This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-007 Schedule OR-A

for the current year.

Instructions for Form 150-101-007 Schedule OR-A Oregon Itemized Deductions - Oregon

This document contains official instructions for Form 150-101-007 Schedule OR-A, Oregon Itemized Deductions - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-007 Schedule OR-A is available for download through this link.

FAQ

Q: What is Form 150-101-007?

A: Form 150-101-007 is a tax form used to report itemized deductions for Oregon residents.

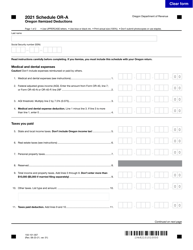

Q: What is Schedule OR-A?

A: Schedule OR-A is a specific section of Form 150-101-007 that focuses on reporting Oregon itemized deductions.

Q: Who needs to file Form 150-101-007?

A: Oregon residents who want to claim itemized deductions on their state tax return need to file Form 150-101-007.

Q: What are itemized deductions?

A: Itemized deductions are specific expenses that you can subtract from your taxable income, such as mortgage interest, medical expenses, and charitable donations.

Q: Why would someone choose to itemize deductions instead of taking the standard deduction?

A: Some individuals choose to itemize deductions if their total deductible expenses are greater than the standard deduction, as it can potentially lower their overall tax liability.

Q: What types of deductions can be reported on Schedule OR-A?

A: Schedule OR-A allows you to report deductions such as medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, and more.

Q: Is Form 150-101-007 required for federal taxes?

A: No, Form 150-101-007 is specifically for reporting deductions on your Oregon state tax return and is not required for federal taxes.

Q: When is the deadline to file Form 150-101-007?

A: The deadline to file Form 150-101-007 is typically the same as the deadline for filing your Oregon state tax return, which is generally April 15th.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.