This version of the form is not currently in use and is provided for reference only. Download this version of

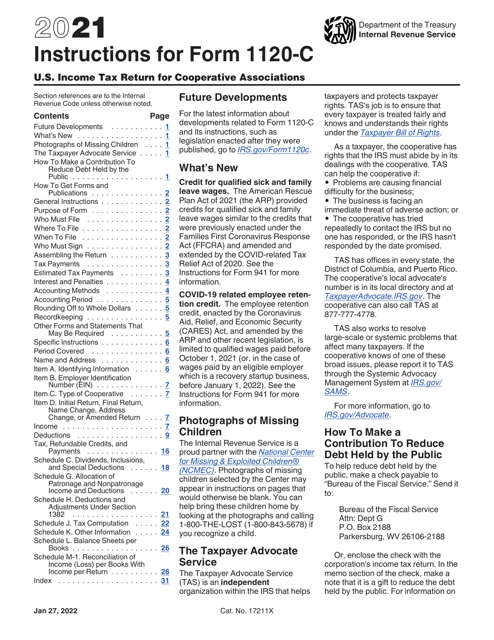

Instructions for IRS Form 1120-C

for the current year.

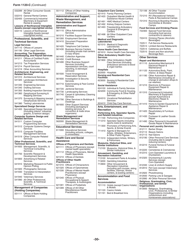

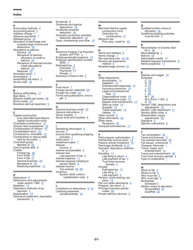

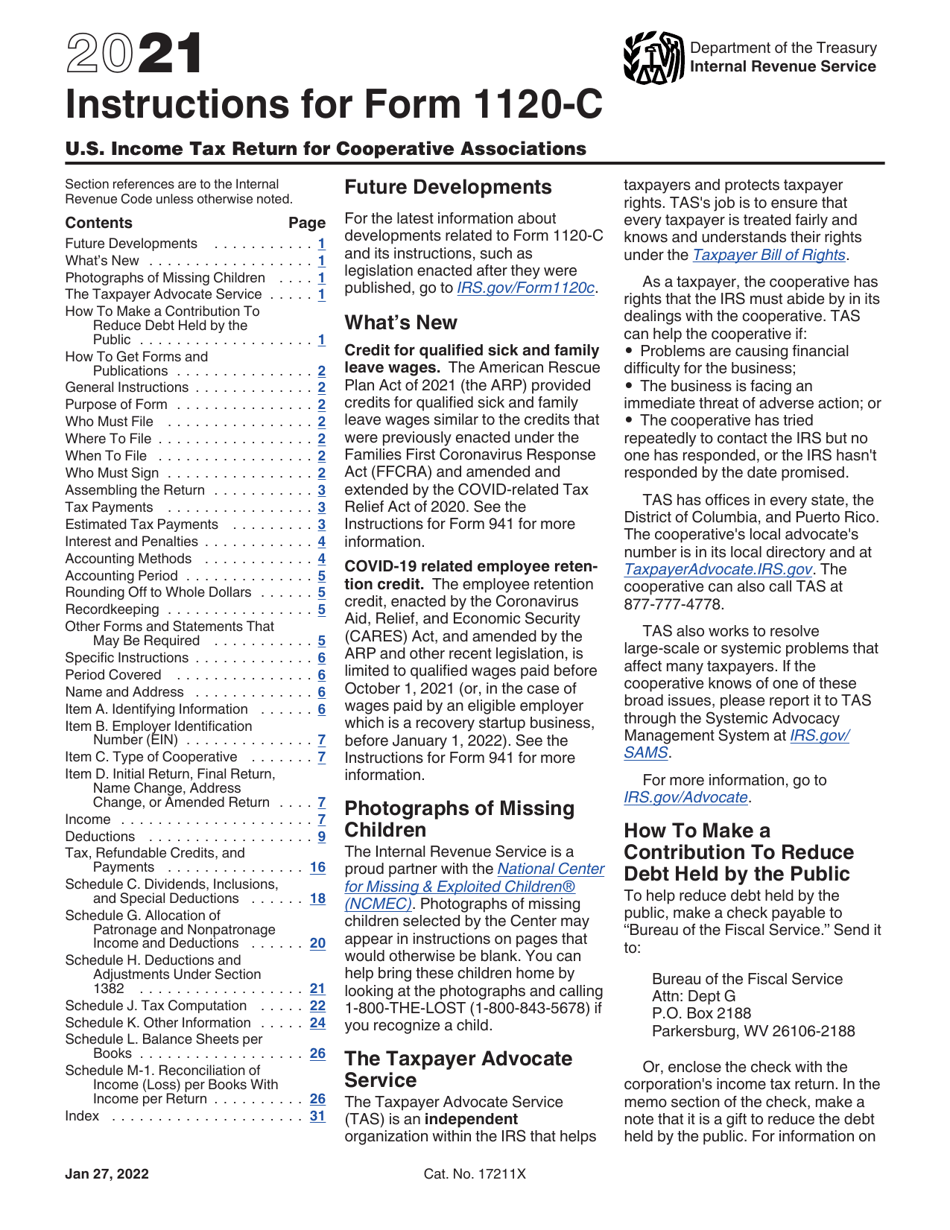

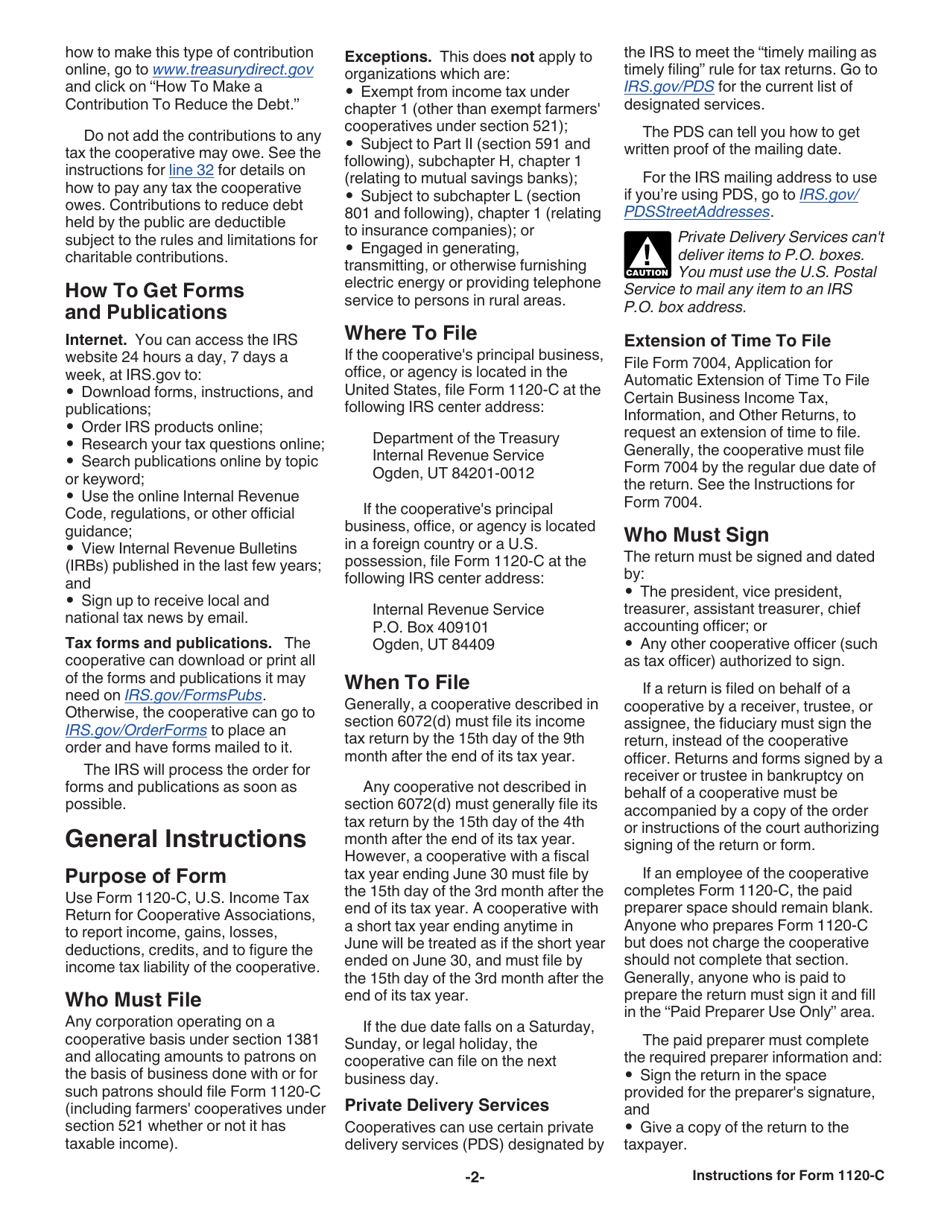

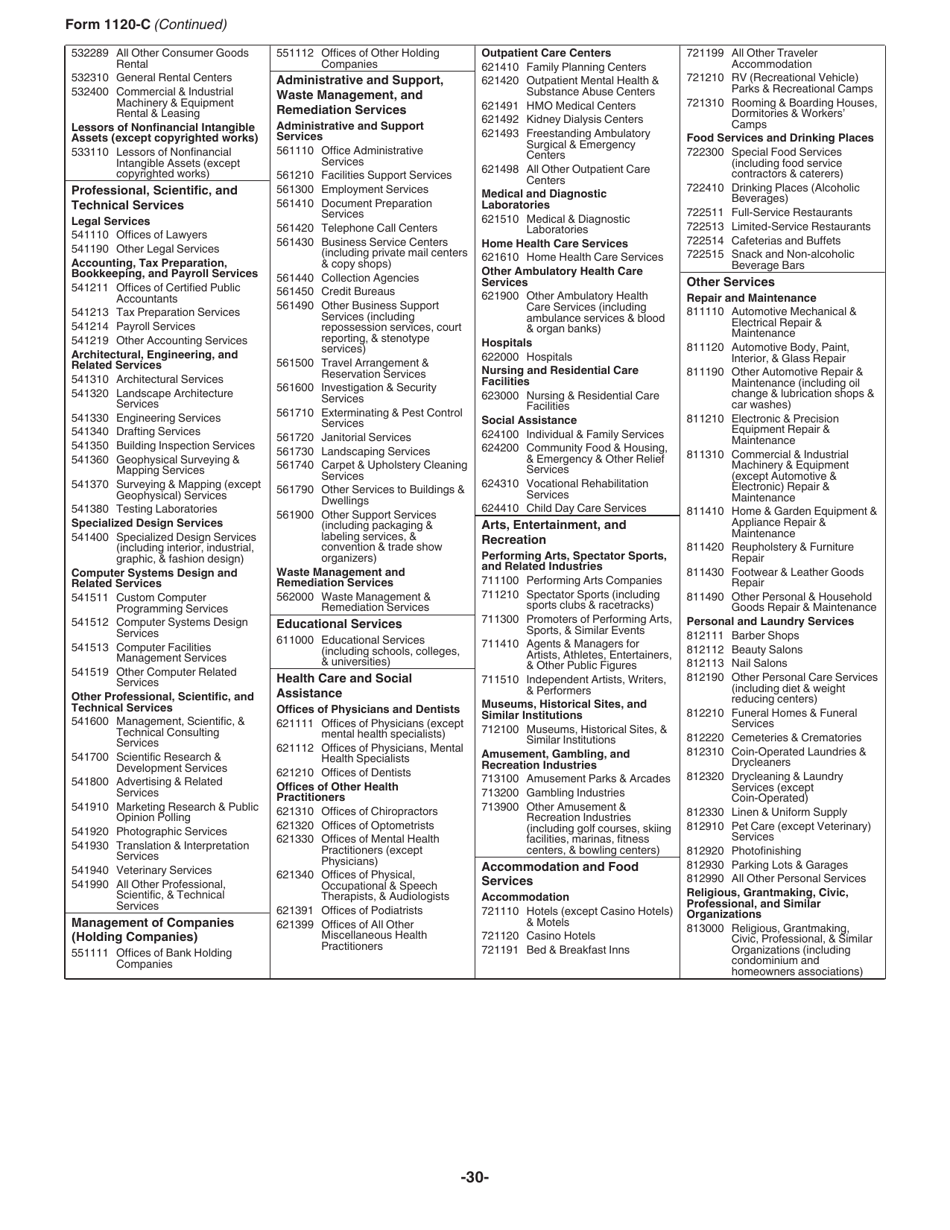

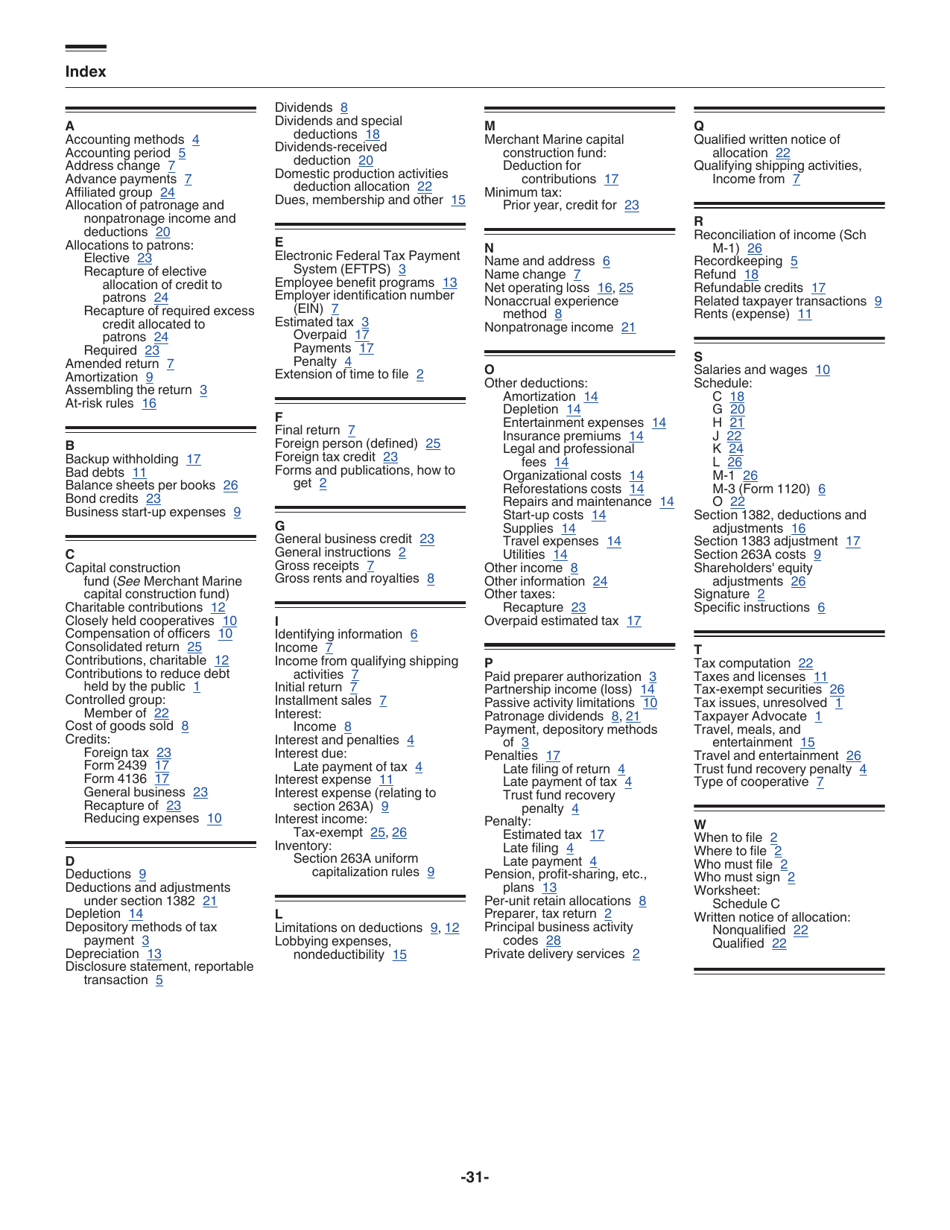

Instructions for IRS Form 1120-C U.S. Income Tax Return for Cooperative Associations

This document contains official instructions for IRS Form 1120-C , U.S. Income Tax Return for Cooperative Associations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is Form 1120-C?

A: Form 1120-C is the U.S. Income Tax Return specifically designed for Cooperative Associations.

Q: Who needs to file Form 1120-C?

A: Cooperative Associations, including those engaged in housing, electricity, or farming, need to file Form 1120-C.

Q: What information is required on Form 1120-C?

A: Form 1120-C requires information about the cooperative association's income, expenses, deductions, assets, and liabilities.

Q: When is the deadline to file Form 1120-C?

A: The deadline to file Form 1120-C is generally the 15th day of the 4th month after the end of the cooperative association's tax year.

Q: Are there any extensions available for filing Form 1120-C?

A: Yes, extensions of time to file Form 1120-C can be requested using Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.

Q: What are the penalties for not filing Form 1120-C?

A: Failure to file Form 1120-C or filing it late may result in penalties and interest charges.

Q: Can Form 1120-C be filed electronically?

A: Yes, Form 1120-C can be filed electronically using the IRS e-file system.

Instruction Details:

- This 31-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.