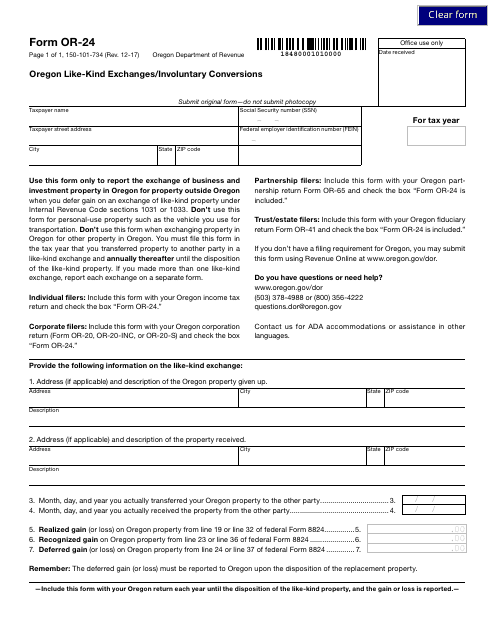

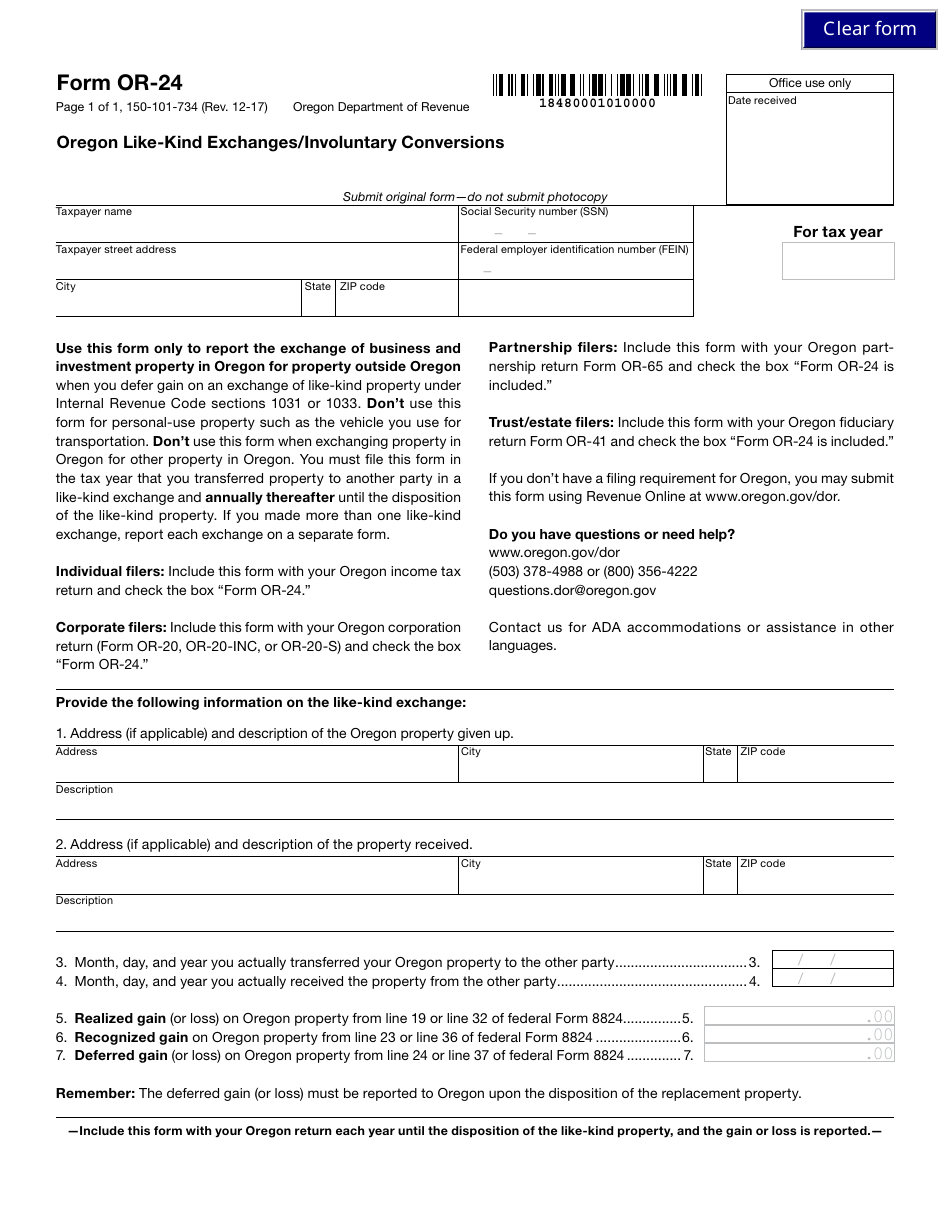

Form OR-24 Oregon Like-Kind Exchanges / Involuntary Conversions - Oregon

What Is Form OR-24?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-24?

A: Form OR-24 is the Oregon tax form used for reporting like-kind exchanges and involuntary conversions in Oregon.

Q: What are like-kind exchanges and involuntary conversions?

A: Like-kind exchanges and involuntary conversions are situations where you exchange or lose property and may qualify for certain tax benefits.

Q: Who needs to file Form OR-24?

A: Anyone who has engaged in a like-kind exchange or involuntary conversion in Oregon may need to file Form OR-24.

Q: What information is required on Form OR-24?

A: Form OR-24 requires you to provide details about the property exchanged or lost, the date of the transaction, and other relevant information for calculating the tax consequences.

Q: When is the deadline to file Form OR-24?

A: The deadline to file Form OR-24 is typically the same as the federal incometax filing deadline, which is April 15th.

Q: Are there any penalties for not filing Form OR-24?

A: Failure to file Form OR-24 or reporting incorrect information may result in penalties and interest charges.

Q: Can I e-file Form OR-24?

A: Currently, Form OR-24 cannot be e-filed and must be filed by mail.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-24 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.