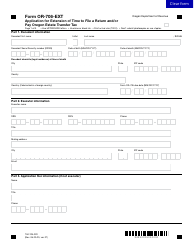

Instructions for Form OR-706-V, 150-104-172 Oregon Estate Transfer Tax Payment Voucher - Oregon

This document contains official instructions for Form OR-706-V , and Form 150-104-172 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-706-V (150-104-172) is available for download through this link. The latest available Form 150-104-172 (OR-706-V) can be downloaded through this link.

FAQ

Q: What is Form OR-706-V?

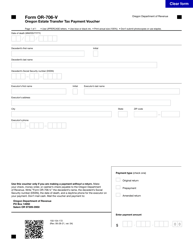

A: Form OR-706-V is the Oregon Estate Transfer Tax Payment Voucher.

Q: What is the purpose of Form OR-706-V?

A: The purpose of Form OR-706-V is to remit payment for Oregon Estate Transfer Tax.

Q: Who needs to fill out Form OR-706-V?

A: Form OR-706-V needs to be filled out by individuals or estates that owe Oregon Estate Transfer Tax.

Q: How should I fill out Form OR-706-V?

A: You should follow the instructions provided on the form and include all necessary information, including your tax payment details.

Q: What happens if I don't file Form OR-706-V or pay the Oregon Estate Transfer Tax?

A: Failure to file Form OR-706-V or pay the Oregon Estate Transfer Tax may result in penalties and interest being assessed.

Q: Is there a deadline for filing Form OR-706-V?

A: Yes, Form OR-706-V should be filed and payment should be made by the due date specified on the form.

Q: Can I make a payment for the Oregon Estate Transfer Tax electronically?

A: Yes, you can make a payment electronically using the available payment methods outlined on the form.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.