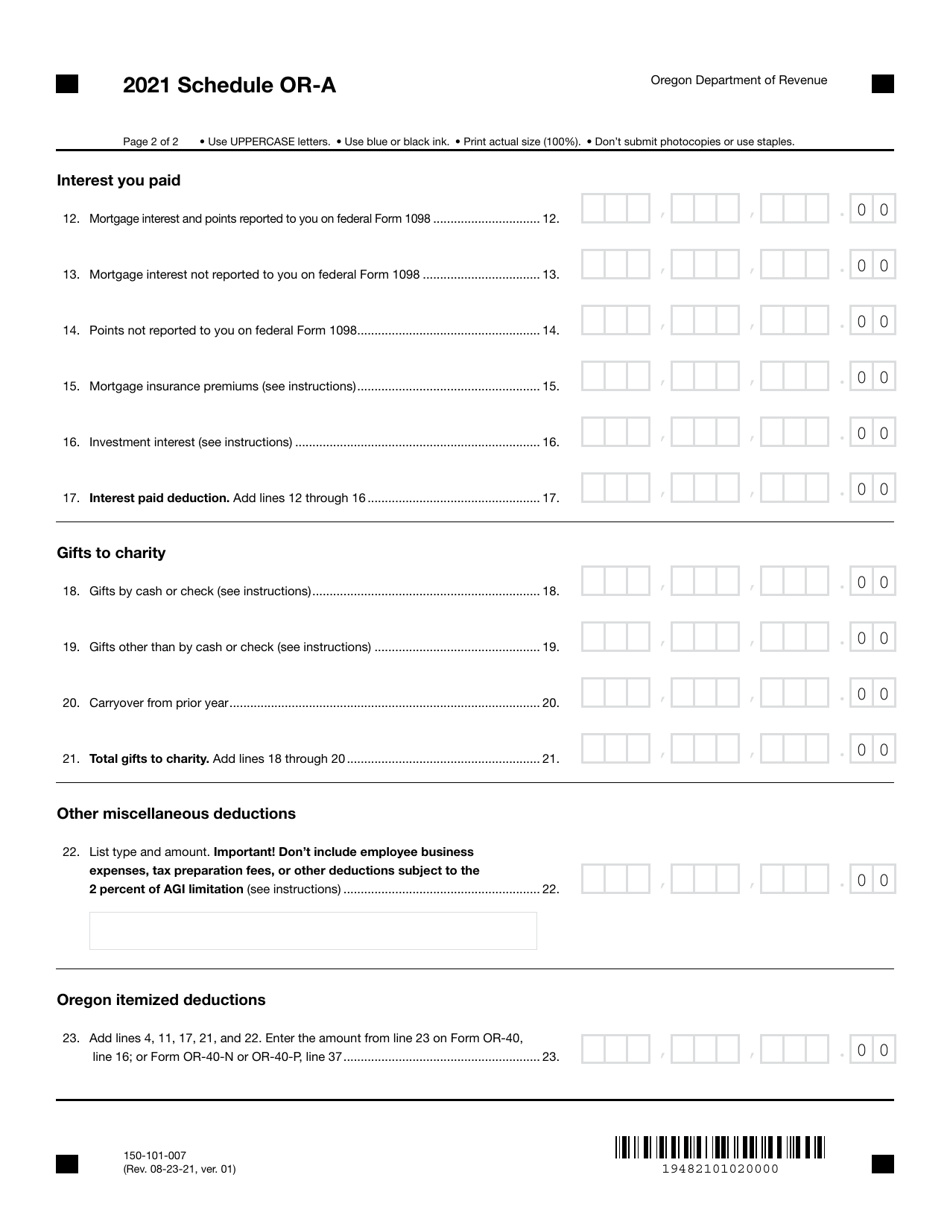

Form 150-101-007 Schedule OR-A

for the current year.

Form 150-101-007 Schedule OR-A Oregon Itemized Deductions - Oregon

What Is Form 150-101-007 Schedule OR-A?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-007?

A: Form 150-101-007 is the Oregon Itemized Deductions Schedule OR-A.

Q: What is the purpose of Form 150-101-007?

A: Form 150-101-007 is used to report itemized deductions specific to the state of Oregon.

Q: Who needs to file Form 150-101-007?

A: Oregon residents who choose to itemize their deductions on their state tax return need to file Form 150-101-007.

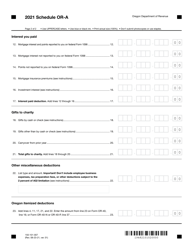

Q: What deductions can be reported on Form 150-101-007?

A: Some deductions that can be reported on Form 150-101-007 include medical and dental expenses, mortgage interest, property taxes, and charitable contributions.

Q: Is Form 150-101-007 only for Oregon residents?

A: Yes, Form 150-101-007 is specific to Oregon residents and can only be used for state tax purposes in Oregon.

Form Details:

- Released on August 23, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-007 Schedule OR-A by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.