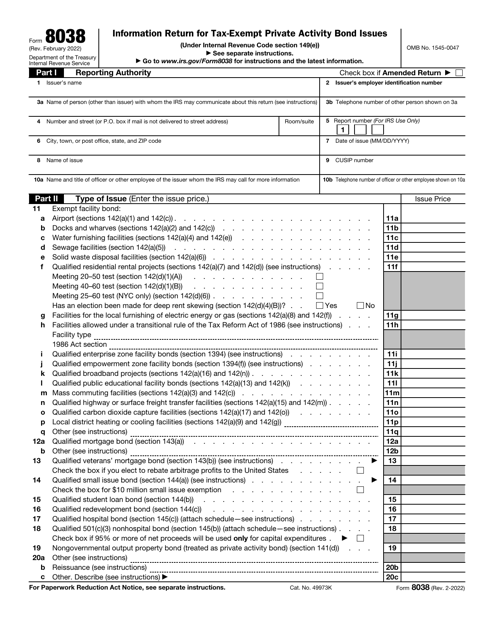

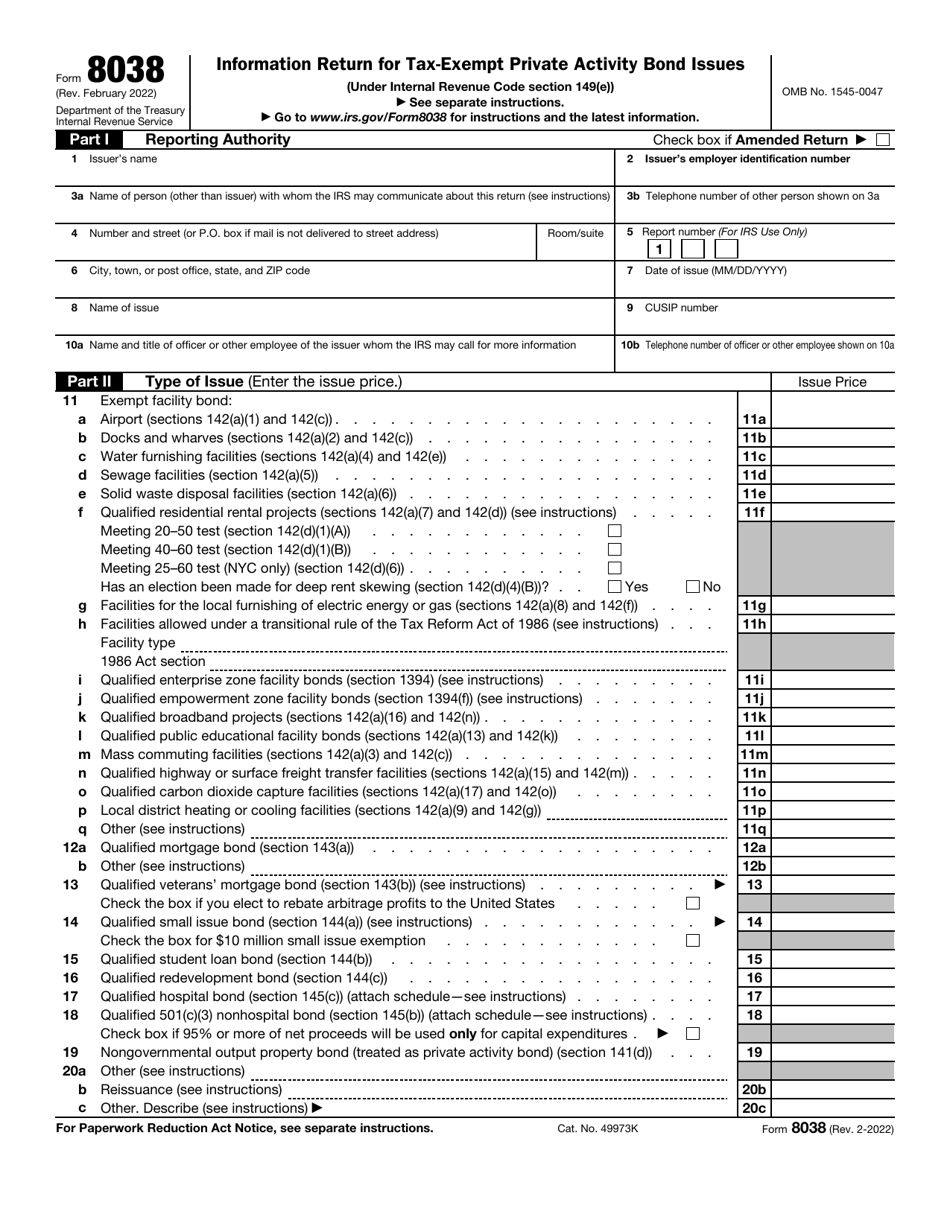

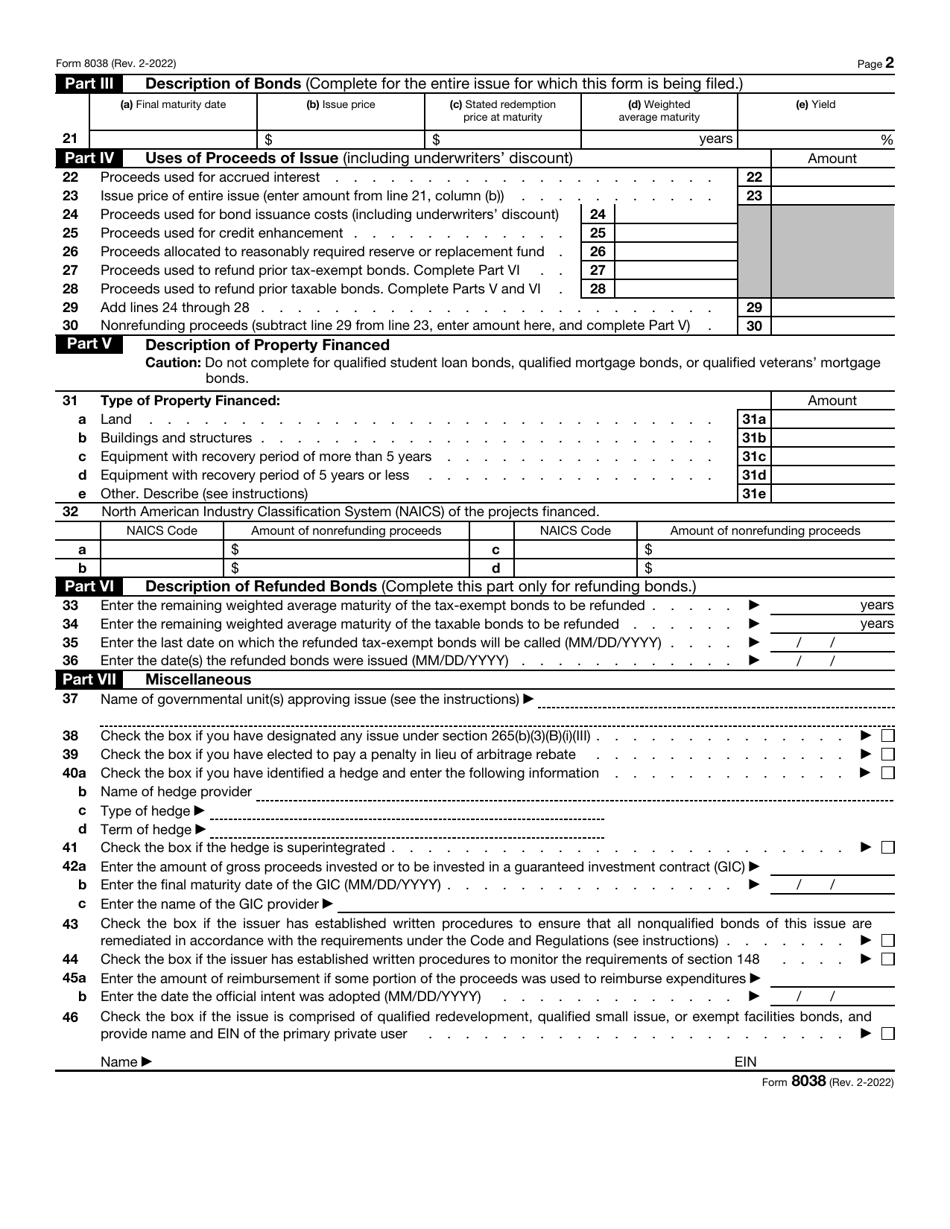

IRS Form 8038 Information Return for Tax-Exempt Private Activity Bond Issues

What Is IRS Form 8038?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8038?

A: IRS Form 8038 is an Information Return for Tax-Exempt Private Activity Bond Issues.

Q: Who needs to file IRS Form 8038?

A: Any issuer of tax-exempt private activity bonds needs to file Form 8038.

Q: What are tax-exempt private activity bonds?

A: Tax-exempt private activity bonds are bonds issued by state or local governments to finance private projects that serve a public purpose, such as affordable housing or economic development.

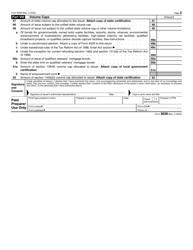

Q: What information is required on IRS Form 8038?

A: IRS Form 8038 requires information about the bond issuer, the bond issue, the project being financed, and the use of bond proceeds.

Q: When is IRS Form 8038 due?

A: IRS Form 8038 is generally due within 15 months after the bond issuance.

Q: Are there any penalties for not filing IRS Form 8038?

A: Yes, the IRS may impose penalties for failure to file Form 8038 or for filing an incomplete or incorrect form.

Q: Can I e-file IRS Form 8038?

A: No, IRS Form 8038 cannot be e-filed and must be filed by mail.

Q: Are there any exceptions to filing IRS Form 8038?

A: There are some limited exceptions to filing Form 8038, such as certain small bond issues or certain types of refunding bonds.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8038 through the link below or browse more documents in our library of IRS Forms.