This version of the form is not currently in use and is provided for reference only. Download this version of

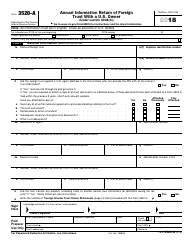

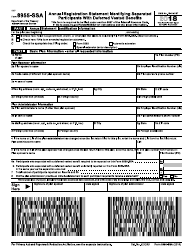

Instructions for IRS Form 3520-A

for the current year.

Instructions for IRS Form 3520-A Annual Information Return of Foreign Trust With a U.S. Owner

This document contains official instructions for IRS Form 3520-A , Annual Information Return of Foreign Trust With a U.S. Owner - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 3520-A?

A: IRS Form 3520-A is the Annual Information Return of Foreign Trust with a U.S. Owner.

Q: Who needs to file IRS Form 3520-A?

A: Anyone who is a U.S. person and is an owner of a foreign trust needs to file IRS Form 3520-A.

Q: What information is required to complete IRS Form 3520-A?

A: IRS Form 3520-A requires information about the foreign trust, its US owner(s), distributions, and other relevant financial details.

Q: When is the deadline to file IRS Form 3520-A?

A: The deadline for filing IRS Form 3520-A is the 15th day of the 3rd month after the end of the trust's tax year.

Q: How should IRS Form 3520-A be filed?

A: IRS Form 3520-A should be filed by mail with the Department of the Treasury, Internal Revenue Service Center in Ogden, UT.

Q: Are there any penalties for not filing IRS Form 3520-A?

A: Yes, there are penalties for not filing IRS Form 3520-A, including monetary penalties and potential criminal charges.

Q: Can IRS Form 3520-A be filed electronically?

A: No, IRS Form 3520-A cannot be filed electronically at this time.

Q: What other forms may be required when filing IRS Form 3520-A?

A: Depending on the specific circumstances, other forms such as IRS Form 3520 or IRS Form 8938 may be required to be filed along with IRS Form 3520-A.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.