This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8288

for the current year.

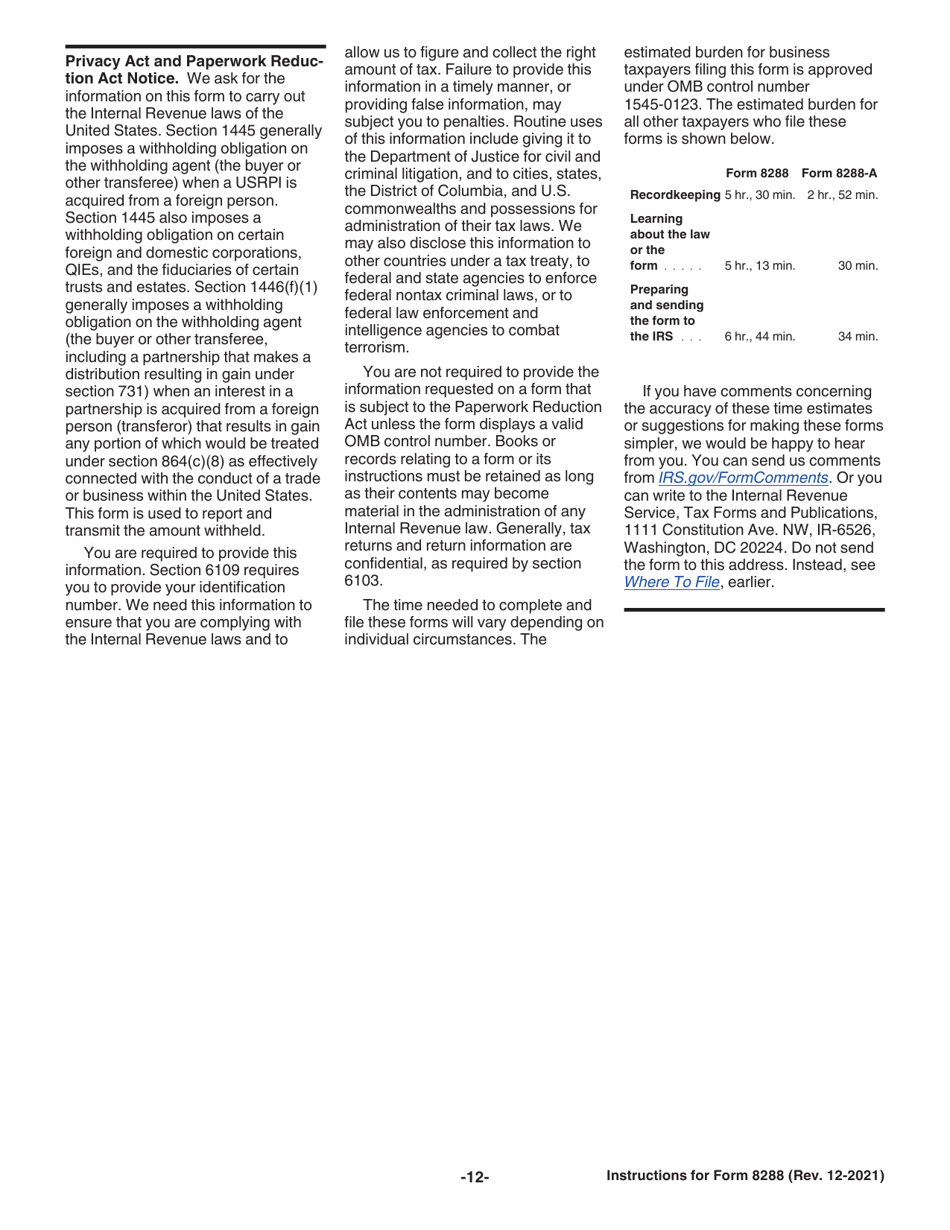

Instructions for IRS Form 8288 U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests

This document contains official instructions for IRS Form 8288 , U.S. Real Property Interests - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8288 is available for download through this link.

FAQ

Q: What is IRS Form 8288?

A: IRS Form 8288 is the U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests.

Q: Who needs to file IRS Form 8288?

A: Foreign persons who have disposed of U.S. real property interests are required to file IRS Form 8288.

Q: What is the purpose of IRS Form 8288?

A: IRS Form 8288 is used to report and pay the withholding tax on the disposition of U.S. real property interests by foreign persons.

Q: What is the withholding tax rate for Form 8288?

A: The withholding tax rate for IRS Form 8288 is generally 15% of the total amount realized from the disposition.

Q: When is Form 8288 due?

A: IRS Form 8288 is generally due within 20 days after the date of the disposition of the U.S. real property interest.

Q: Can Form 8288 be filed electronically?

A: No, IRS Form 8288 cannot be filed electronically. It must be filed by mail.

Q: Are there any penalties for late filing of Form 8288?

A: Yes, there are penalties for late filing of IRS Form 8288, so it is important to file on time.

Q: Are there any exceptions to filing Form 8288?

A: There are certain exceptions to filing IRS Form 8288, such as when the disposition is not subject to withholding under the Internal Revenue Code.

Q: Can I get a refund of the withholding tax reported on Form 8288?

A: Yes, foreign persons may be eligible for a refund of the withholding tax reported on IRS Form 8288 if they meet certain criteria.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.