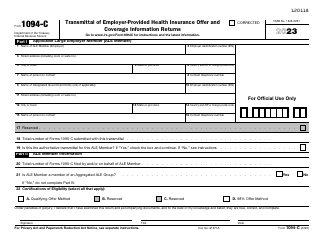

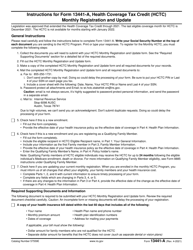

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1094-B, 1095-B

for the current year.

Instructions for IRS Form 1094-B, 1095-B

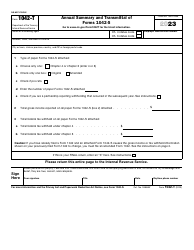

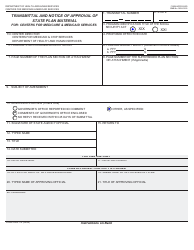

This document contains official instructions for IRS Form 1094-B , and IRS Form 1095-B . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1094-B is available for download through this link. The latest available IRS Form 1095-B can be downloaded through this link.

FAQ

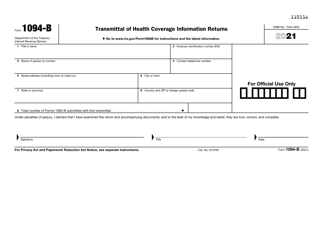

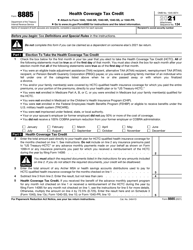

Q: What is IRS Form 1094-B?

A: IRS Form 1094-B is a form used to report information about Minimum Essential Coverage (MEC) for individuals.

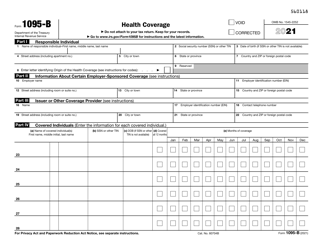

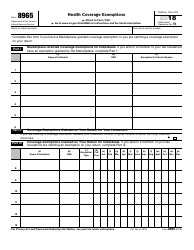

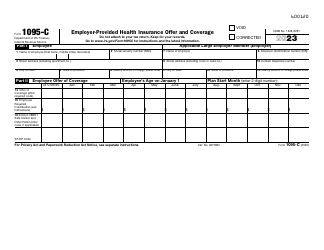

Q: What is IRS Form 1095-B?

A: IRS Form 1095-B is a form used to provide individuals with information about their health coverage.

Q: Who needs to file Form 1094-B?

A: Insurance providers and certain employers are required to file Form 1094-B.

Q: Do individuals need to file Form 1094-B?

A: No, individuals do not need to file Form 1094-B.

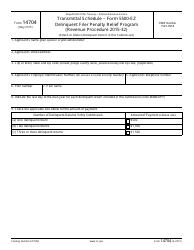

Q: What information is reported on Form 1094-B?

A: Form 1094-B reports information such as the number of individuals covered by MEC, the coverage start and end dates, and the name and contact information of the insurance provider.

Q: What happens if I don't file Form 1094-B?

A: Failure to file Form 1094-B or filing it late may result in penalties imposed by the IRS.

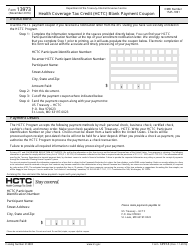

Q: Can Form 1094-B be filed electronically?

A: Yes, Form 1094-B can be filed electronically through the IRS's Affordable Care Act Information Returns (AIR) Program.

Q: Are there any exceptions to filing Form 1094-B?

A: Certain small employers may be eligible for relief from filing Form 1094-B if they meet certain criteria. It is recommended to consult with a tax professional or refer to the IRS guidelines for more information.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.