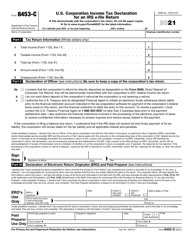

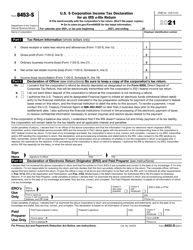

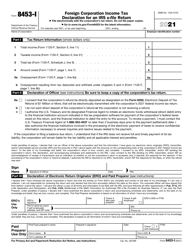

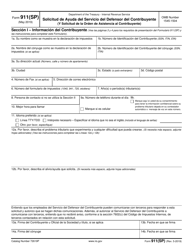

Instructions for IRS Form 1139 Corporation Application for Tentative Refund

This document contains official instructions for IRS Form 1139 , Corporation Application for Tentative Refund - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1139 is available for download through this link.

FAQ

Q: What is IRS Form 1139?

A: IRS Form 1139 is the Corporation Application for Tentative Refund.

Q: Who needs to file IRS Form 1139?

A: Corporations need to file IRS Form 1139 to claim a tentative refund of taxes.

Q: What is a tentative refund?

A: A tentative refund is a refund claimed by a corporation before its final tax liability is determined.

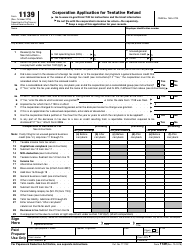

Q: What information is required on IRS Form 1139?

A: IRS Form 1139 requires information about the corporation's income, deductions, taxes paid, and other relevant details.

Q: How do I submit IRS Form 1139?

A: IRS Form 1139 can be submitted by mail or electronically, depending on the corporation's preference.

Q: How long does it take to process IRS Form 1139?

A: The processing time for IRS Form 1139 varies, but it typically takes around 90 days.

Q: Can I amend IRS Form 1139?

A: No, once IRS Form 1139 is filed, it cannot be amended. However, if there are changes or errors, a new form should be filed.

Q: What should I do if my IRS Form 1139 is rejected?

A: If your IRS Form 1139 is rejected, you should review the rejection notice and take appropriate action to correct any errors.

Q: Is there a fee to file IRS Form 1139?

A: No, there is no fee to file IRS Form 1139.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.