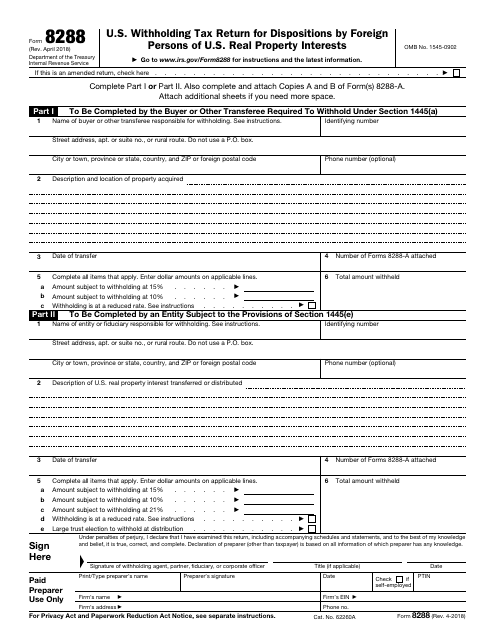

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8288

for the current year.

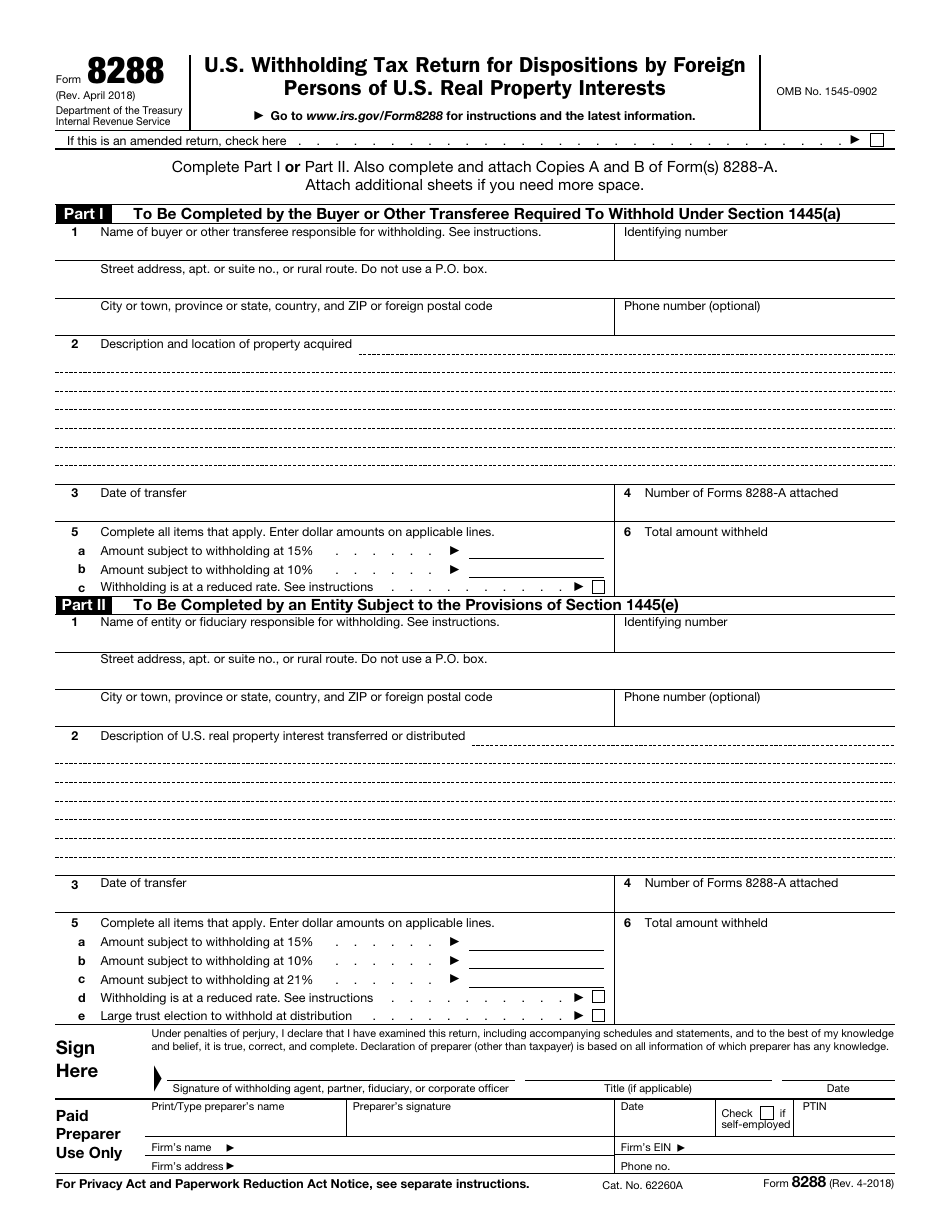

IRS Form 8288 U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests

What Is IRS Form 8288?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8288?

A: IRS Form 8288 is the U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests.

Q: Who needs to file IRS Form 8288?

A: Foreign persons who dispose of U.S. real property interests are required to file IRS Form 8288.

Q: What is the purpose of IRS Form 8288?

A: The purpose of IRS Form 8288 is to report and pay the withholding tax on the disposition of U.S. real property interests by foreign persons.

Q: What is U.S. withholding tax?

A: U.S. withholding tax is the tax withheld from the proceeds of a disposition of U.S. real property interests by foreign persons.

Q: When is IRS Form 8288 due?

A: IRS Form 8288 is generally due within 20 days after the date of the disposition of U.S. real property interests.

Q: Are there any penalties for not filing IRS Form 8288?

A: Yes, there are penalties for not filing IRS Form 8288, including fines and interest on the withheld tax amount.

Q: Is there any exemption from U.S. withholding tax?

A: Yes, there are certain exemptions from U.S. withholding tax, such as transactions below a certain threshold or specific types of transactions.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8288 through the link below or browse more documents in our library of IRS Forms.