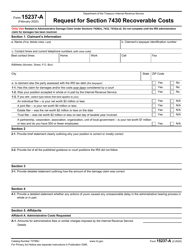

This version of the form is not currently in use and is provided for reference only. Download this version of

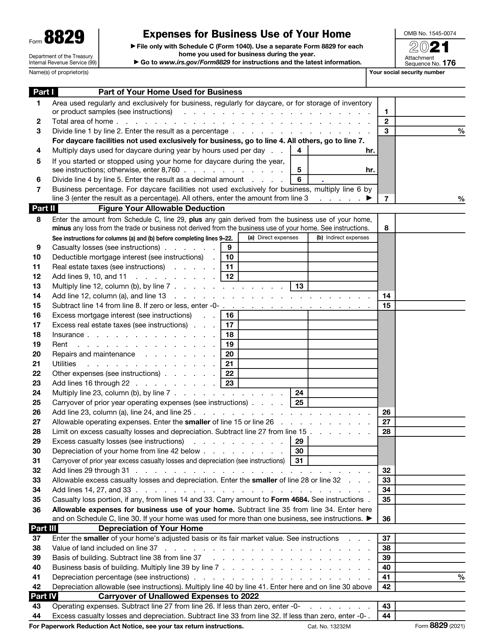

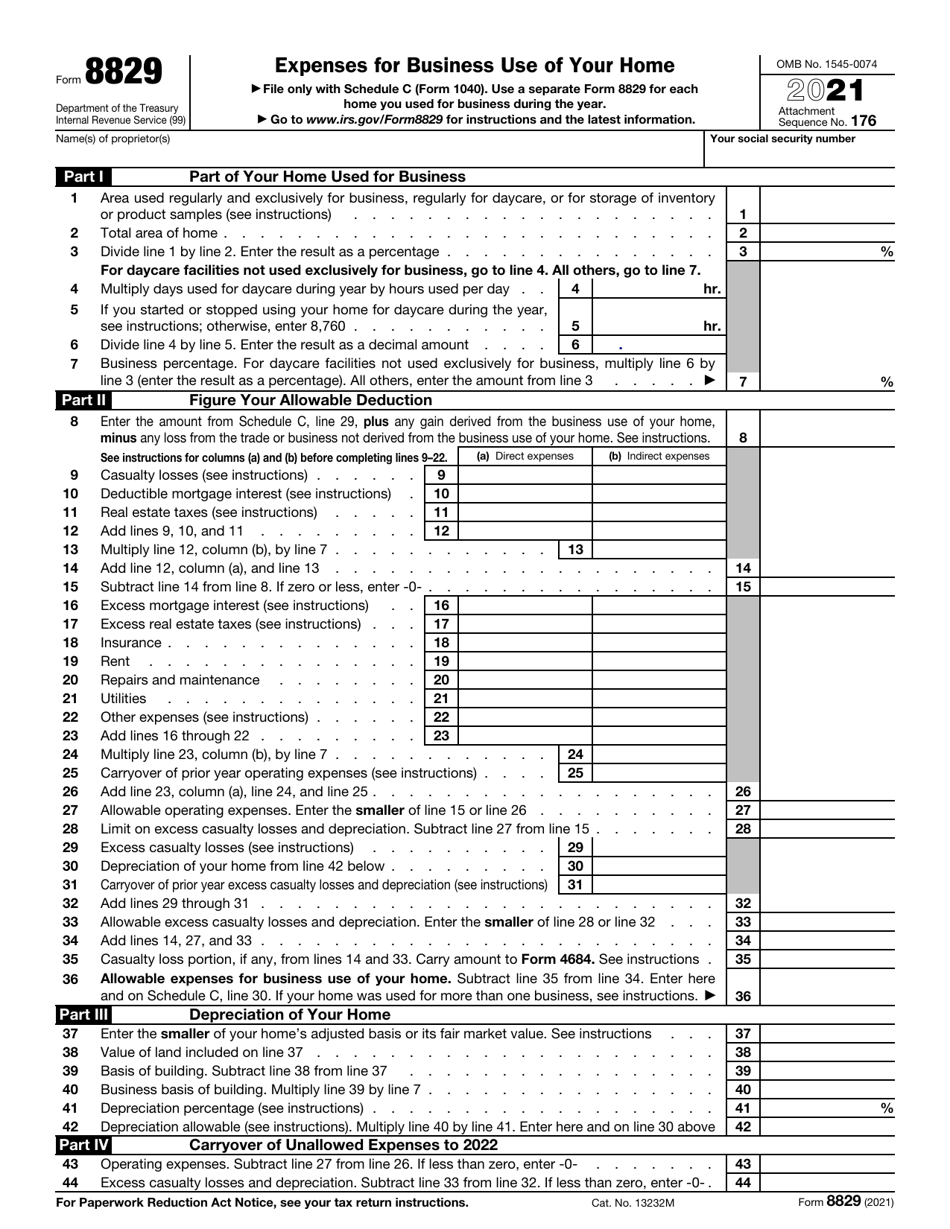

IRS Form 8829

for the current year.

IRS Form 8829 Expenses for Business Use of Your Home

What Is IRS Form 8829?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8829?

A: IRS Form 8829 is a tax form used to calculate and deduct expenses related to the business use of a home.

Q: Who can use IRS Form 8829?

A: Self-employed individuals or small business owners who use some part of their home exclusively for their business can use IRS Form 8829.

Q: What expenses can be deducted using IRS Form 8829?

A: Expenses that can be deducted using IRS Form 8829 include mortgage interest, insurance, utilities, repairs, and depreciation.

Q: How do I calculate the deductible expenses on IRS Form 8829?

A: To calculate the deductible expenses, you need to determine the percentage of your home used for business purposes and apply that percentage to your total eligible expenses.

Q: Can I deduct expenses for a home office if I am an employee?

A: No, the home office deduction using IRS Form 8829 is only available to self-employed individuals or small business owners.

Q: Do I need to keep records for IRS Form 8829?

A: Yes, it is important to keep records of all expenses related to the business use of your home in case of an IRS audit.

Q: When is the deadline to file IRS Form 8829?

A: IRS Form 8829 is typically filed with your annual tax return by the tax filing deadline, which is usually April 15th.

Q: Can I amend my previous tax returns to claim the home office deduction?

A: Yes, if you have not claimed the home office deduction in previous years, you can amend your tax returns to include the deduction using IRS Form 8829.

Q: What should I do if I have questions about IRS Form 8829?

A: If you have questions or need clarification about IRS Form 8829, it is recommended to consult a tax professional or contact the IRS directly.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8829 through the link below or browse more documents in our library of IRS Forms.