This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-S Schedule D

for the current year.

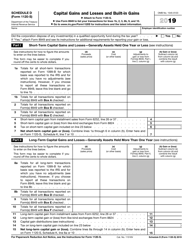

Instructions for IRS Form 1120-S Schedule D Capital Gains and Losses and Built-In Gains

This document contains official instructions for IRS Form 1120-S Schedule D, Capital Gains and Losses and Built-In Gains - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120-S Schedule D?

A: IRS Form 1120-S Schedule D is a form used by S corporations to report capital gains, losses, and built-in gains.

Q: What are capital gains and losses?

A: Capital gains are the profits earned from the sale of an asset, while capital losses are the losses incurred from the sale of an asset.

Q: What is a built-in gain?

A: A built-in gain is a gain recognized when an S corporation sells an asset that had appreciated in value while the corporation was a C corporation.

Q: What information is required on Schedule D?

A: Schedule D requires the S corporation to report details of each capital asset sold or disposed of during the tax year, including the date of sale, cost basis, and selling price.

Q: Are there any special rules for built-in gains?

A: Yes, S corporations with built-in gains may be subject to a separate tax at the corporate level.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.