This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1042-S

for the current year.

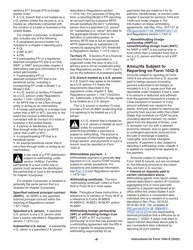

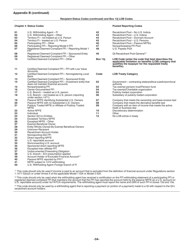

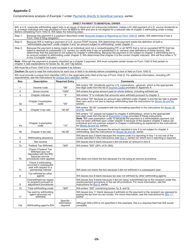

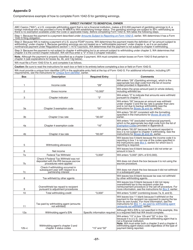

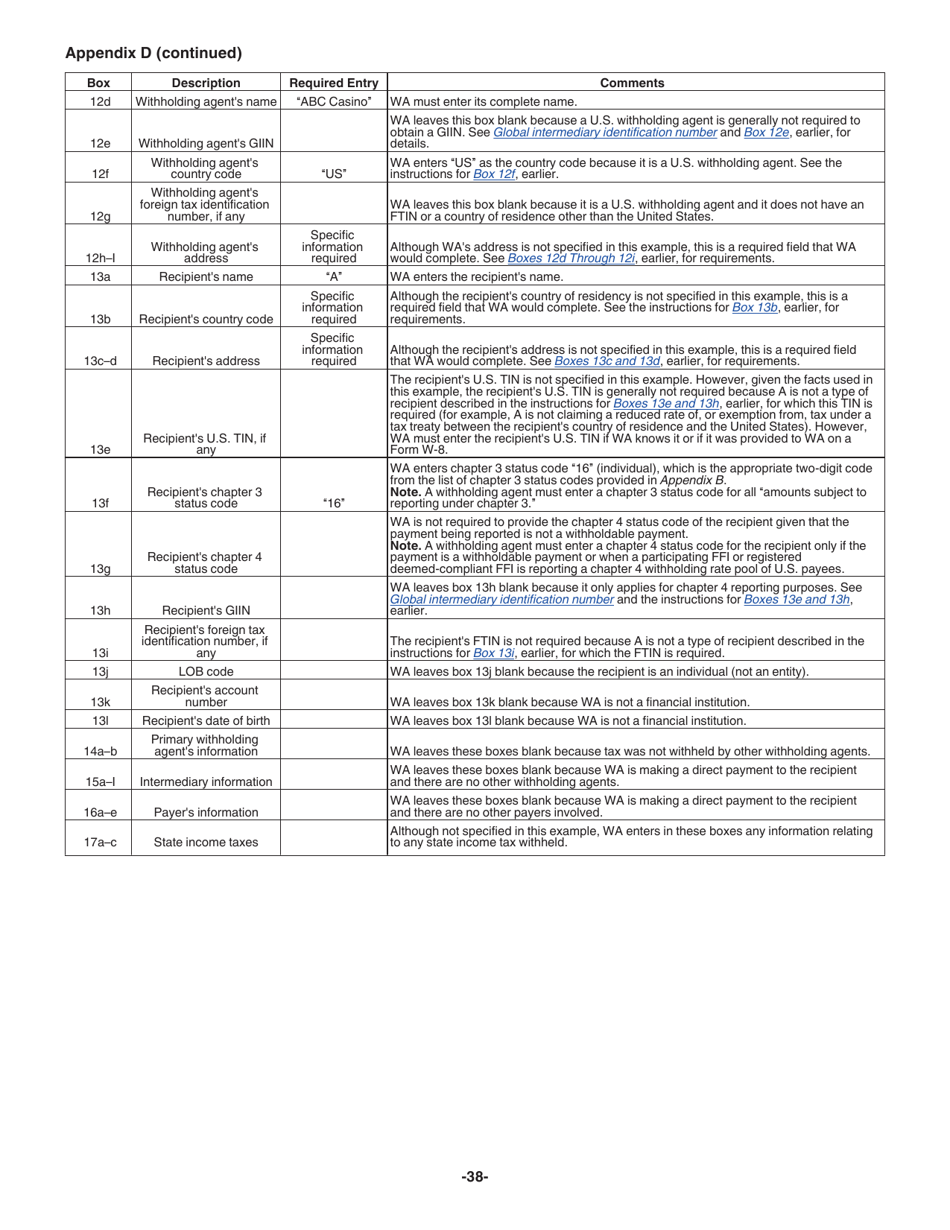

Instructions for IRS Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding

This document contains official instructions for IRS Form 1042-S , Foreign Person's U.S. Source Income Subject to Withholding - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1042-S?

A: IRS Form 1042-S is a tax form used to report income subject to withholding for foreign persons.

Q: Who should file Form 1042-S?

A: Form 1042-S should be filed by the withholding agent who pays the income subject to withholding to a foreign person.

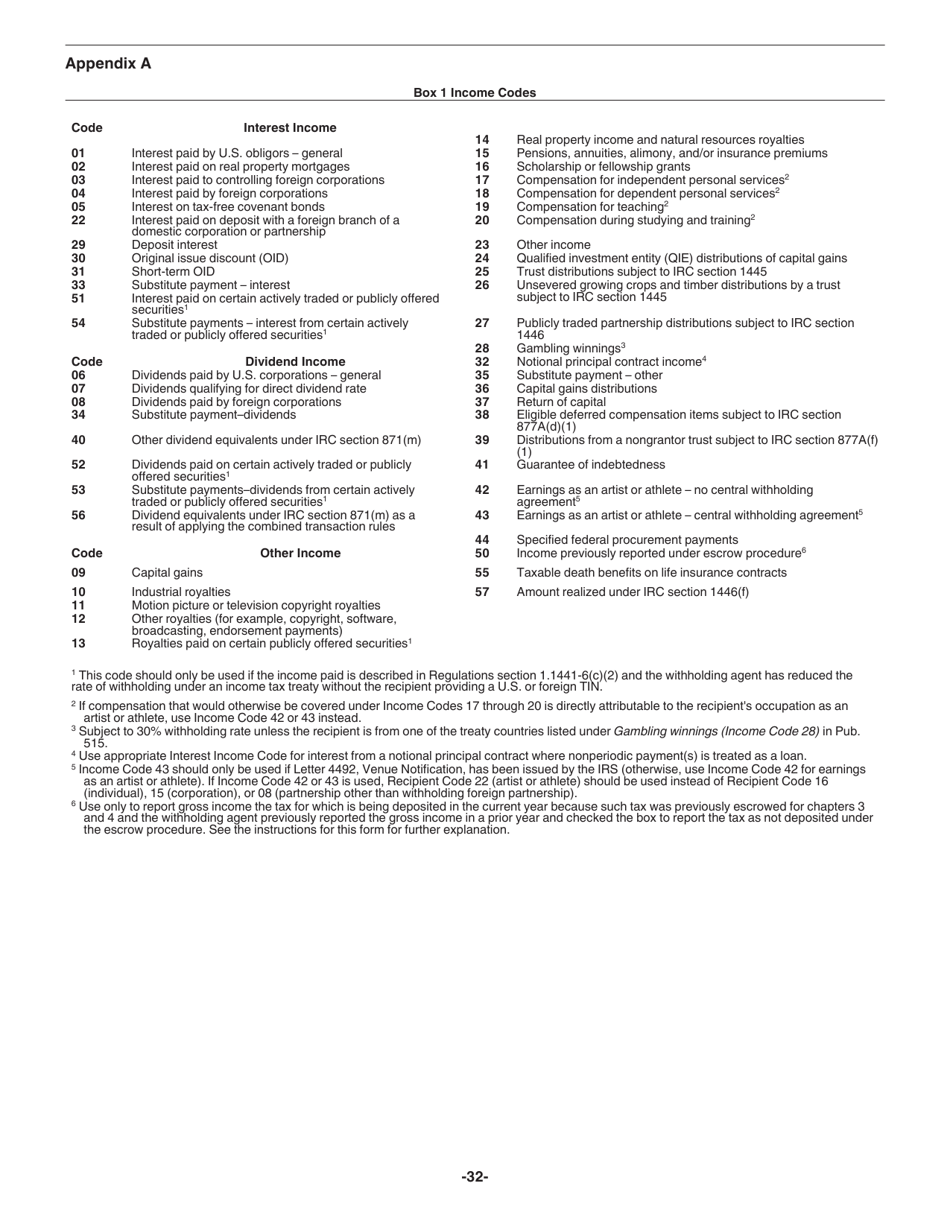

Q: What income should be reported on Form 1042-S?

A: Form 1042-S is used to report various types of U.S. source income subject to withholding, such as wages, scholarships, and royalties.

Q: What is the purpose of withholding on Form 1042-S?

A: Withholding on Form 1042-S ensures that the IRS receives tax payments from foreign persons on their U.S. source income.

Q: When is Form 1042-S due?

A: Form 1042-S must be furnished to the recipient by March 15th and filed with the IRS by March 31st following the calendar year in which the income was paid.

Q: Are there any penalties for not filing Form 1042-S?

A: Yes, there are penalties for not filing Form 1042-S or for filing it late. It is important to meet the filing deadlines to avoid any penalties.

Q: Is Form 1042-S used for reporting income from U.S. sources only?

A: Yes, Form 1042-S is specifically used for reporting income from U.S. sources that are subject to withholding for foreign persons.

Q: Can I file Form 1042-S electronically?

A: Yes, Form 1042-S can be filed electronically through the Filing Information Returns Electronically (FIRE) system.

Q: What supporting documents do I need to attach with Form 1042-S?

A: You generally do not need to attach supporting documents with Form 1042-S. However, you should keep records of payments made and withholding taxes withheld.

Instruction Details:

- This 38-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.