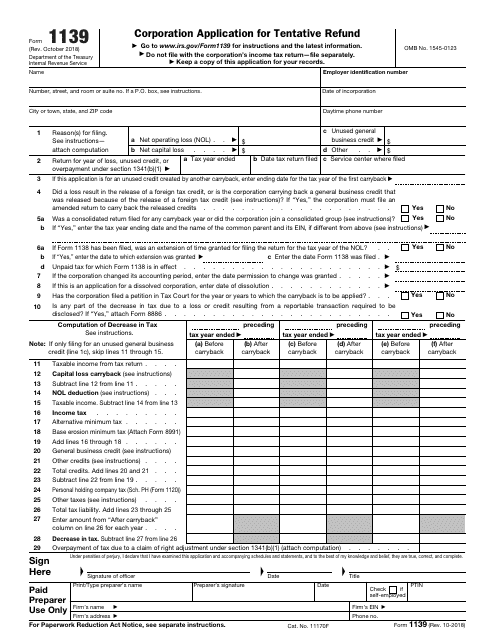

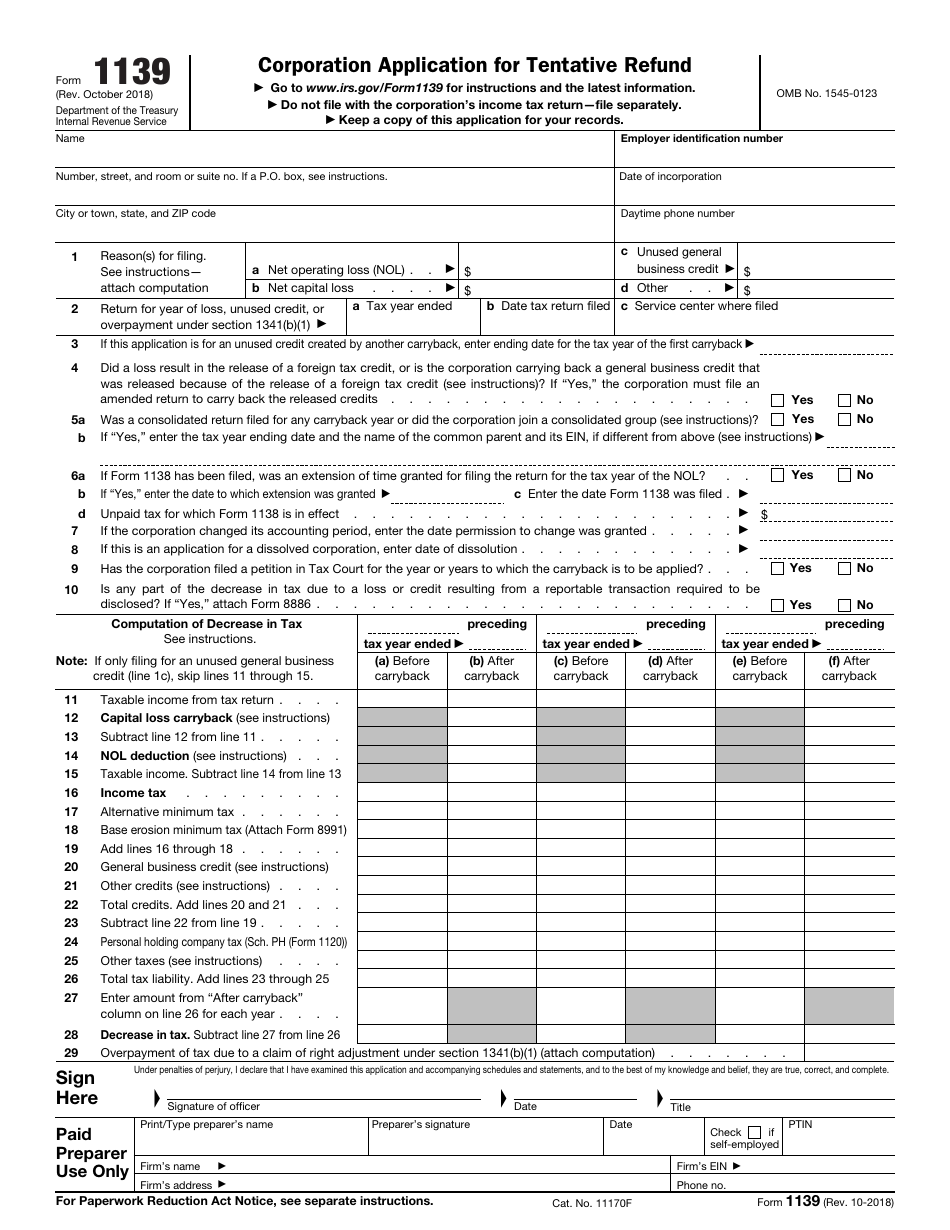

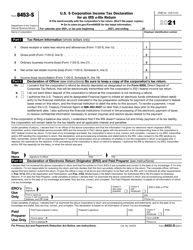

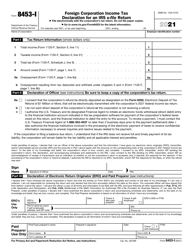

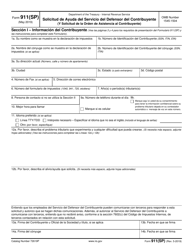

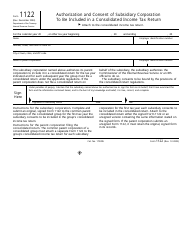

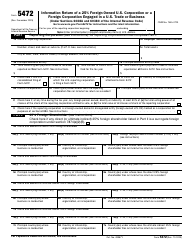

IRS Form 1139 Corporation Application for Tentative Refund

What Is IRS Form 1139?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1139?

A: IRS Form 1139 is the Corporation Application for Tentative Refund.

Q: Who can use IRS Form 1139?

A: Corporations can use IRS Form 1139 to apply for a tentative refund of taxes.

Q: What is a tentative refund?

A: A tentative refund is a refund that is issued before the final determination of the amount of tax owed.

Q: What types of taxes can be claimed for a refund using IRS Form 1139?

A: Corporations can claim overpayments of income tax, estimated tax payments, and certain credits.

Q: How long does it take to process an IRS Form 1139?

A: The processing time for IRS Form 1139 can vary, but it is generally within 90 days.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1139 through the link below or browse more documents in our library of IRS Forms.