This version of the form is not currently in use and is provided for reference only. Download this version of

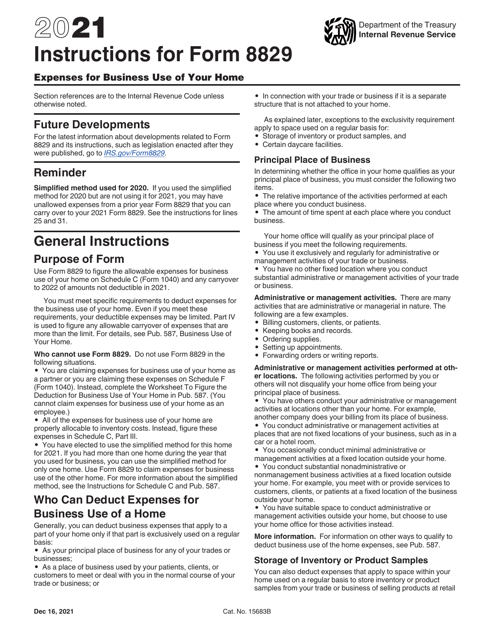

Instructions for IRS Form 8829

for the current year.

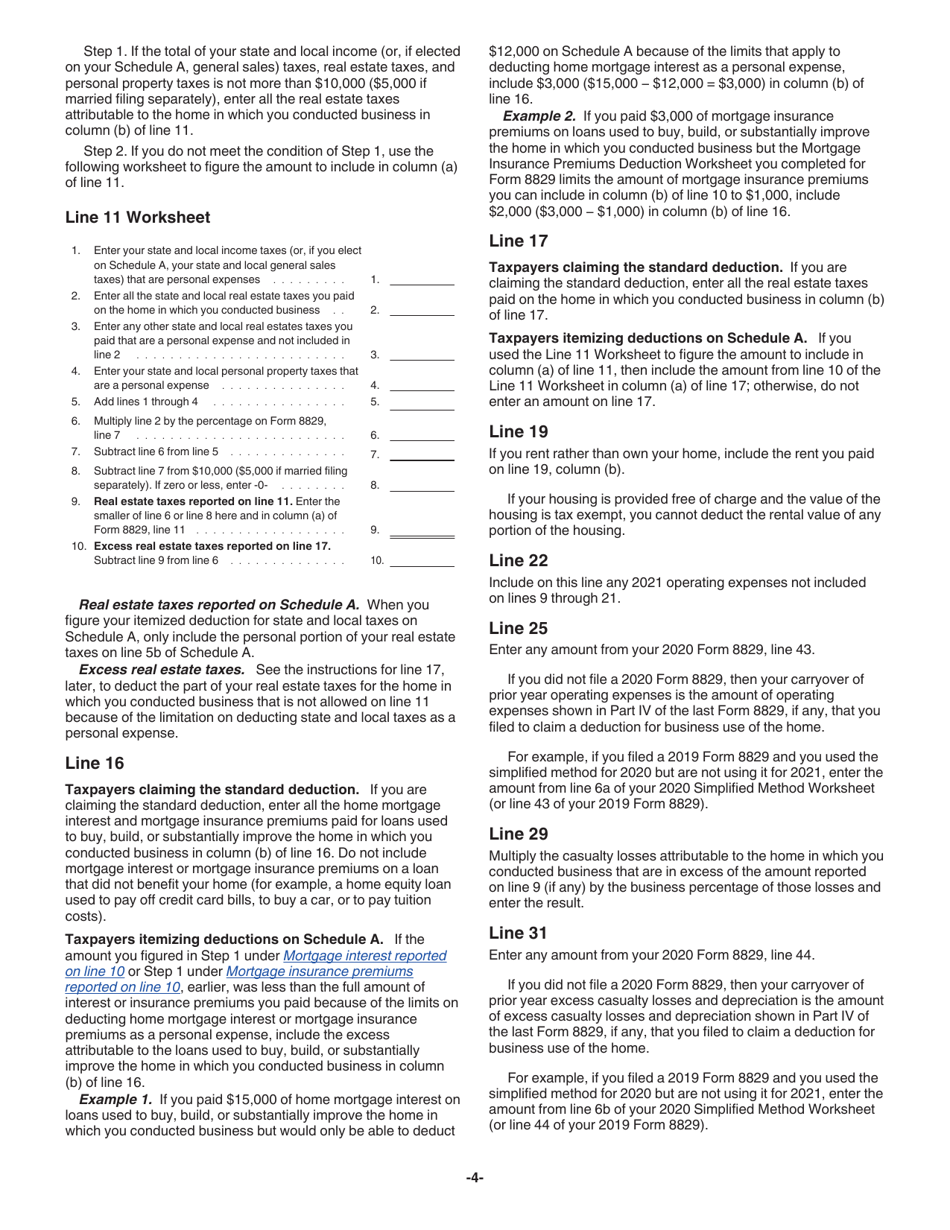

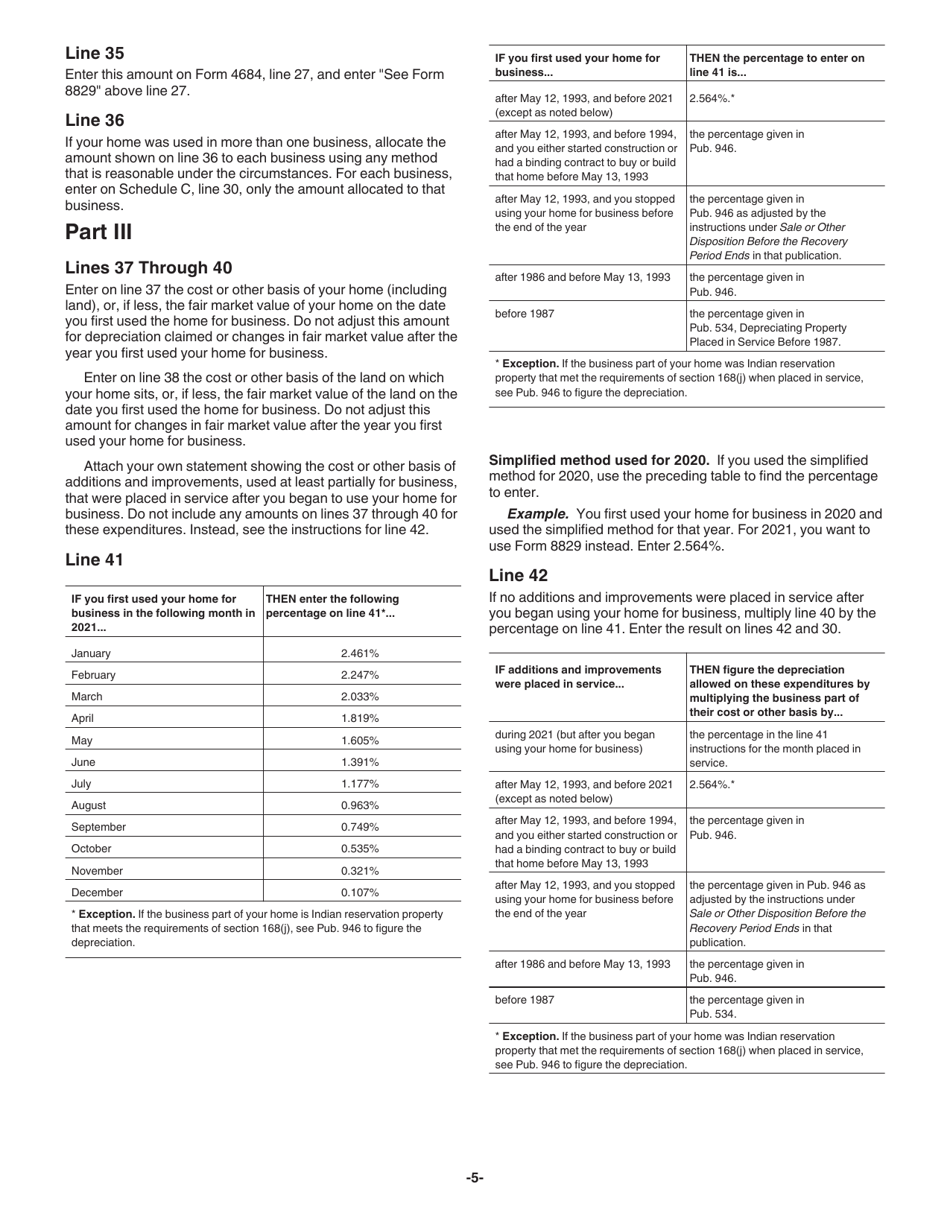

Instructions for IRS Form 8829 Expenses for Business Use of Your Home

This document contains official instructions for IRS Form 8829 , Expenses for Business Use of Your Home - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8829 is available for download through this link.

FAQ

Q: What is IRS Form 8829?

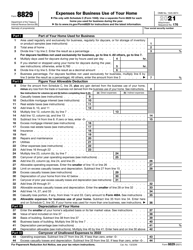

A: IRS Form 8829 is used to claim expenses for business use of your home.

Q: What kind of expenses can be claimed using Form 8829?

A: You can claim expenses for the portion of your home used exclusively for your business, such as mortgage interest, insurance, utilities, and repairs.

Q: Who is eligible to use Form 8829?

A: Self-employed individuals and employees working from home can use this form if they meet certain criteria.

Q: What is the purpose of Form 8829?

A: The purpose of this form is to calculate the deductible expenses related to the business use of your home.

Q: How do I fill out Form 8829?

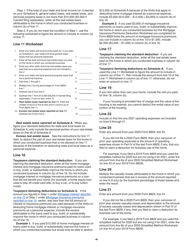

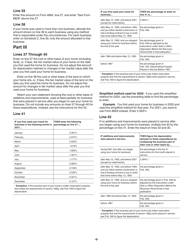

A: You need to provide information about your home, the percentage of your home used for business, and the expenses you incurred.

Q: Can I claim all my home expenses on Form 8829?

A: No, you can only claim the expenses that are directly related to the business use of your home.

Q: What records should I keep when filing Form 8829?

A: You should keep records of your home expenses, such as receipts, bills, and a floor plan of your home showing the portion used for business.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.