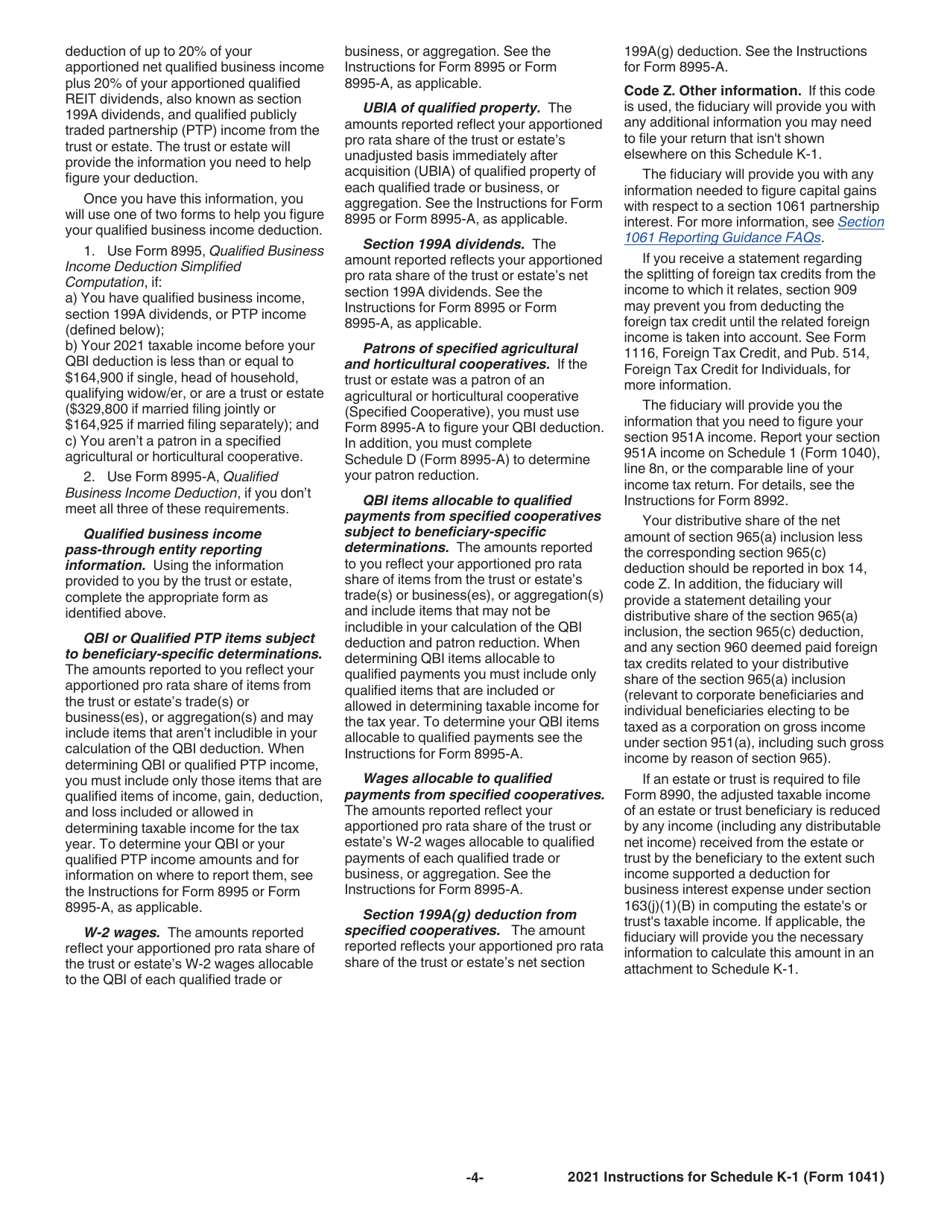

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1041 Schedule K-1

for the current year.

Instructions for IRS Form 1041 Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc. for a Beneficiary Filing Form 1040 or 1040-sr

This document contains official instructions for IRS Form 1041 Schedule K-1, Beneficiary's Share of Income, Deductions, Credits, Etc. for a Beneficiary Filing Form 1040 or 1040-sr - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1041 Schedule K-1?

A: IRS Form 1041 Schedule K-1 is used to report a beneficiary's share of income, deductions, credits, and other tax information that must be reported on their personal tax return, either Form 1040 or 1040-SR.

Q: Who needs to file IRS Form 1041 Schedule K-1?

A: Beneficiaries of a trust or estate who have received income and other tax items from the trust or estate need to file IRS Form 1041 Schedule K-1 if they are required to file a personal tax return.

Q: What information is reported on IRS Form 1041 Schedule K-1?

A: IRS Form 1041 Schedule K-1 reports the beneficiary's share of income, deductions, credits, and other tax information from a trust or estate.

Q: When is IRS Form 1041 Schedule K-1 due?

A: IRS Form 1041 Schedule K-1 is typically due on the same date as the beneficiary's personal tax return, which is usually April 15th.

Q: Do I need to attach IRS Form 1041 Schedule K-1 to my personal tax return?

A: Yes, beneficiaries who receive Form 1041 Schedule K-1 must attach it to their personal tax return (Form 1040 or 1040-SR) when filing their taxes.

Q: What should I do if I have not received IRS Form 1041 Schedule K-1?

A: If you have not received IRS Form 1041 Schedule K-1, you should contact the trust or estate administrator or the person responsible for distributing the form to beneficiaries.

Q: Can I e-file IRS Form 1041 Schedule K-1?

A: No, IRS Form 1041 Schedule K-1 cannot be e-filed. It must be filed by mail along with the beneficiary's personal tax return.

Q: What if there are errors on IRS Form 1041 Schedule K-1?

A: If there are errors on IRS Form 1041 Schedule K-1, you should contact the trust or estate administrator or the person responsible for preparing the form to request a corrected version.

Q: Are there penalties for not filing IRS Form 1041 Schedule K-1?

A: Yes, there may be penalties for not filing IRS Form 1041 Schedule K-1 or for filing it late. It's important to file the form and report your share of income and deductions accurately to avoid penalties.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.