This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8038

for the current year.

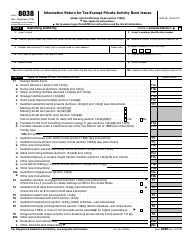

Instructions for IRS Form 8038 Information Return for Tax-Exempt Private Activity Bond Issues

This document contains official instructions for IRS Form 8038 , Information Return for Tax-Exempt Private Activity Bond Issues - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8038 is available for download through this link.

FAQ

Q: What is IRS Form 8038?

A: IRS Form 8038 is an information return for tax-exempt private activity bond issues.

Q: Who needs to file IRS Form 8038?

A: Entities that issue tax-exempt private activity bonds need to file IRS Form 8038.

Q: What information is required on IRS Form 8038?

A: IRS Form 8038 requires information about the bond issuer, the bond issue, and the use of bond proceeds.

Q: When is IRS Form 8038 due?

A: IRS Form 8038 is generally due by the 15th day of the 9th calendar month after the close of the bond issuer's fiscal year.

Q: Are there any penalties for late filing of IRS Form 8038?

A: Yes, there are penalties for late filing of IRS Form 8038. The penalty amount is based on the size of the bond issue.

Q: Can IRS Form 8038 be filed electronically?

A: Yes, IRS Form 8038 can be filed electronically using the IRS's e-File system.

Q: Are there any exceptions or special rules for filing IRS Form 8038?

A: Yes, there are exceptions and special rules for certain types of bonds and bond issuers. It is important to review the instructions for IRS Form 8038 for specific guidance.

Q: Is professional assistance recommended for filing IRS Form 8038?

A: Yes, it is recommended to seek professional assistance, such as a tax advisor or accountant, to ensure accurate and timely filing of IRS Form 8038.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.