This version of the form is not currently in use and is provided for reference only. Download this version of

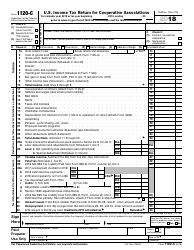

Instructions for IRS Form 1120-H

for the current year.

Instructions for IRS Form 1120-H U.S. Income Tax Return for Homeowners Associations

This document contains official instructions for IRS Form 1120-H , U.S. Income Tax Return for Homeowners Associations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120-H?

A: IRS Form 1120-H is the U.S. Income Tax Return specifically designed for Homeowners Associations.

Q: Who should file IRS Form 1120-H?

A: Homeowners Associations should file IRS Form 1120-H.

Q: What is the purpose of filing IRS Form 1120-H?

A: The purpose of filing IRS Form 1120-H is to report the income, expenses, and taxes of Homeowners Associations.

Q: When is the deadline to file IRS Form 1120-H?

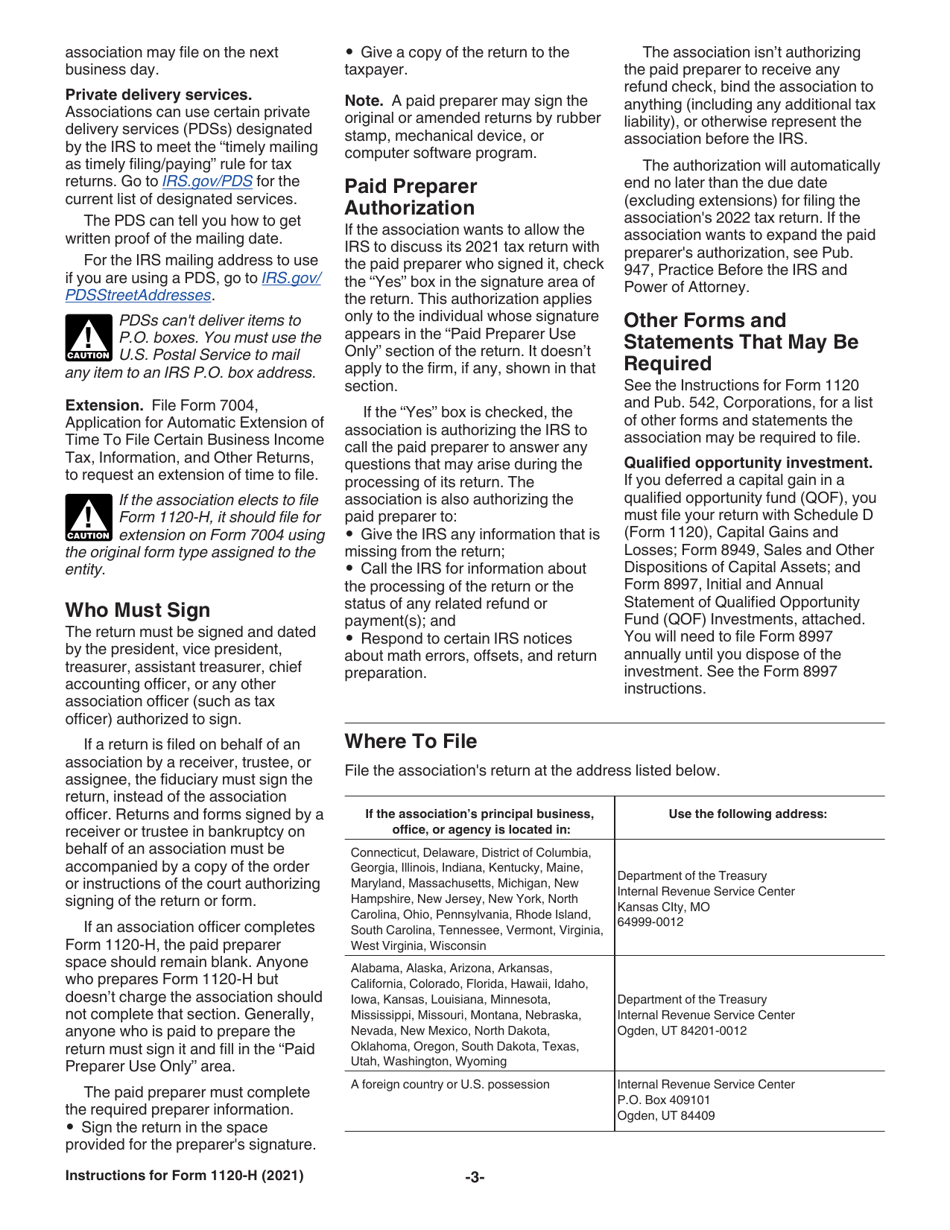

A: The deadline to file IRS Form 1120-H is the 15th day of the 4th month following the end of the association's tax year.

Q: Can a Homeowners Association use Form 1120 instead of Form 1120-H?

A: No, a Homeowners Association cannot use Form 1120. They must use Form 1120-H specifically designed for their tax return.

Q: What are the requirements for eligibility to file Form 1120-H?

A: To be eligible to file Form 1120-H, a Homeowners Association must meet certain criteria such as having at least 60% of its gross income from exempt function income and meet the organizational test.

Q: What is exempt function income?

A: Exempt function income refers to the income that Homeowners Associations receive from sources like membership dues, fees, or assessments to fund association activities.

Q: What is the penalty for late filing of IRS Form 1120-H?

A: The penalty for late filing of IRS Form 1120-H is generally $25 for each month or part of a month the return is late, up to a maximum of 5 months.

Q: Can a Homeowners Association amend an already filed IRS Form 1120-H?

A: Yes, a Homeowners Association can file an amended IRS Form 1120-H to correct errors or provide additional information.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.