This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8824

for the current year.

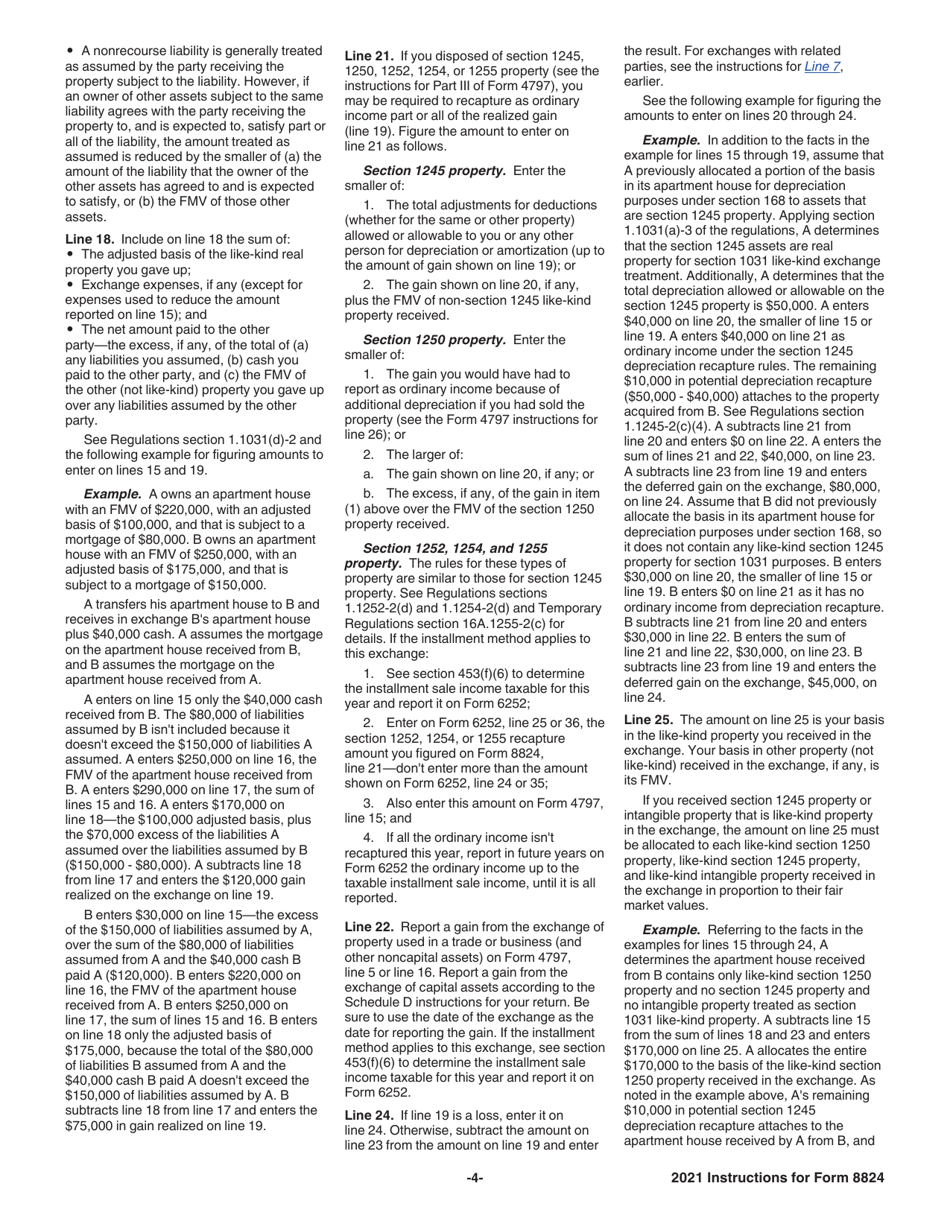

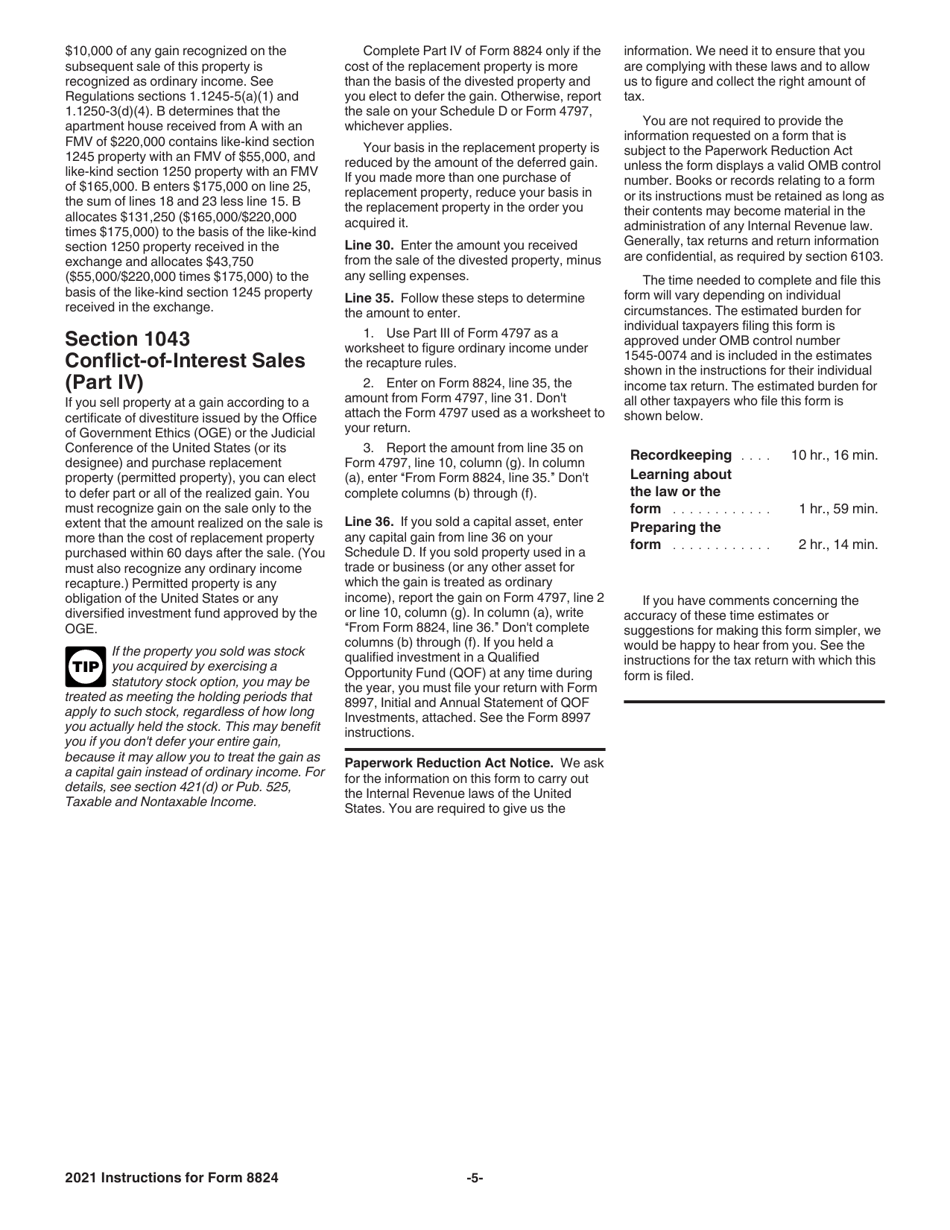

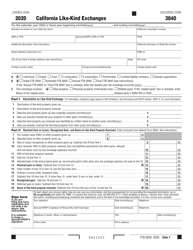

Instructions for IRS Form 8824 Like-Kind Exchanges (And Section 1043 Conflict-Of-Interest Sales)

This document contains official instructions for IRS Form 8824 , Like-Kind Exchanges (And Section 1043 Conflict-Of-Interest Sales) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8824?

A: IRS Form 8824 is used for reporting like-kind exchanges of property.

Q: What is a like-kind exchange?

A: A like-kind exchange is a transaction that allows the exchange of similar properties without recognizing a taxable gain.

Q: What is Section 1043 conflict-of-interest sales?

A: Section 1043 conflict-of-interest sales refer to the sale of property by individuals who have a potential conflict of interest due to their government employment.

Q: Who should use IRS Form 8824?

A: Individuals or businesses that have engaged in like-kind exchanges of property should use IRS Form 8824.

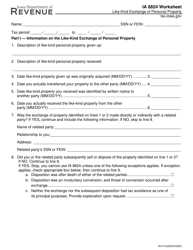

Q: What information is required on IRS Form 8824?

A: Form 8824 requires information about the taxpayer, the properties involved in the exchange, the value of the properties, and any gain or loss realized.

Q: When should IRS Form 8824 be filed?

A: IRS Form 8824 should be filed with your tax return for the year in which the like-kind exchange occurred.

Q: Are there any special rules or considerations for like-kind exchanges?

A: Yes, there are specific rules regarding the timing of the exchange, the types of properties that qualify, and the calculation of any taxable gain or loss.

Q: Are like-kind exchanges always tax-free?

A: No, there may be taxable gain or loss if the properties involved in the exchange do not meet the requirements for a like-kind exchange.

Q: What is the purpose of Section 1043 conflict-of-interest sales?

A: Section 1043 aims to prevent conflicts of interest by providing guidelines and restrictions on the sale of property by government employees who have a potential conflict of interest.

Q: Are Section 1043 conflict-of-interest sales subject to taxation?

A: Yes, the gains from Section 1043 conflict-of-interest sales are subject to taxation, but the taxes can be deferred through a like-kind exchange.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.