This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8854

for the current year.

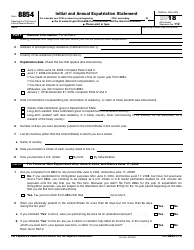

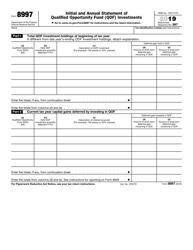

Instructions for IRS Form 8854 Initial and Annual Expatriation Statement

This document contains official instructions for IRS Form 8854 , Initial and Annual Expatriation Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8854?

A: IRS Form 8854 is the Initial and Annual Expatriation Statement.

Q: Who needs to file IRS Form 8854?

A: U.S. citizens or long-term residents who have expatriated or given up their green card.

Q: When do I need to file IRS Form 8854?

A: IRS Form 8854 must be filed in the year after you expatriate or give up your green card.

Q: What information is required on IRS Form 8854?

A: IRS Form 8854 requires information about your expatriation, tax liabilities, and financial assets.

Q: What are the consequences of not filing IRS Form 8854?

A: Failure to file IRS Form 8854 can result in penalties and the continued treatment as a U.S. taxpayer.

Q: Are there any exceptions to filing IRS Form 8854?

A: There are exceptions for individuals who meet certain income or net worth thresholds.

Q: Can I file IRS Form 8854 electronically?

A: No, IRS Form 8854 must be filed by mail with the appropriate IRS office.

Q: Can I get an extension to file IRS Form 8854?

A: No, there are no extensions available for filing IRS Form 8854.

Q: Do I need to hire a tax professional to file IRS Form 8854?

A: While not required, it may be beneficial to seek the assistance of a tax professional to ensure compliance with the requirements of IRS Form 8854.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.