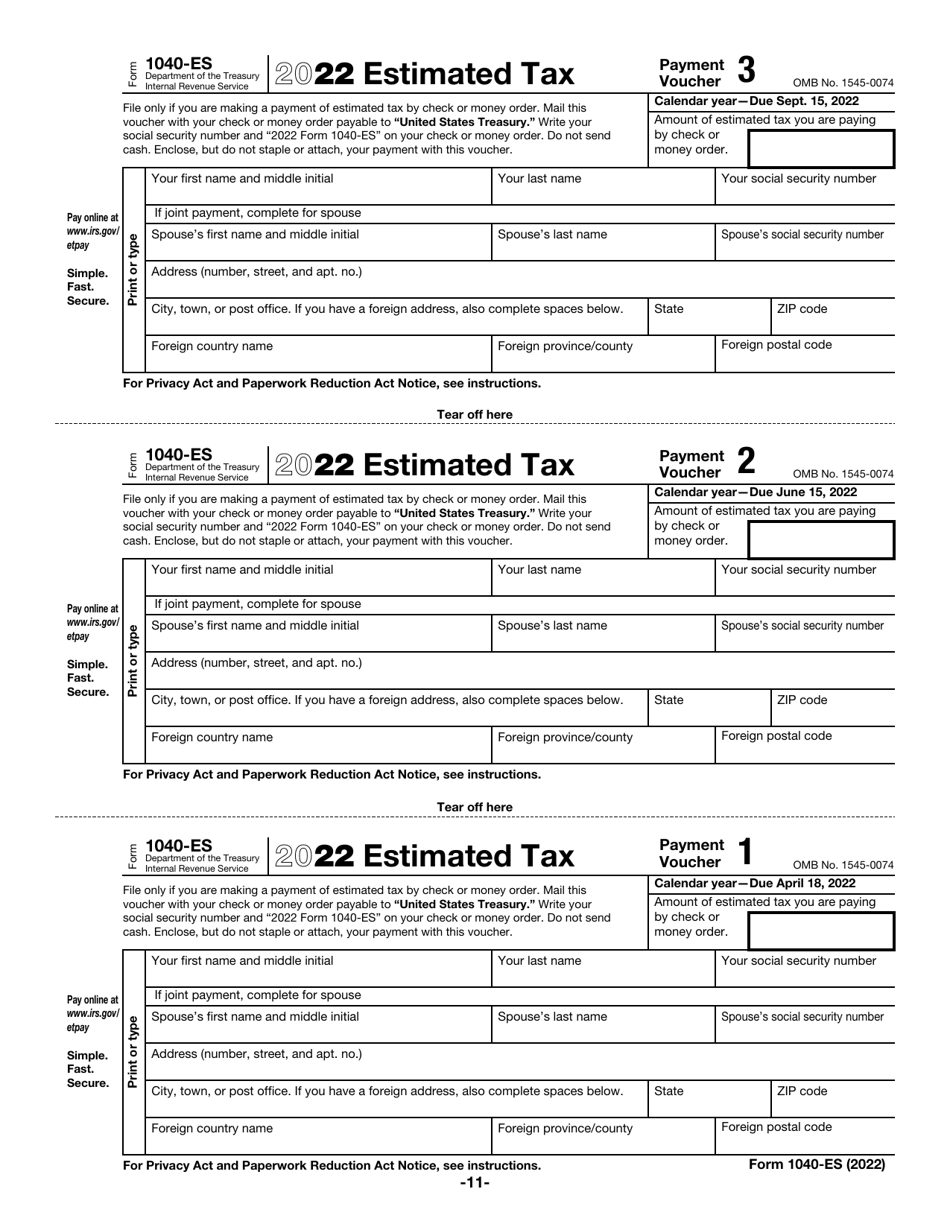

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040-ES

for the current year.

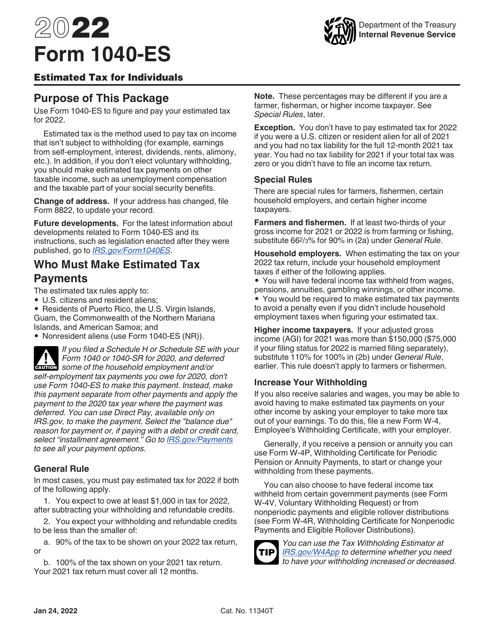

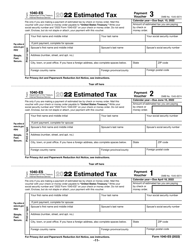

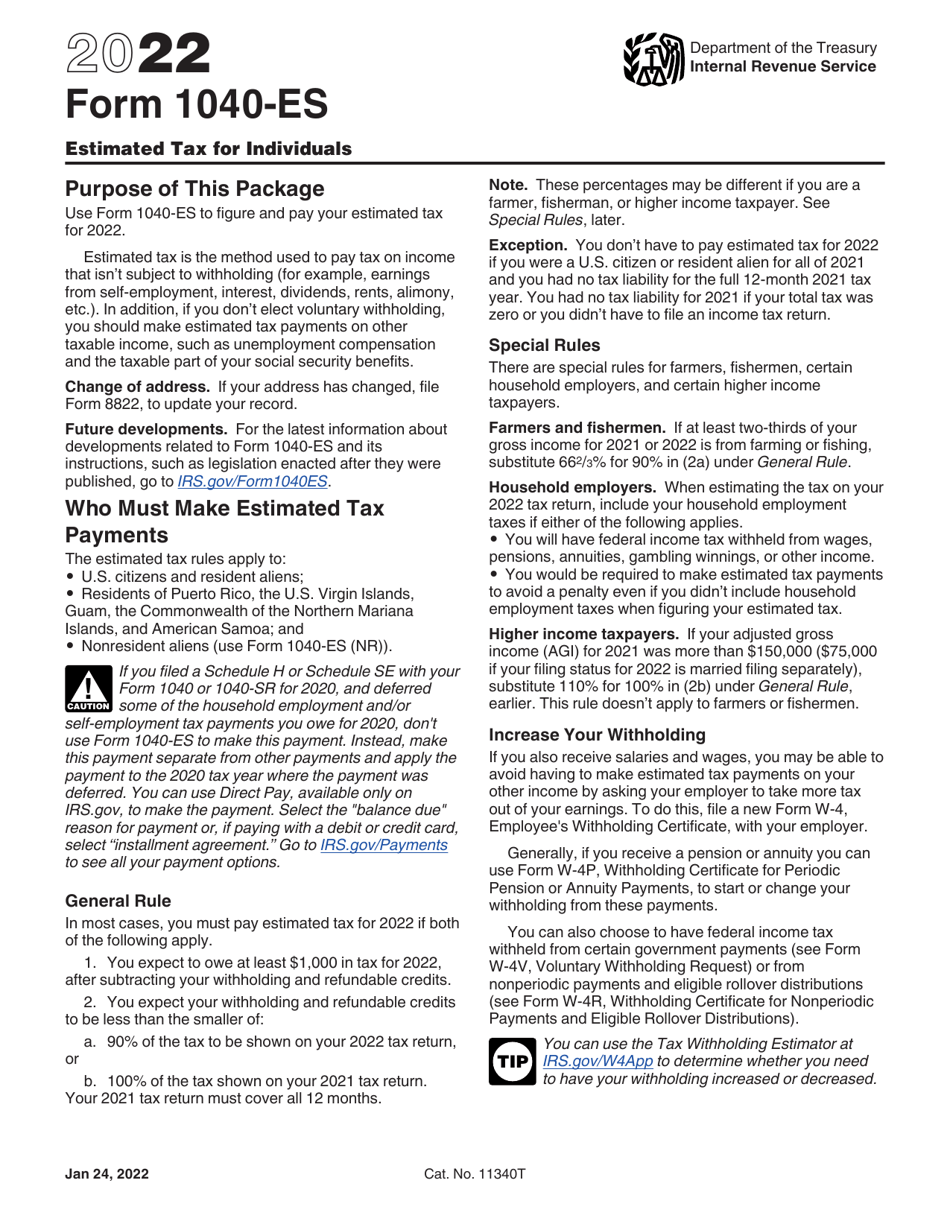

IRS Form 1040-ES Estimated Tax for Individuals

What Is IRS Form 1040-ES?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 24, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040-ES?

A: IRS Form 1040-ES is a tax form used to calculate and pay estimated taxes for individuals.

Q: Who needs to file IRS Form 1040-ES?

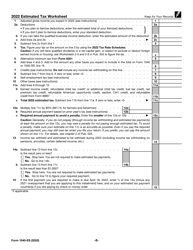

A: Individuals who expect to owe at least $1,000 in federal taxes and are not having enough tax withheld from their income need to file IRS Form 1040-ES.

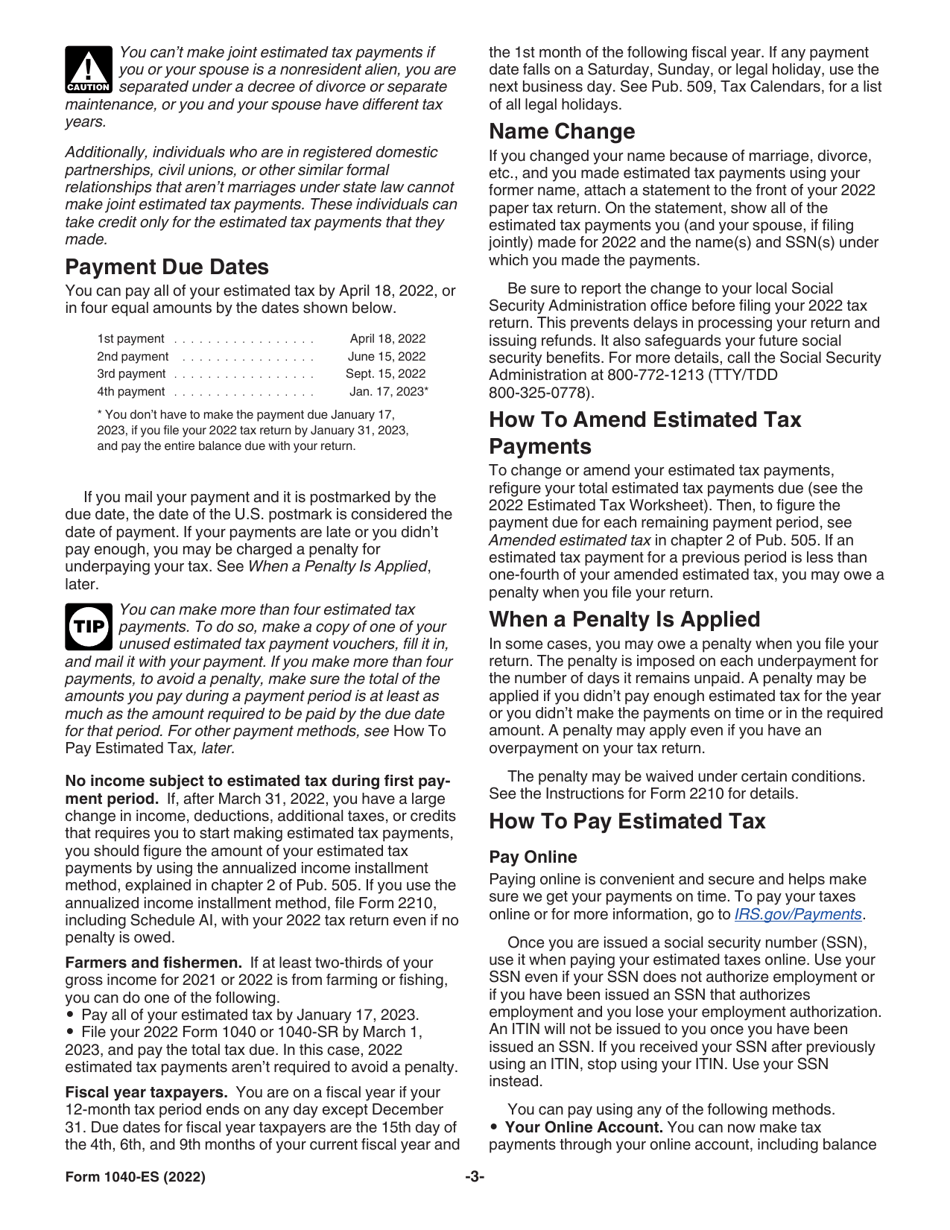

Q: When is IRS Form 1040-ES due?

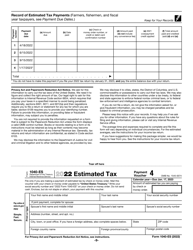

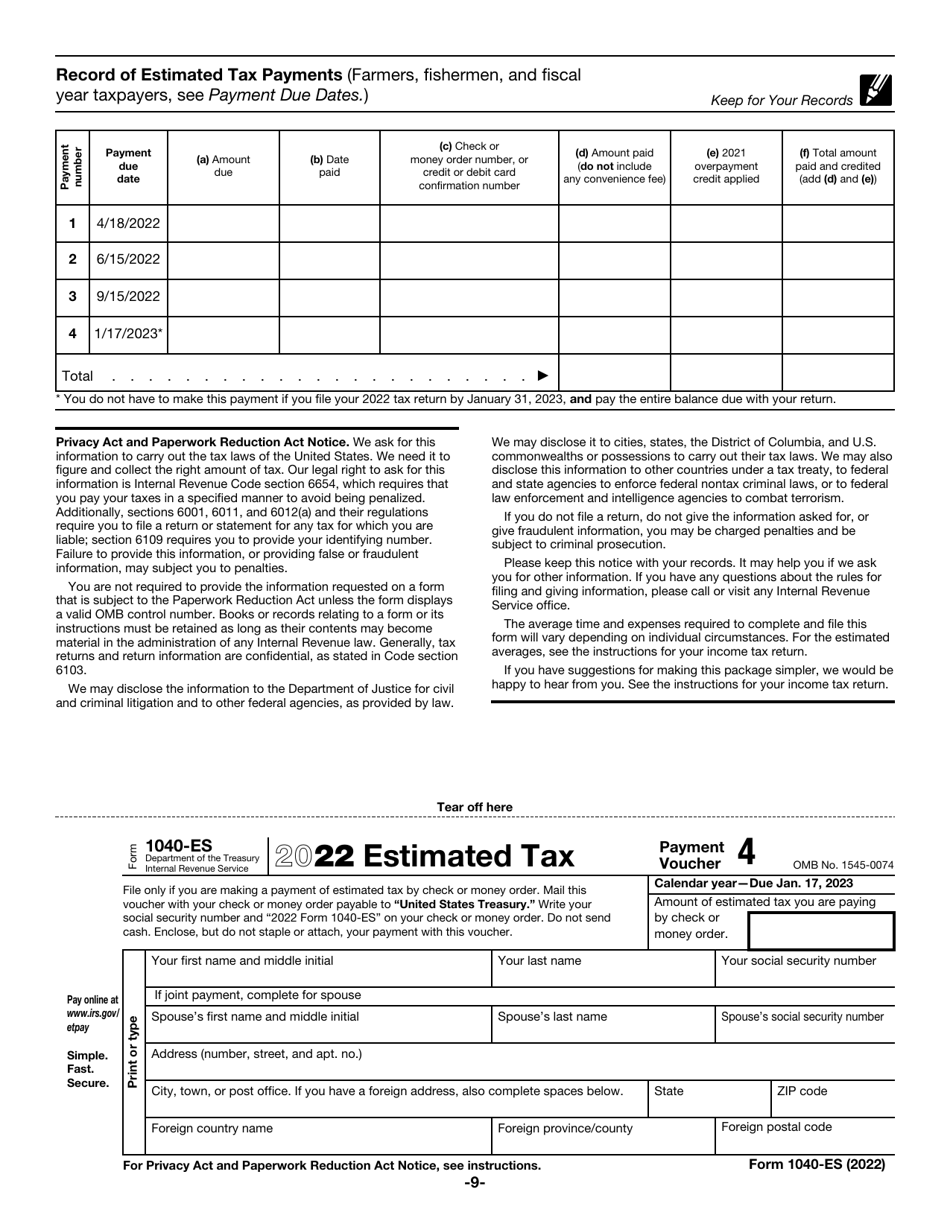

A: IRS Form 1040-ES is due on a quarterly basis. The due dates are April 15, June 15, September 15, and January 15 of the following year.

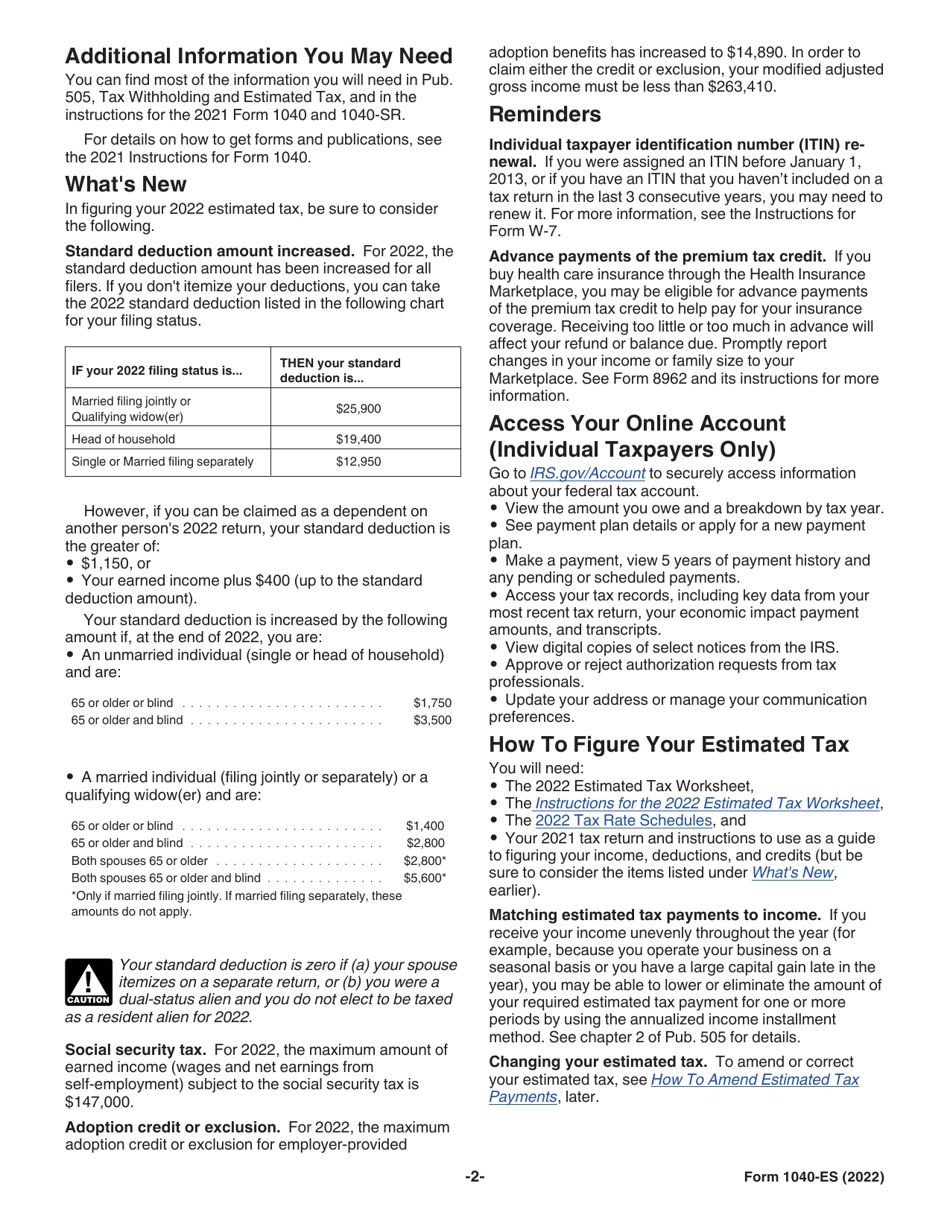

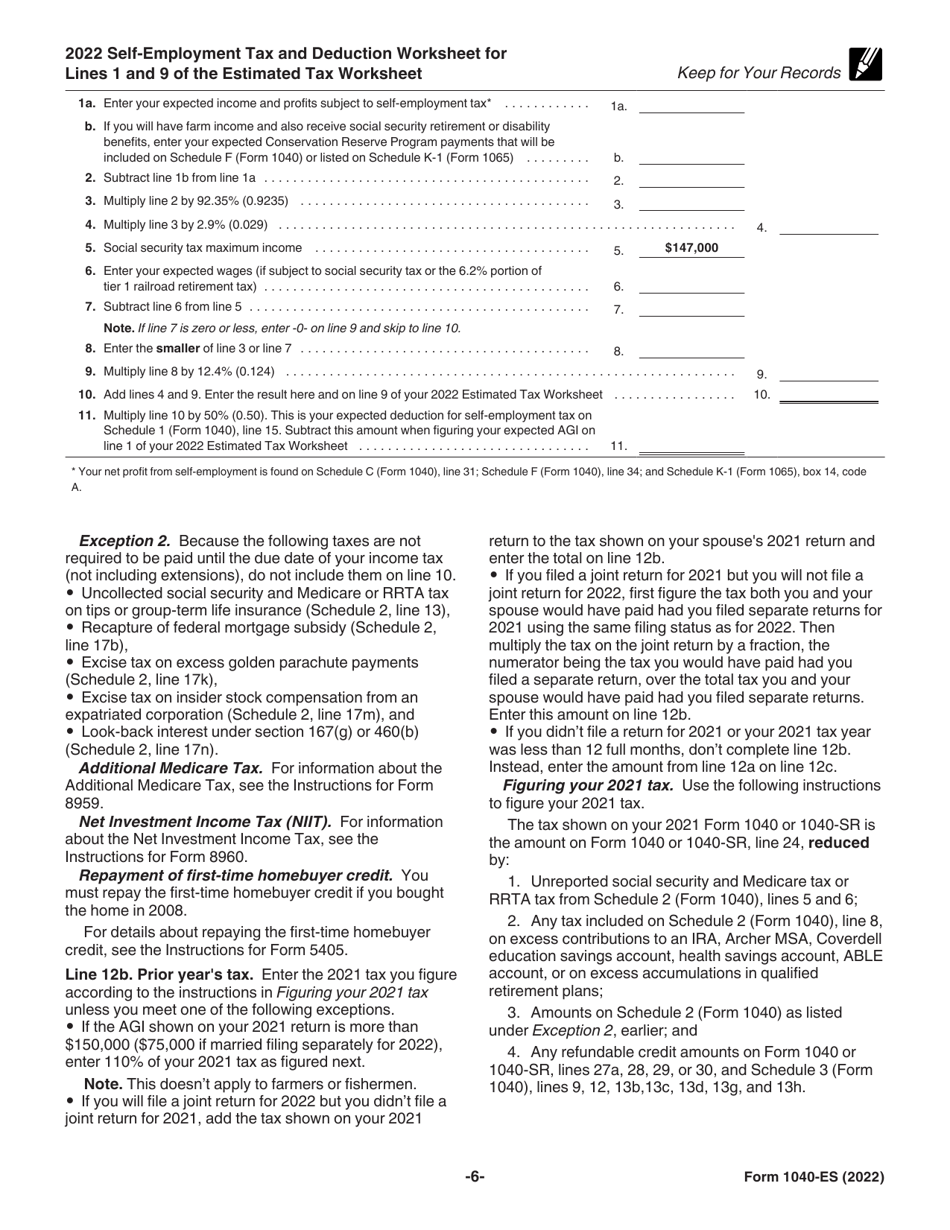

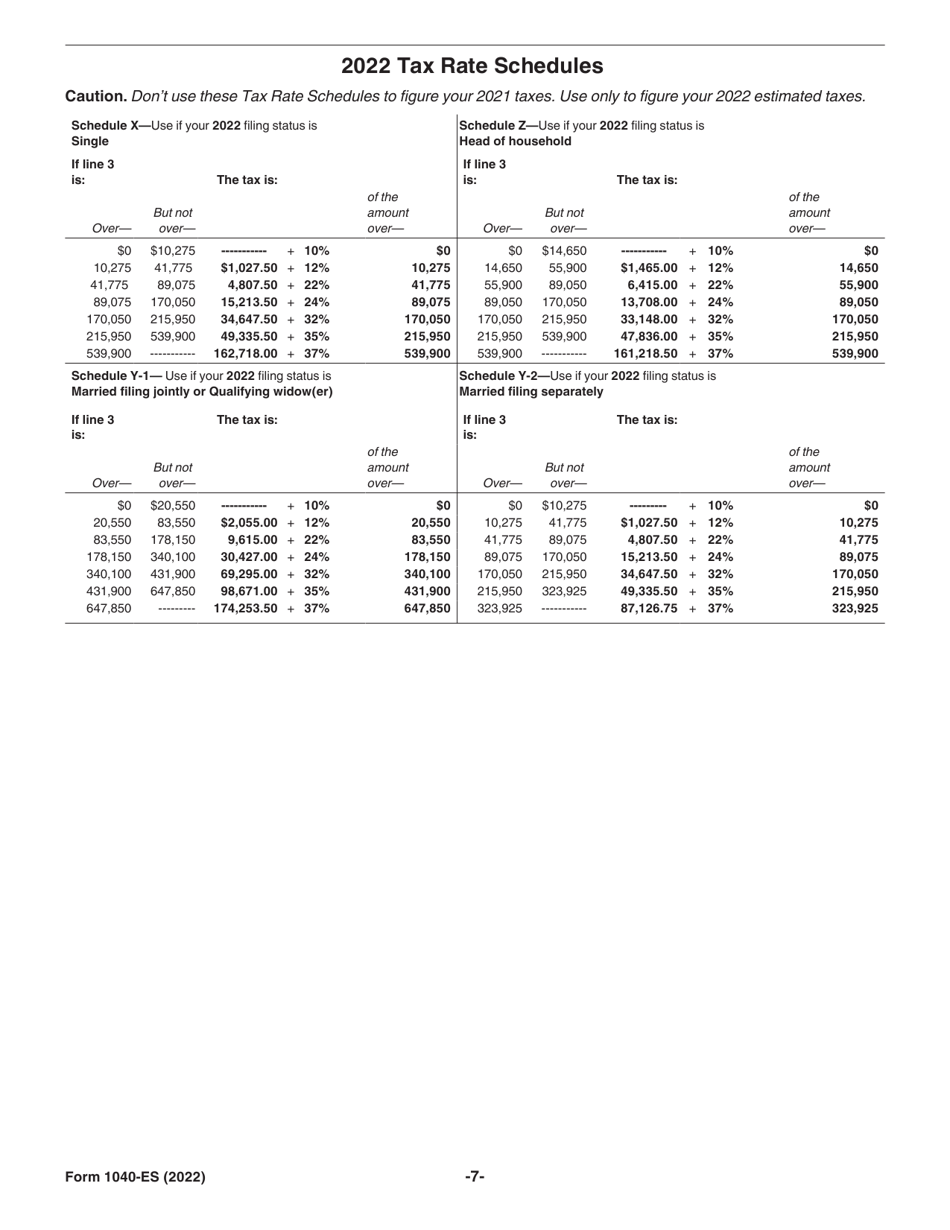

Q: How do I calculate the amount to pay on IRS Form 1040-ES?

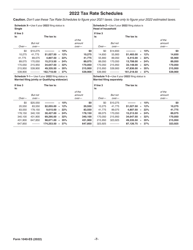

A: To calculate the amount to pay on IRS Form 1040-ES, you need to estimate your taxable income, deductions, and credits for the year, and use the IRS tax tables or tax software to determine the amount.

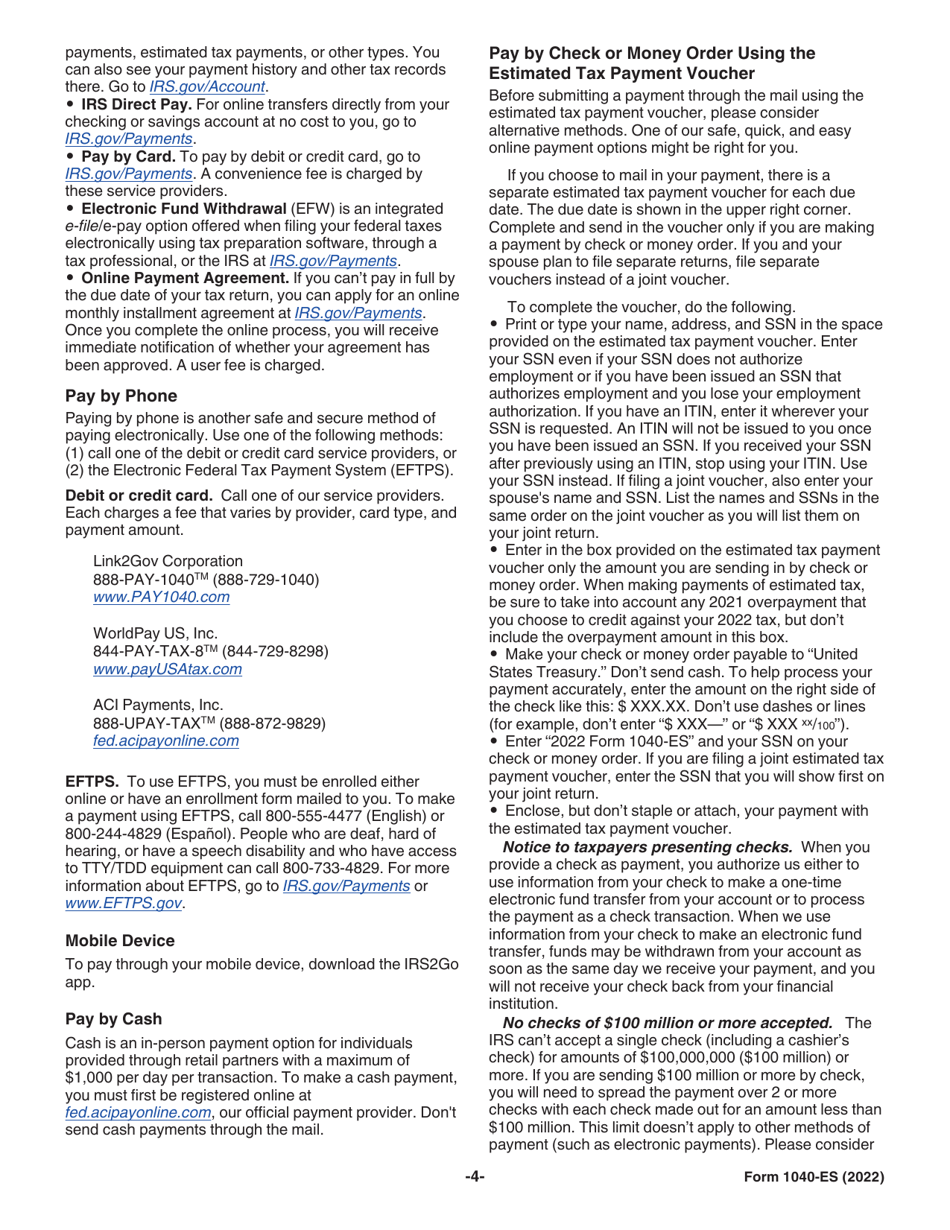

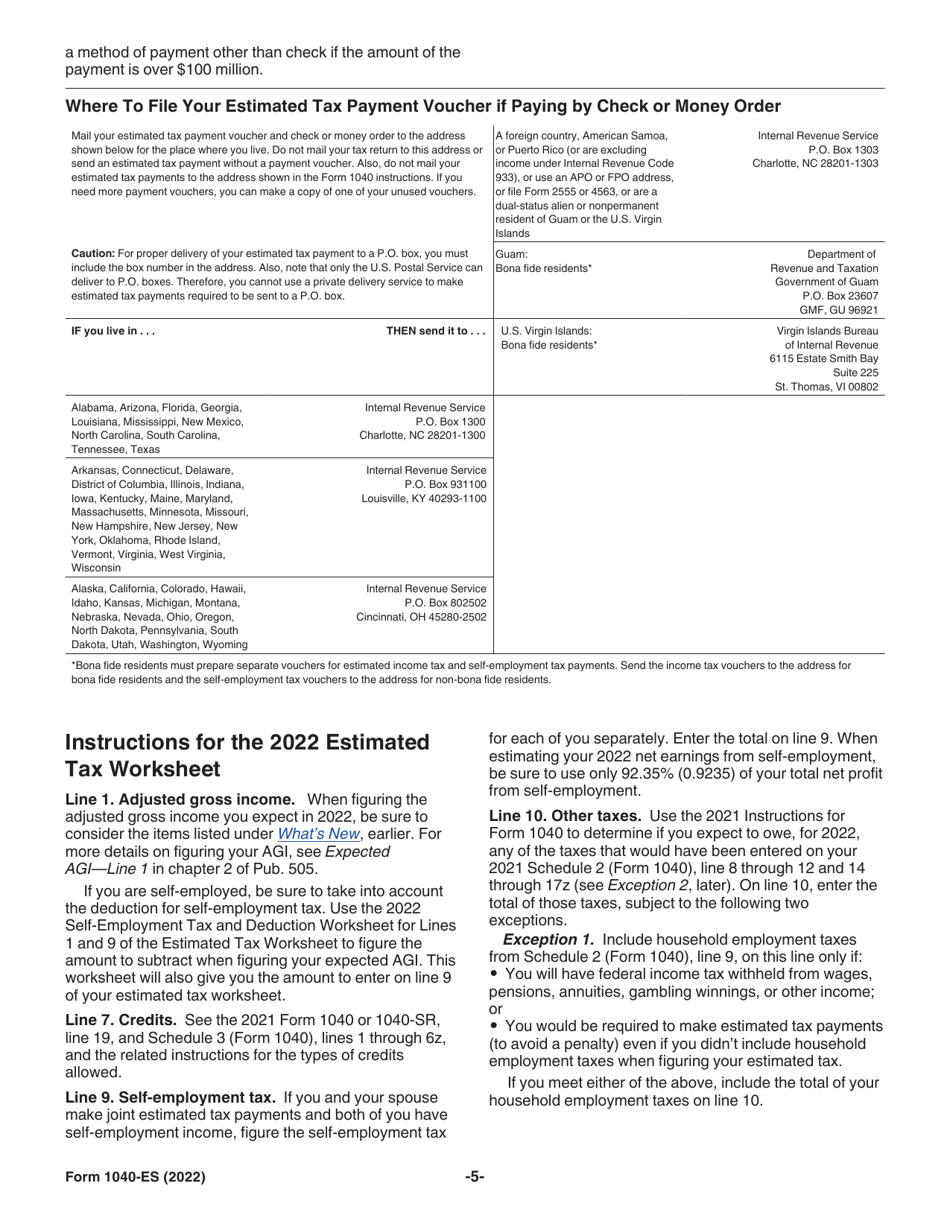

Q: How can I pay the amount due on IRS Form 1040-ES?

A: You can pay the amount due on IRS Form 1040-ES electronically using the IRS Direct Pay system, through a credit or debit card payment, or by mailing a check or money order.

Form Details:

- A 12-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-ES through the link below or browse more documents in our library of IRS Forms.