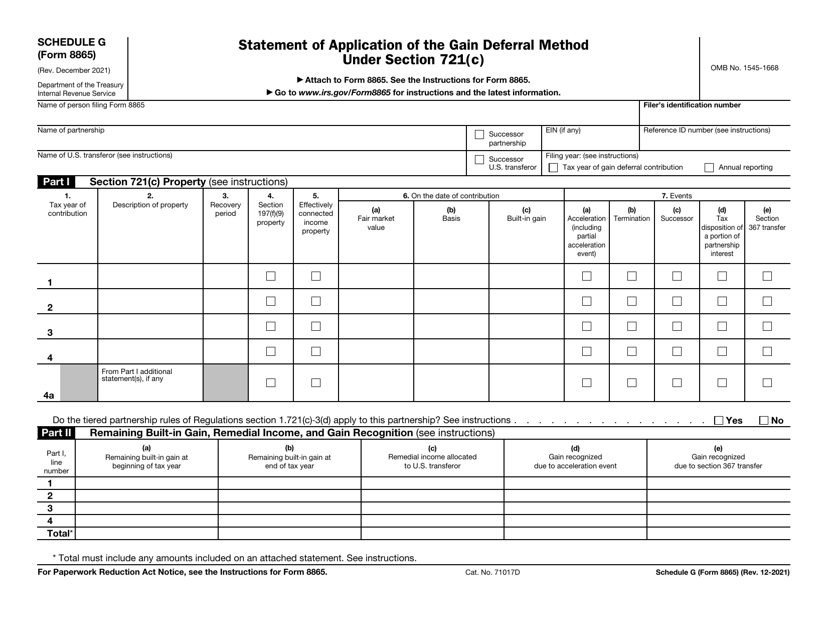

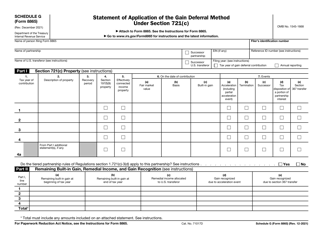

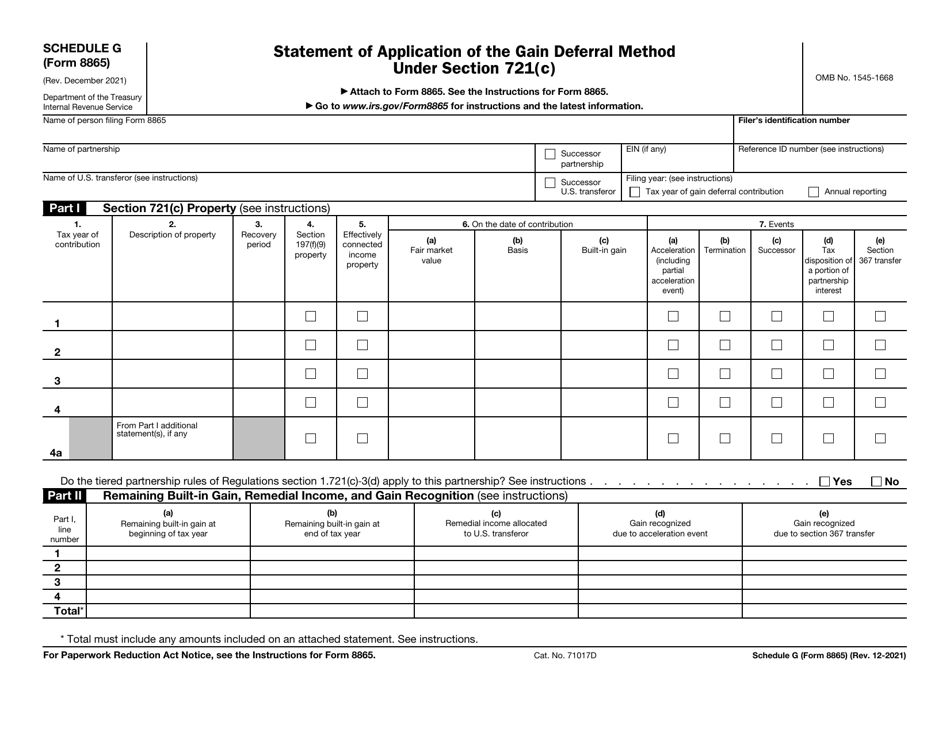

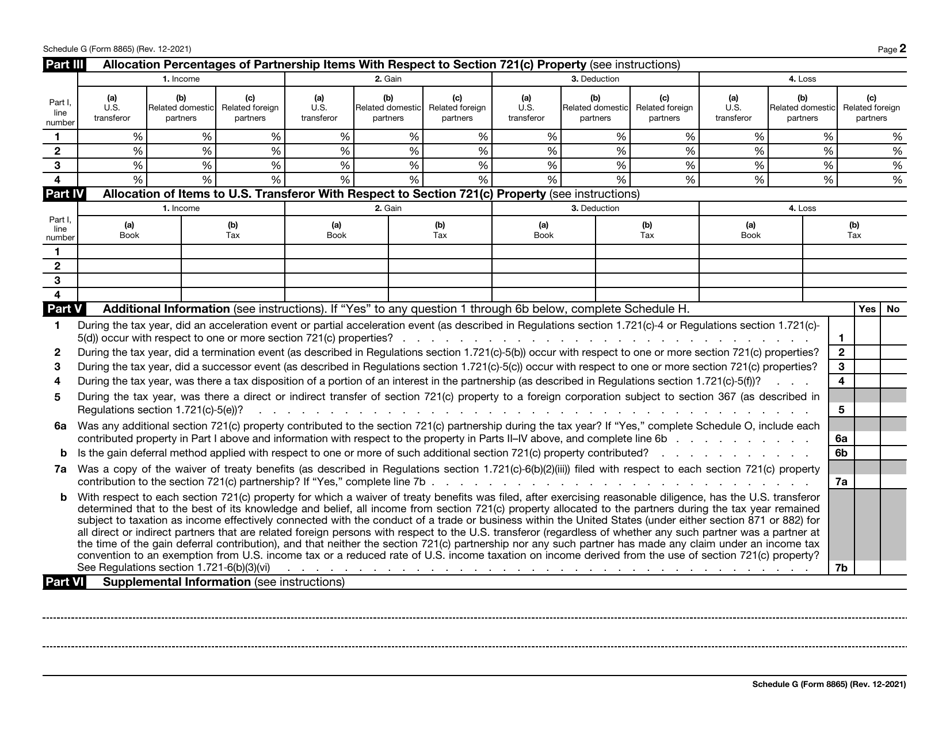

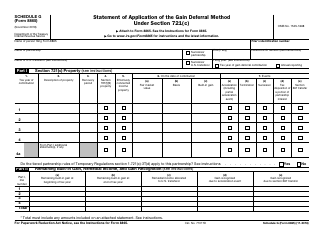

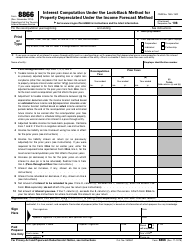

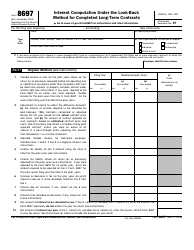

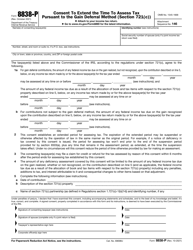

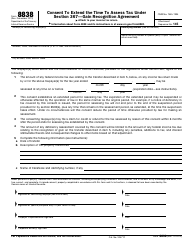

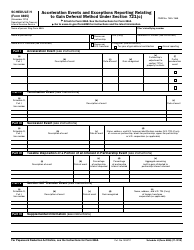

IRS Form 8865 Statement of Application of the Gain Deferral Method Under Section 721(C)

What Is IRS Form 8865?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8865?

A: IRS Form 8865 is a form used to report the Statement of Application of the Gain Deferral Method Under Section 721(C).

Q: What does IRS Form 8865 report?

A: IRS Form 8865 reports the application of the gain deferral method under Section 721(C).

Q: Who needs to file IRS Form 8865?

A: Partnerships that have made certain transfers of property to foreign partnerships or foreign corporations need to file IRS Form 8865.

Q: What is the purpose of filing IRS Form 8865?

A: The purpose of filing IRS Form 8865 is to report and document the application of the gain deferral method.

Q: Is there a deadline for filing IRS Form 8865?

A: Yes, there is a deadline for filing IRS Form 8865. The due date is generally the same as the due date for the related income tax return, including extensions.

Q: Are there any penalties for failing to file IRS Form 8865?

A: Yes, there are penalties for failing to file IRS Form 8865. The penalties can vary depending on the circumstances, so it's important to file the form accurately and on time.

Q: Can I e-file IRS Form 8865?

A: No, IRS Form 8865 cannot be e-filed. It must be filed in paper format and mailed to the appropriate IRS address.

Q: What other forms may be required to be filed with IRS Form 8865?

A: Depending on the specific circumstances, additional forms such as Form 5471 or Form 8621 may need to be filed along with IRS Form 8865.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8865 through the link below or browse more documents in our library of IRS Forms.