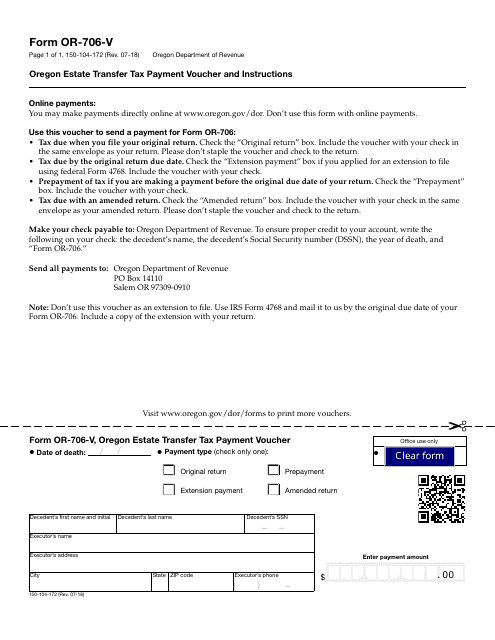

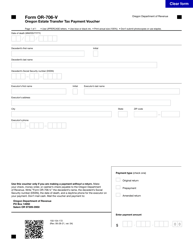

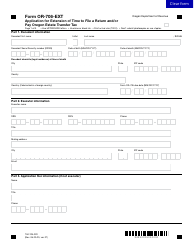

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 150-104-172 (OR-706-V)

for the current year.

Form 150-104-172 (OR-706-V) Estate Transfer Tax Payment Voucher - Oregon

What Is Form 150-104-172 (OR-706-V)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-104-172 (OR-706-V)?

A: Form 150-104-172 (OR-706-V) is the Estate Transfer Tax Payment Voucher for the state of Oregon.

Q: What is the purpose of Form 150-104-172 (OR-706-V)?

A: The purpose of Form 150-104-172 (OR-706-V) is to make a payment for estate transfer taxes in Oregon.

Q: Who needs to file Form 150-104-172 (OR-706-V)?

A: Individuals or estates that are subject to estate transfer tax in Oregon need to file Form 150-104-172 (OR-706-V).

Q: When is Form 150-104-172 (OR-706-V) due?

A: Form 150-104-172 (OR-706-V) is due on the same date as the estate transfer tax return in Oregon, which is generally nine months after the decedent's death.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-104-172 (OR-706-V) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.