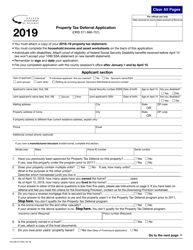

This version of the form is not currently in use and is provided for reference only. Download this version of

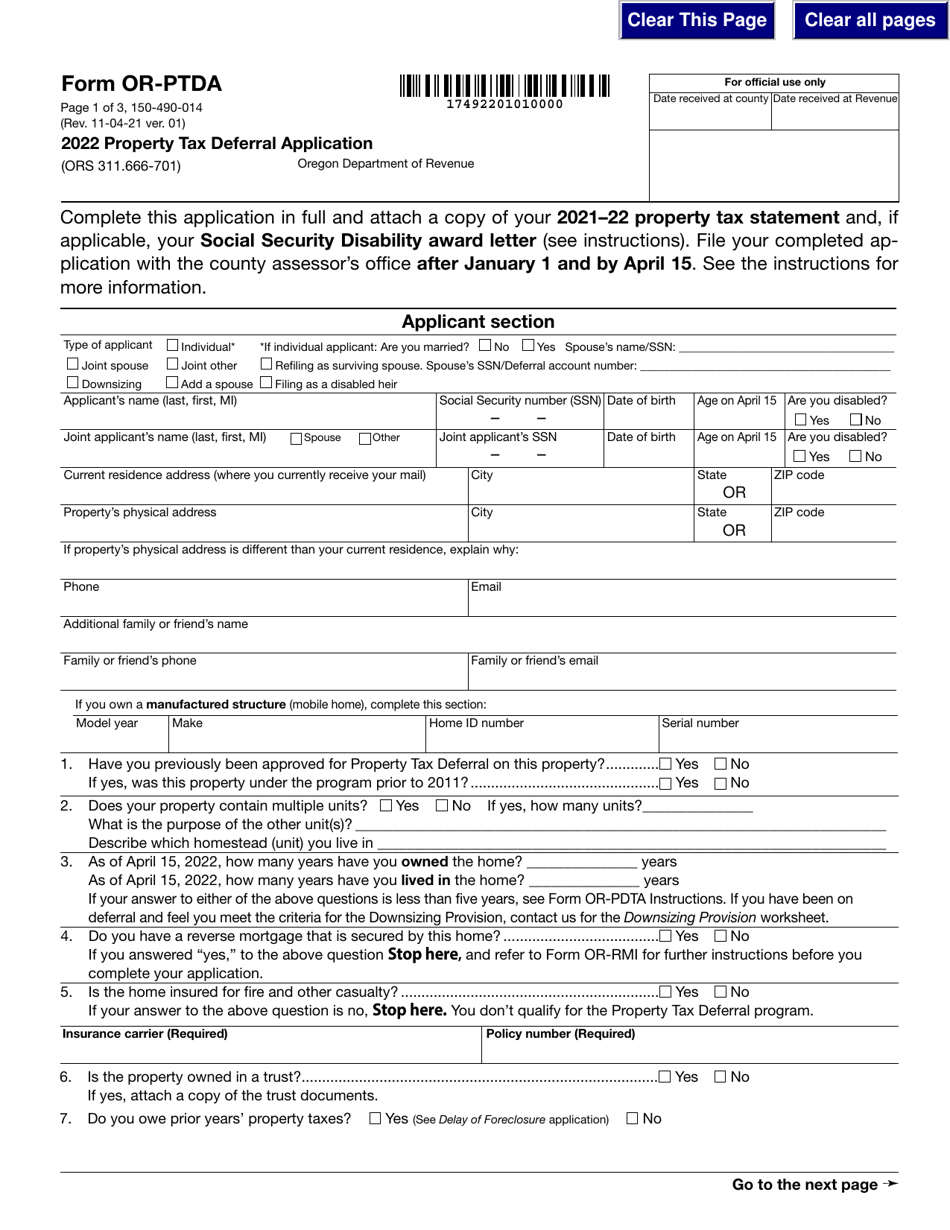

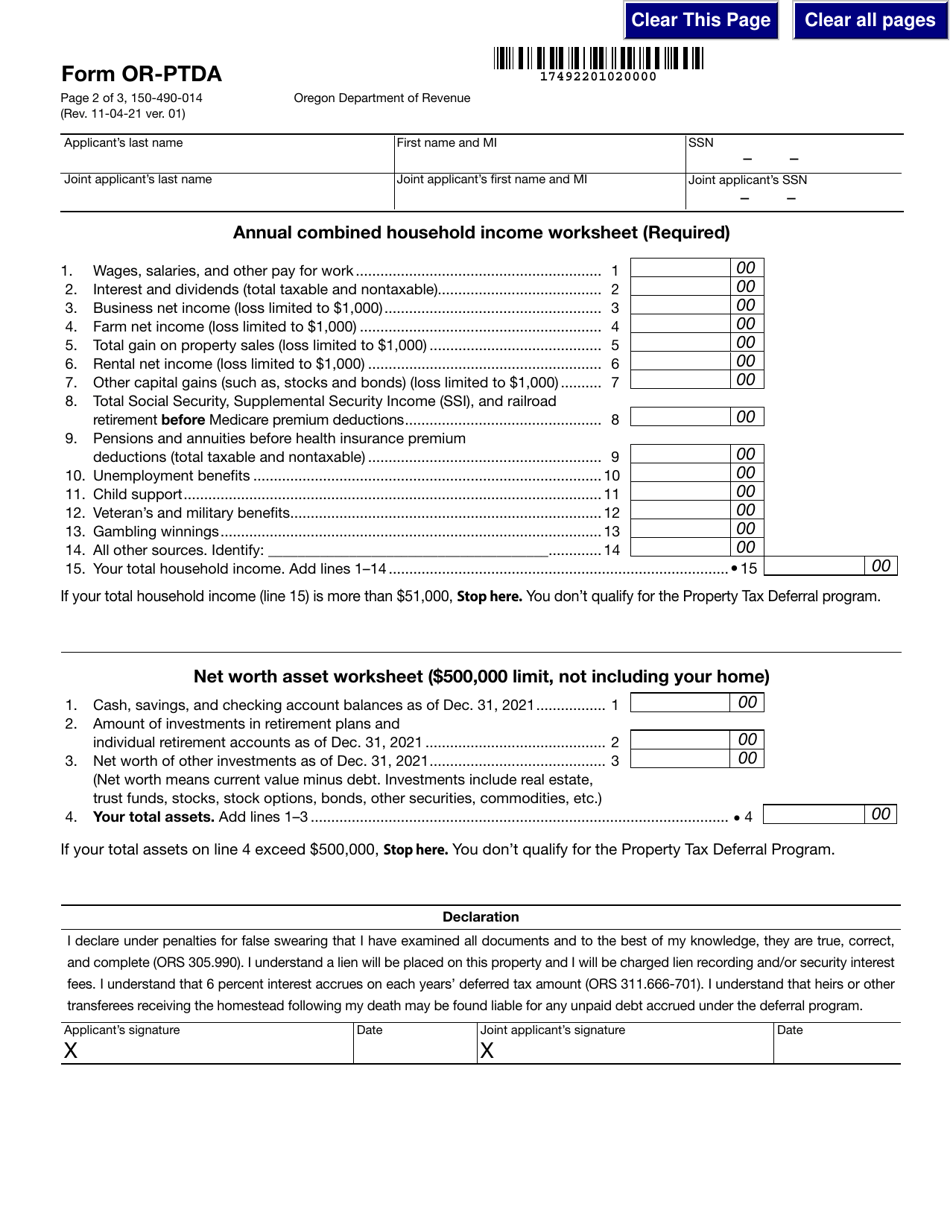

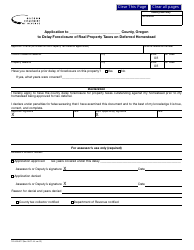

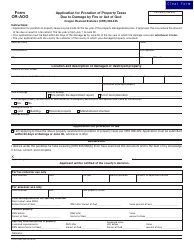

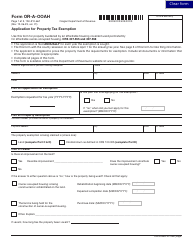

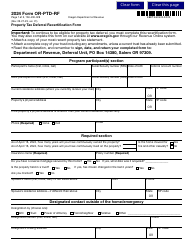

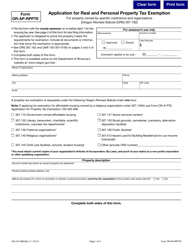

Form OR-PDTA (150-490-014)

for the current year.

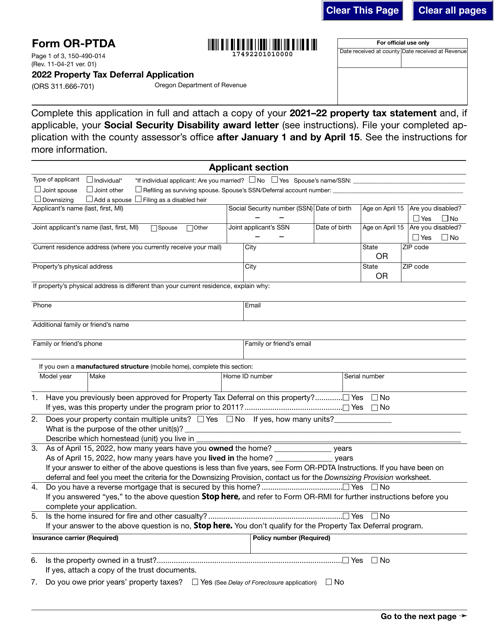

Form OR-PDTA (150-490-014) Property Tax Deferral Application - Oregon

What Is Form OR-PDTA (150-490-014)?

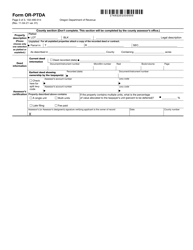

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

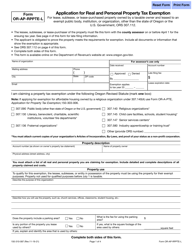

Q: What is the OR-PDTA (150-490-014) Property Tax Deferral Application?

A: The OR-PDTA (150-490-014) Property Tax Deferral Application is a form used in Oregon to apply for property tax deferral.

Q: Who can use the OR-PDTA (150-490-014) Property Tax Deferral Application?

A: Homeowners in Oregon who meet certain eligibility requirements can use the OR-PDTA (150-490-014) Property Tax Deferral Application.

Q: What does property tax deferral mean?

A: Property tax deferral allows eligible homeowners to postpone paying their property taxes.

Q: How does the OR-PDTA (150-490-014) Property Tax Deferral Application work?

A: By submitting the OR-PDTA (150-490-014) Property Tax Deferral Application, homeowners can request to defer payment of their property taxes.

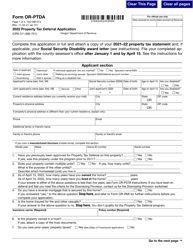

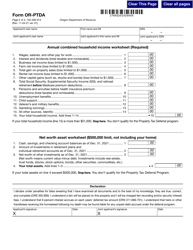

Q: What are the eligibility requirements for property tax deferral in Oregon?

A: To be eligible for property tax deferral in Oregon, homeowners must be at least 62 years old, have a household income below certain limits, and live in the property as their primary residence.

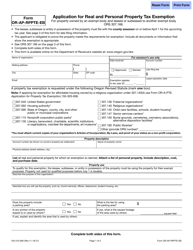

Form Details:

- Released on November 4, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-PDTA (150-490-014) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.