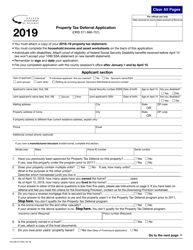

This version of the form is not currently in use and is provided for reference only. Download this version of

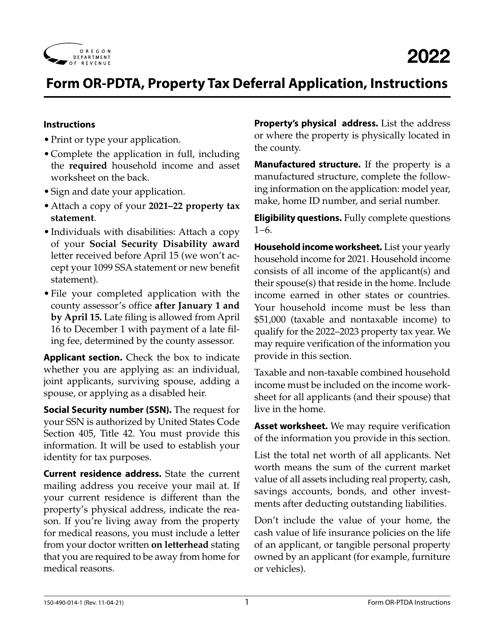

Instructions for Form OR-PDTA, 150-490-014

for the current year.

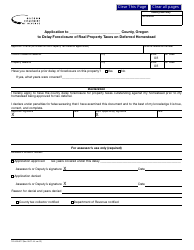

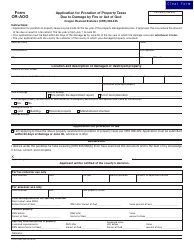

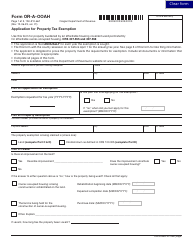

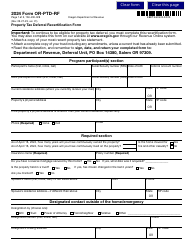

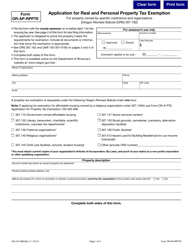

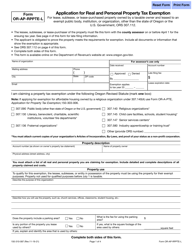

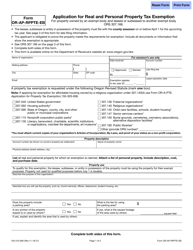

Instructions for Form OR-PDTA, 150-490-014 Property Tax Deferral Application - Oregon

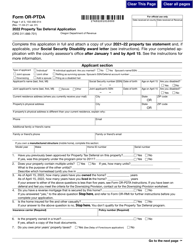

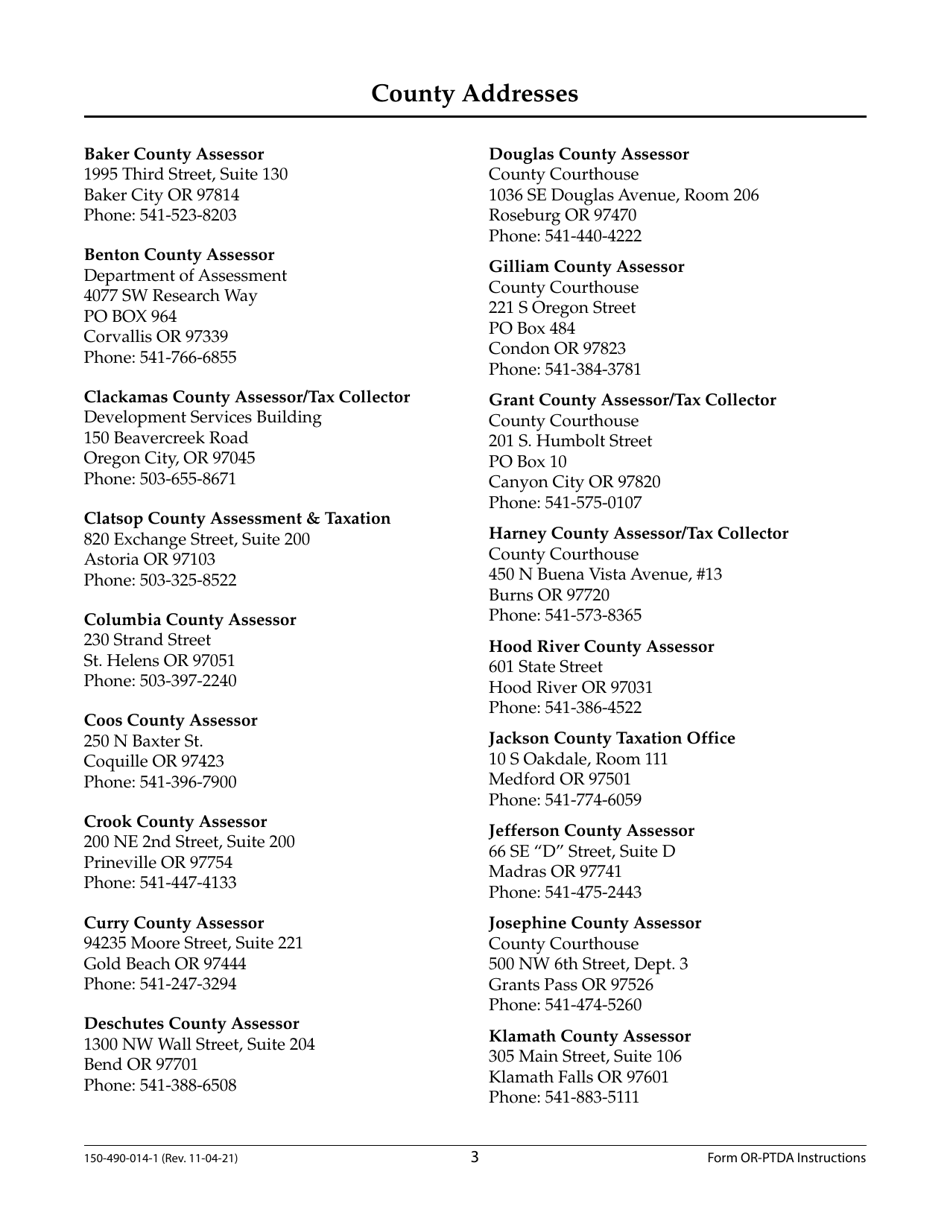

This document contains official instructions for Form OR-PDTA , and Form 150-490-014 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-PDTA (150-490-014) is available for download through this link.

FAQ

Q: What is Form OR-PDTA?

A: Form OR-PDTA is the Property Tax Deferral Application form in Oregon.

Q: What is the purpose of Form OR-PDTA?

A: The purpose of Form OR-PDTA is to apply for property tax deferral in Oregon.

Q: What is property tax deferral?

A: Property tax deferral is a program in Oregon that allows eligible homeowners to delay paying property taxes.

Q: Who is eligible for property tax deferral in Oregon?

A: To be eligible for property tax deferral in Oregon, you must be at least 62 years old, have a household income below a certain limit, and own and live in your home.

Q: What supporting documents do I need to submit along with Form OR-PDTA?

A: You will need to submit proof of your age, income, and ownership of the home, as well as any other documents requested on the form.

Q: When is the deadline to submit Form OR-PDTA?

A: The deadline to submit Form OR-PDTA is April 15th of the tax year for which you are applying for deferral.

Q: Is there a fee for applying for property tax deferral?

A: Yes, there is a $25 fee for applying for property tax deferral.

Q: What happens after I submit Form OR-PDTA?

A: After you submit Form OR-PDTA, the Oregon Department of Revenue will review your application and notify you of their decision.

Q: Can I appeal if my application for property tax deferral is denied?

A: Yes, you can appeal the decision if your application for property tax deferral is denied. The appeals process will be explained in the denial notice you receive.

Q: How long does property tax deferral last?

A: Property tax deferral lasts as long as you continue to meet the eligibility requirements. However, deferred taxes become a lien on your property and must be repaid with interest when certain events occur, such as the sale or transfer of the property.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.