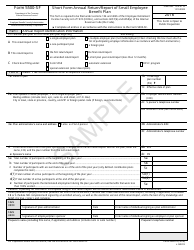

This version of the form is not currently in use and is provided for reference only. Download this version of

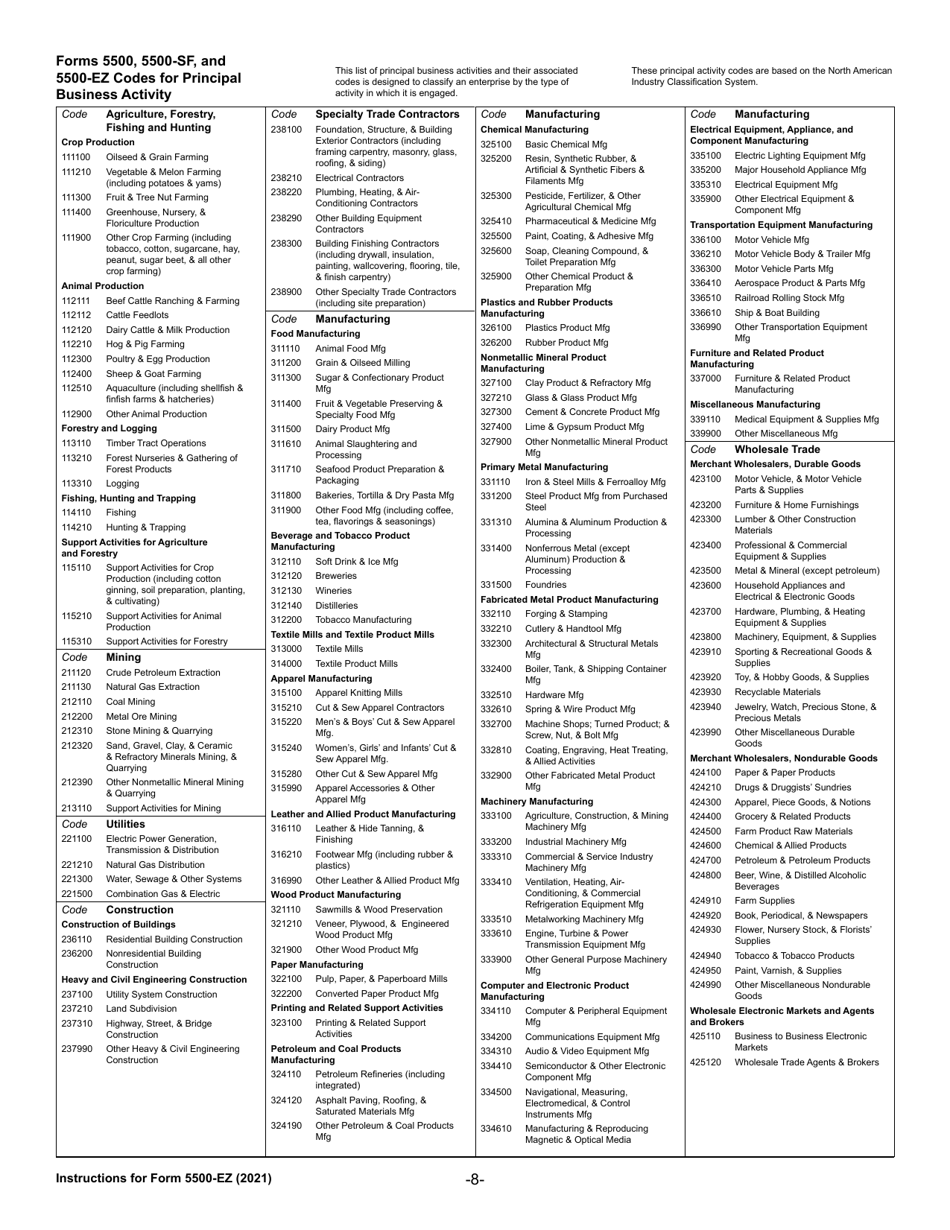

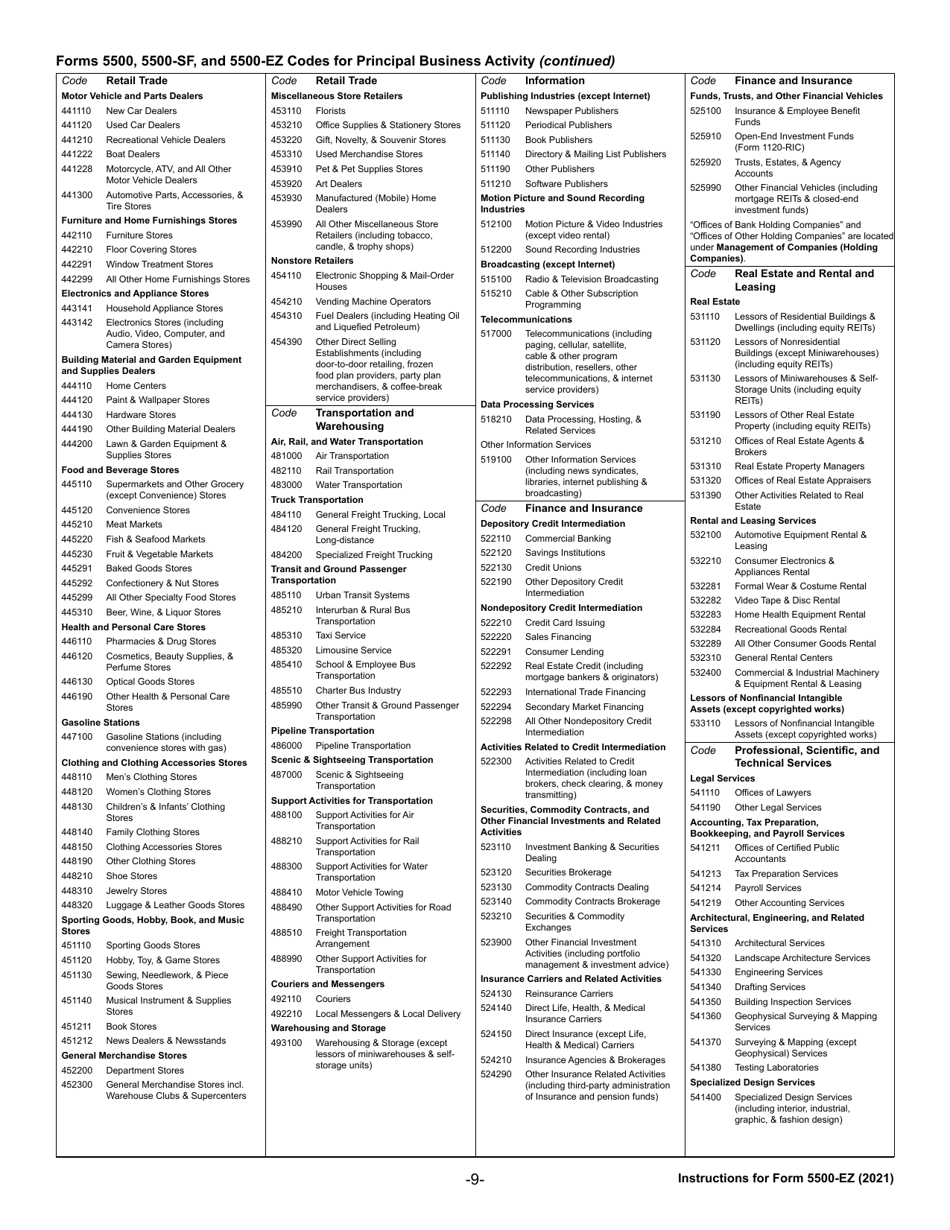

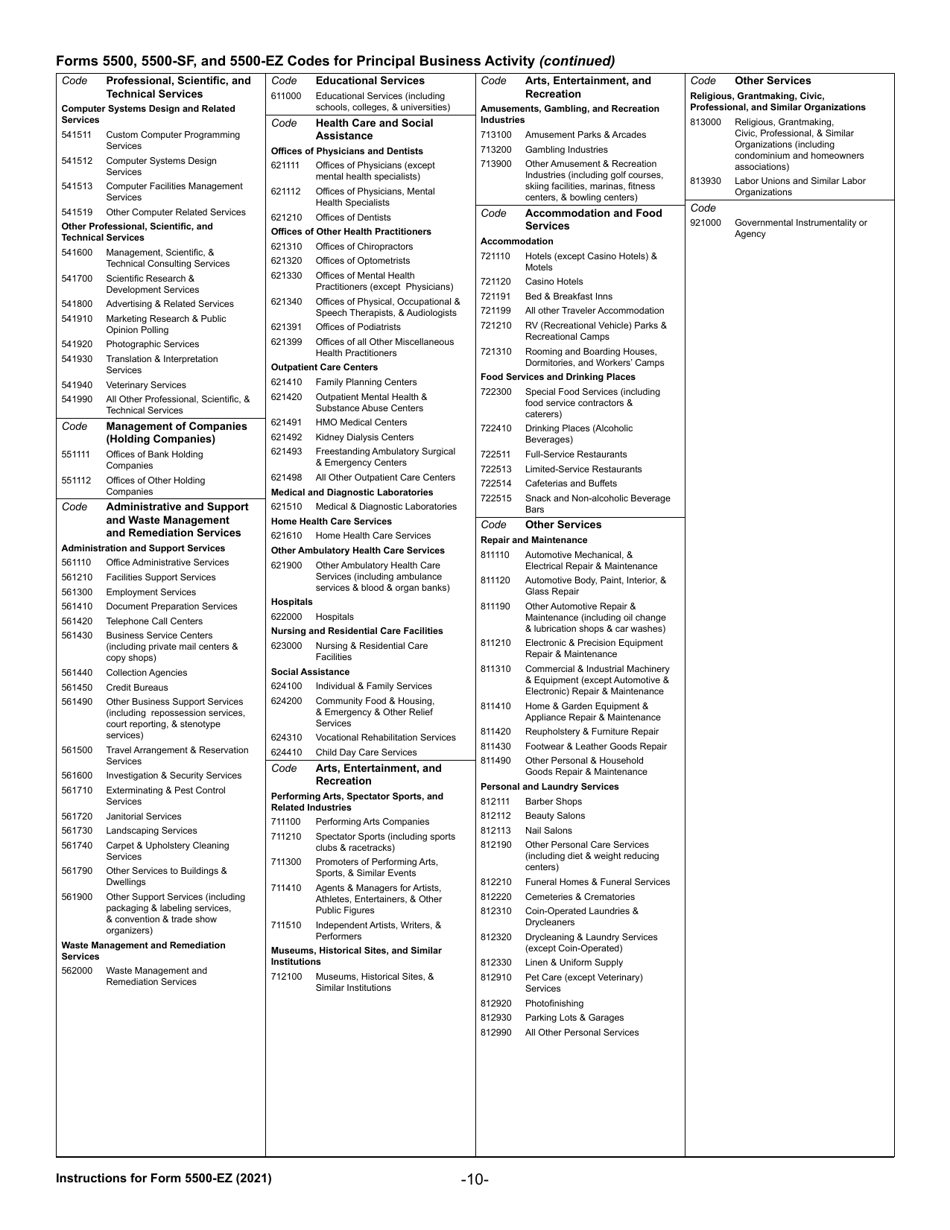

Instructions for IRS Form 5500-EZ

for the current year.

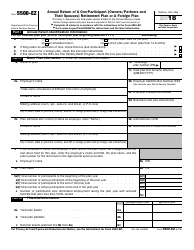

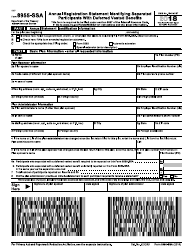

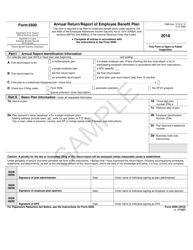

Instructions for IRS Form 5500-EZ Annual Return of a One-Participant (Owners / Partners and Their Spouses) Retirement Plan or a Foreign Plan

This document contains official instructions for IRS Form 5500-EZ , Annual Return of a One-Participant (Owners/Partners and Their Spouses) Retirement Plan or a Foreign Plan - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 5500-EZ?

A: IRS Form 5500-EZ is an annual return used to report information about a one-participant retirement plan or a foreign retirement plan.

Q: Who needs to file IRS Form 5500-EZ?

A: Owners or partners and their spouses who have a one-participant retirement plan or a foreign retirement plan need to file IRS Form 5500-EZ.

Q: What information needs to be reported on IRS Form 5500-EZ?

A: IRS Form 5500-EZ requires reporting on contributions, distributions, and the value of assets held by the retirement plan.

Q: Are there any exceptions or exemptions for filing IRS Form 5500-EZ?

A: Certain small plans may be exempt from filing IRS Form 5500-EZ, but it is best to consult the instructions or a tax professional for specific exemptions.

Q: When is IRS Form 5500-EZ due?

A: IRS Form 5500-EZ is generally due on the last day of the seventh month following the end of the plan year.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.