This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1065-X

for the current year.

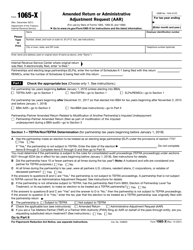

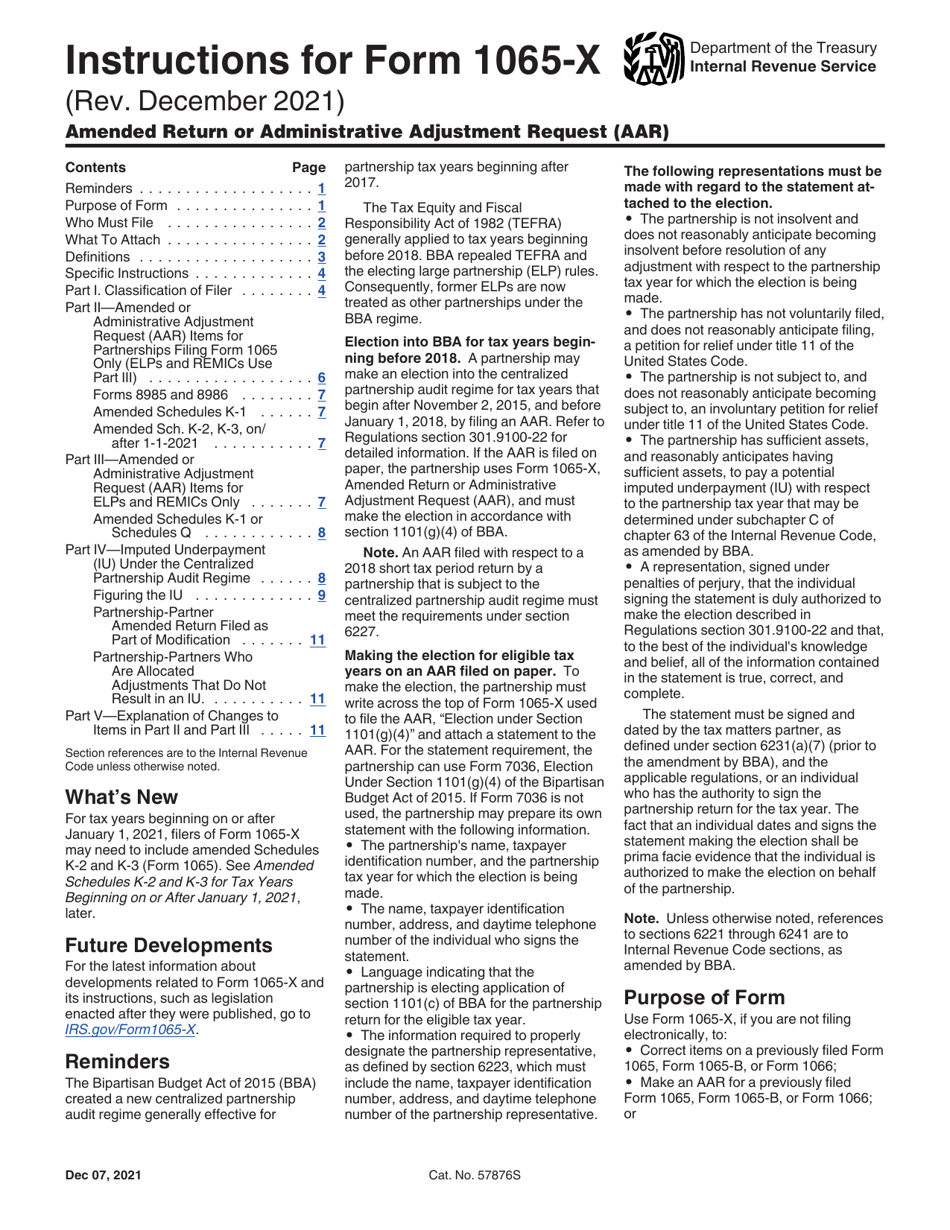

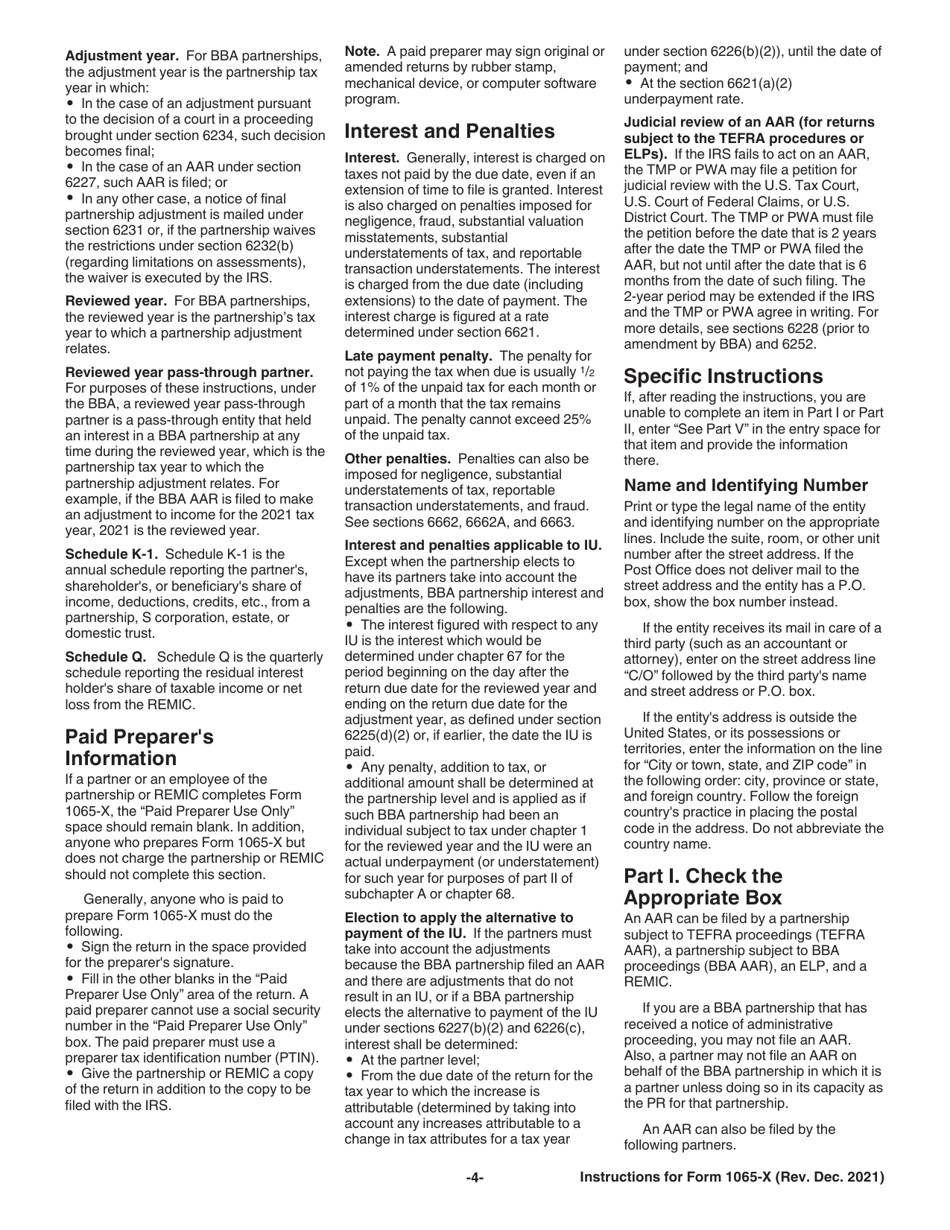

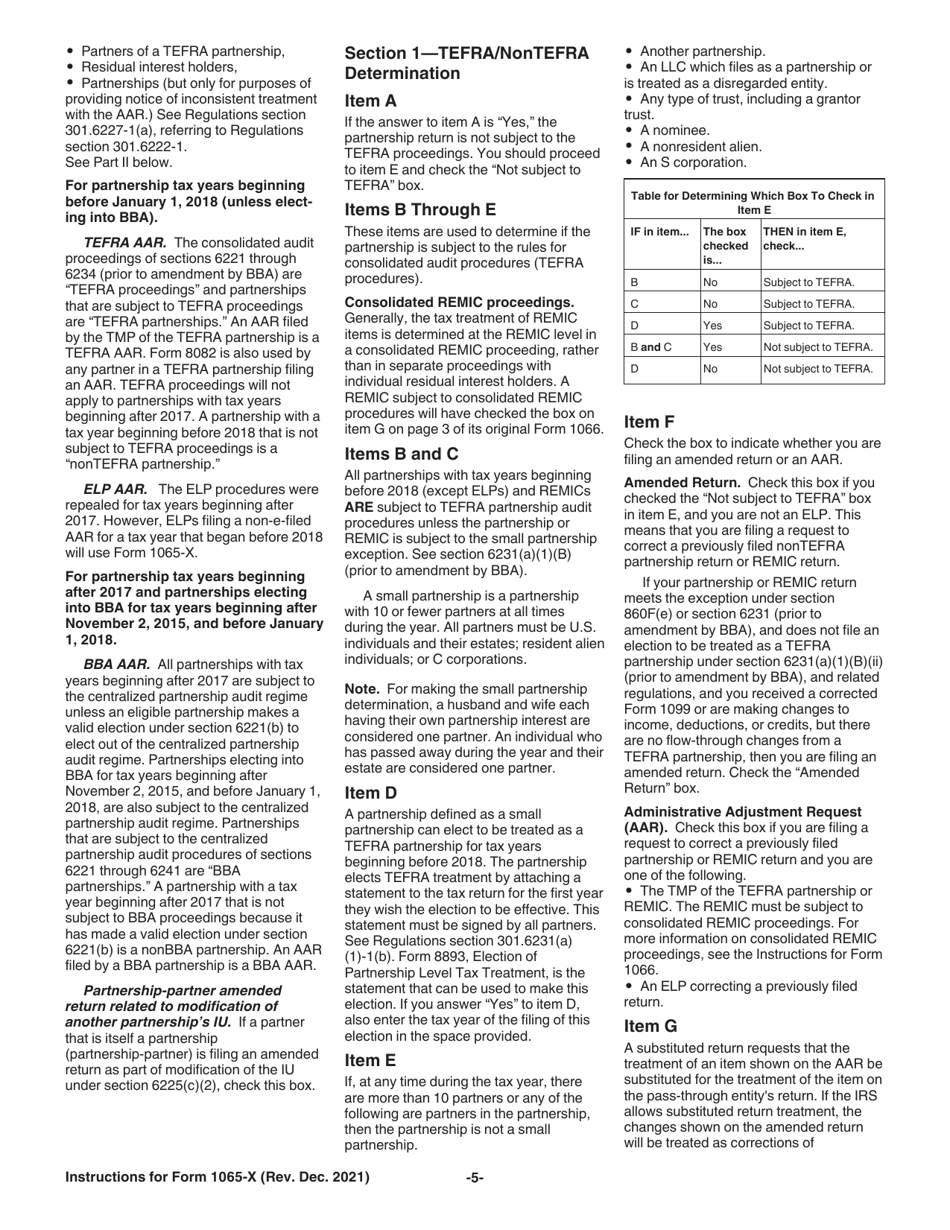

Instructions for IRS Form 1065-X Amended Return or Administrative Adjustment Request (AAR)

This document contains official instructions for IRS Form 1065-X , Amended Return or Administrative Adjustment Request (Aar) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065-X is available for download through this link.

FAQ

Q: What is IRS Form 1065-X?

A: IRS Form 1065-X is used to file an amended return or an administrative adjustment request (AAR) for partnerships.

Q: When should I use IRS Form 1065-X?

A: You should use IRS Form 1065-X to correct errors on a previously filed Form 1065, U.S. Return of Partnership Income.

Q: What is an amended return?

A: An amended return is used to make changes to a previously filed tax return.

Q: What is an administrative adjustment request (AAR)?

A: An administrative adjustment request (AAR) is a request for the IRS to make certain adjustments to a partnership return without filing an amended return.

Q: How do I fill out IRS Form 1065-X?

A: You will need to provide information about the partnership, the changes being made, and the reason for the changes on IRS Form 1065-X.

Q: What if I need to amend multiple years?

A: If you need to amend multiple years, you should file a separate Form 1065-X for each year.

Q: Is there a deadline for filing IRS Form 1065-X?

A: Yes, you should generally file IRS Form 1065-X within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later.

Q: Can I e-file IRS Form 1065-X?

A: No, IRS Form 1065-X cannot be e-filed. You must mail it to the IRS.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.