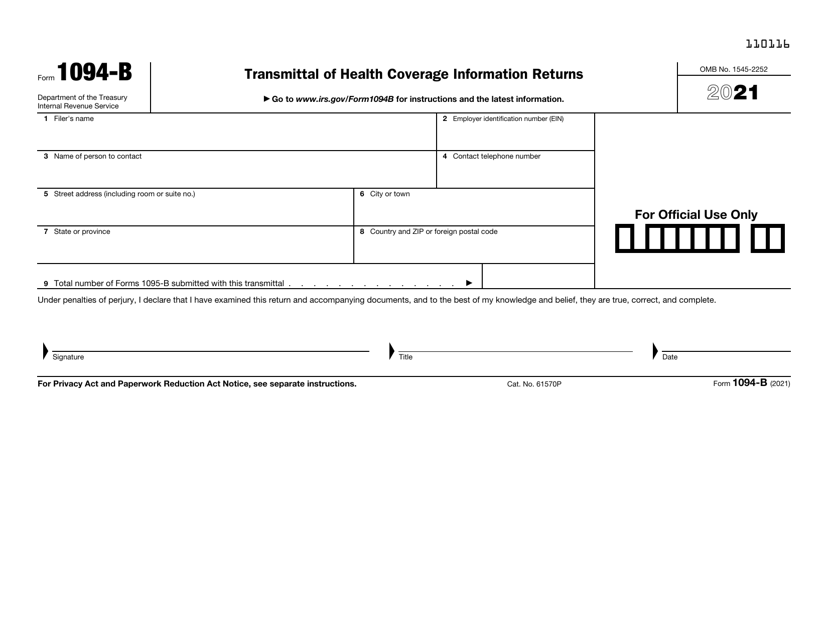

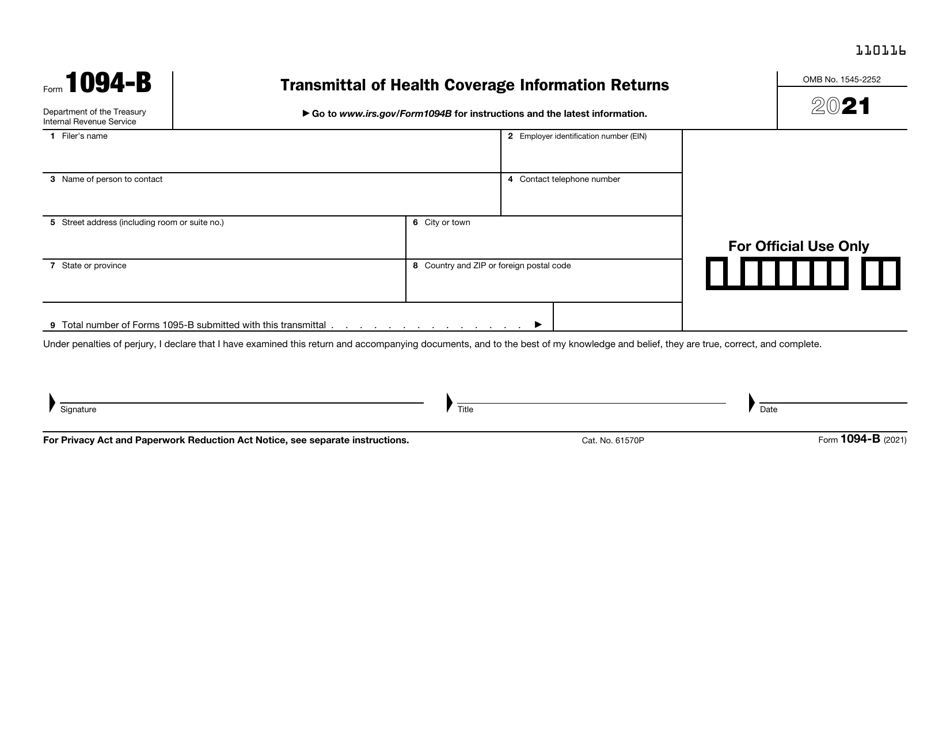

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1094-B

for the current year.

IRS Form 1094-B Transmittal of Health Coverage Information Returns

What Is IRS Form 1094-B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1094-B?

A: IRS Form 1094-B is a transmittal form used to send health coverage information returns to the IRS.

Q: Who needs to file IRS Form 1094-B?

A: Health insurance providers, such as insurers and certain employers, who are required to report information about the health coverage they offer.

Q: What information is reported on IRS Form 1094-B?

A: IRS Form 1094-B reports information about the individuals covered under a health insurance plan, including their names, Social Security Numbers, and the months they were covered.

Q: When is IRS Form 1094-B due?

A: IRS Form 1094-B is typically due to the IRS by the end of February following the calendar year being reported.

Q: What happens if you don't file IRS Form 1094-B?

A: Failure to timely file IRS Form 1094-B can result in penalties imposed by the IRS.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1094-B through the link below or browse more documents in our library of IRS Forms.