This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 7203

for the current year.

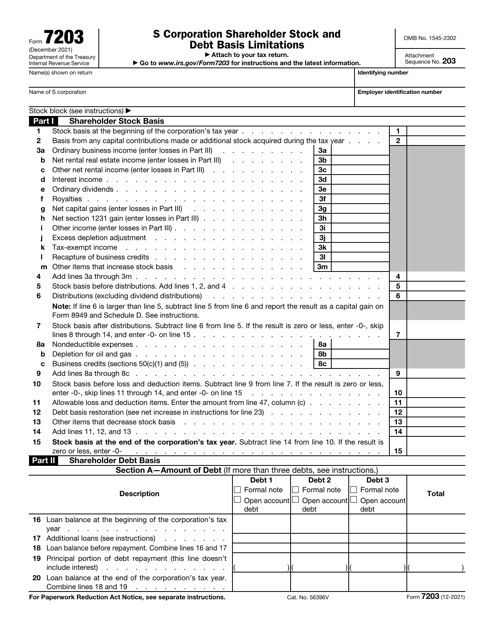

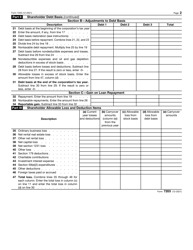

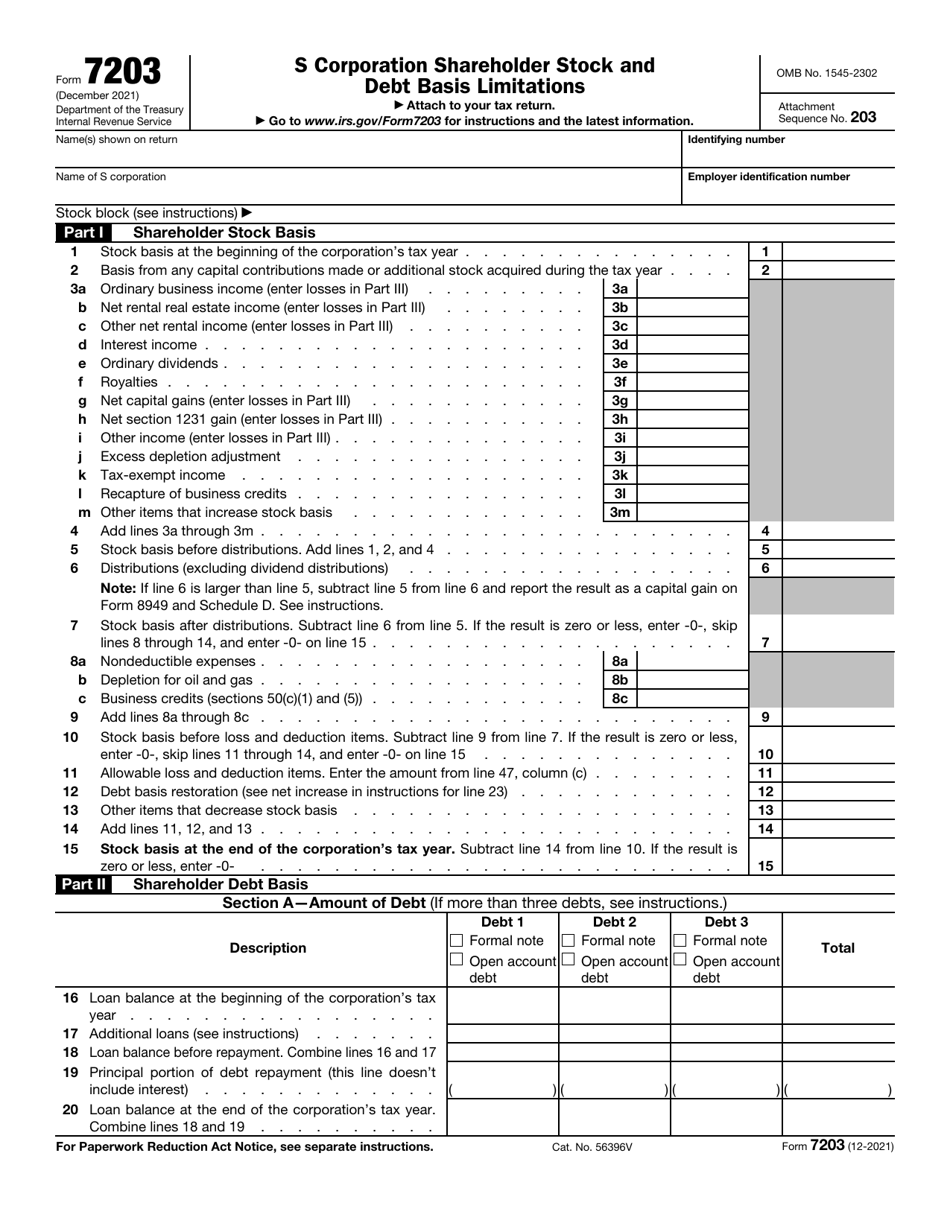

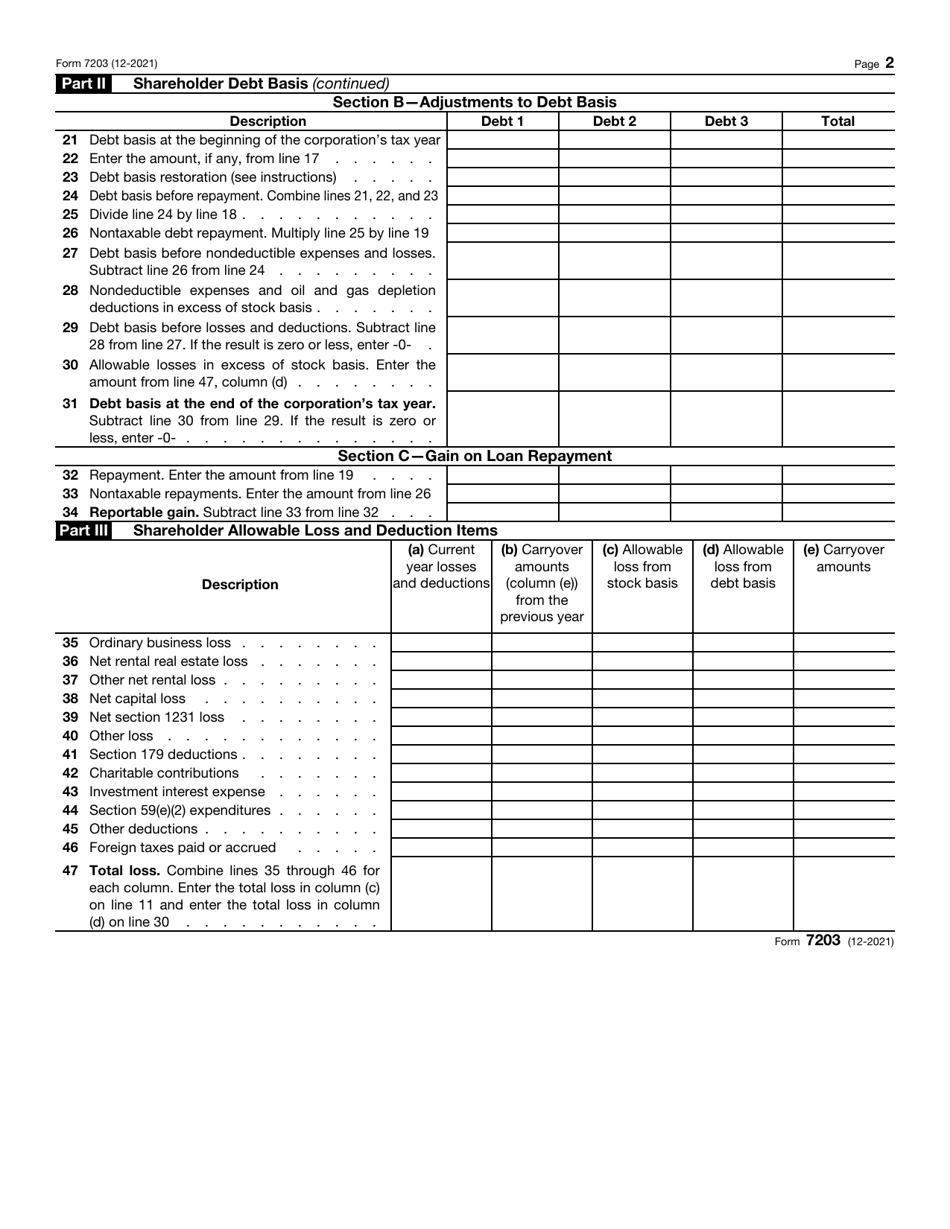

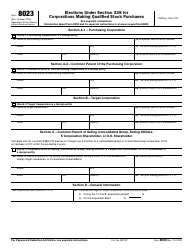

IRS Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

What Is IRS Form 7203?

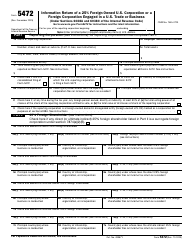

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 7203?

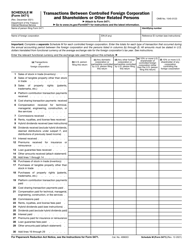

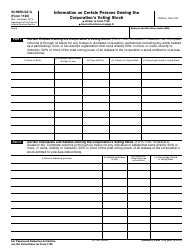

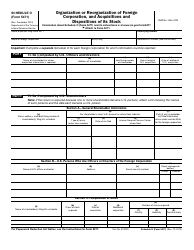

A: IRS Form 7203 is used by S corporations to calculate the stock and debt basis limitations for their shareholders.

Q: What are stock and debt basis limitations?

A: Stock and debt basis limitations are the restrictions on how much losses or deductions shareholders of an S corporation can claim on their individual tax returns.

Q: Who needs to fill out IRS Form 7203?

A: S corporations that have shareholders with stock and debt basis limitations need to fill out IRS Form 7203.

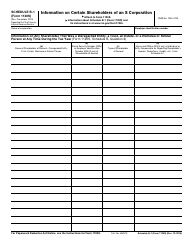

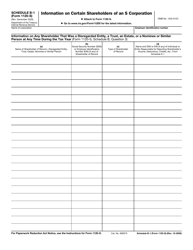

Q: What information is required on IRS Form 7203?

A: IRS Form 7203 requires information about the S corporation's income, deductions, and distributions, as well as the shareholders' basis calculations.

Q: Why are stock and debt basis limitations important?

A: Stock and debt basis limitations are important because they determine the amount of losses or deductions that shareholders can claim on their individual tax returns.

Q: Are stock and debt basis limitations the same for all S corporations?

A: No, stock and debt basis limitations can vary for each S corporation based on their individual financial situation.

Q: Is IRS Form 7203 required every year?

A: IRS Form 7203 is required every year if the S corporation has shareholders with stock and debt basis limitations.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 7203 through the link below or browse more documents in our library of IRS Forms.